The Bitcoin worth has fallen by 4.7% since peaking at $71,231 yesterday, now hovering round $66,967. This decline marks a notable return of volatility out there, pushed by a number of crucial components.

#1 Federal Reserve’s FOMC Meeting Anticipation

The Bitcoin market appears to be in a risk-off mode forward of tomorrow’s Federal Open Market Committee (FOMC) meeting on Wednesday, June twelfth. The market’s sensitivity to macroeconomic indicators is on full show as stakeholders await the US Federal Reserve’s resolution on rates of interest and its financial projections.

Current expectations counsel that the Fed will keep the rates of interest at a variety of 5.25%-5.50%, however the market is bracing for the up to date dot plot which is projected to undertake a extra hawkish stance. The adjustment anticipated entails decreasing the anticipated price cuts in 2024 from three to 2, with some speculating about the potential for just one minimize. This hawkish tilt in financial coverage projections is poised to affect investor conduct considerably, as greater rates of interest sometimes dampen the enchantment of non-yielding belongings like cryptocurrencies.

Adding to the uncertainty, the May 2024 US Consumer Price Index (CPI) information is scheduled for launch simply hours earlier than the FOMC’s announcement. The market has reacted strongly to US macroeconomic information in current months, and any deviation from expectations may result in substantial worth fluctuations.

Crypto analyst Ted commented on X, noting the crucial nature of this week’s occasions: “After final Friday’s robust employment information, markets have nearly utterly priced out a July price minimize. Powell may shortly change this on Wednesday, particularly if CPI is available in mushy. There’s an (off) likelihood for important repricing this week, which may transfer BTC + crypto…”

#2 Intensified Spot Selling Pressure

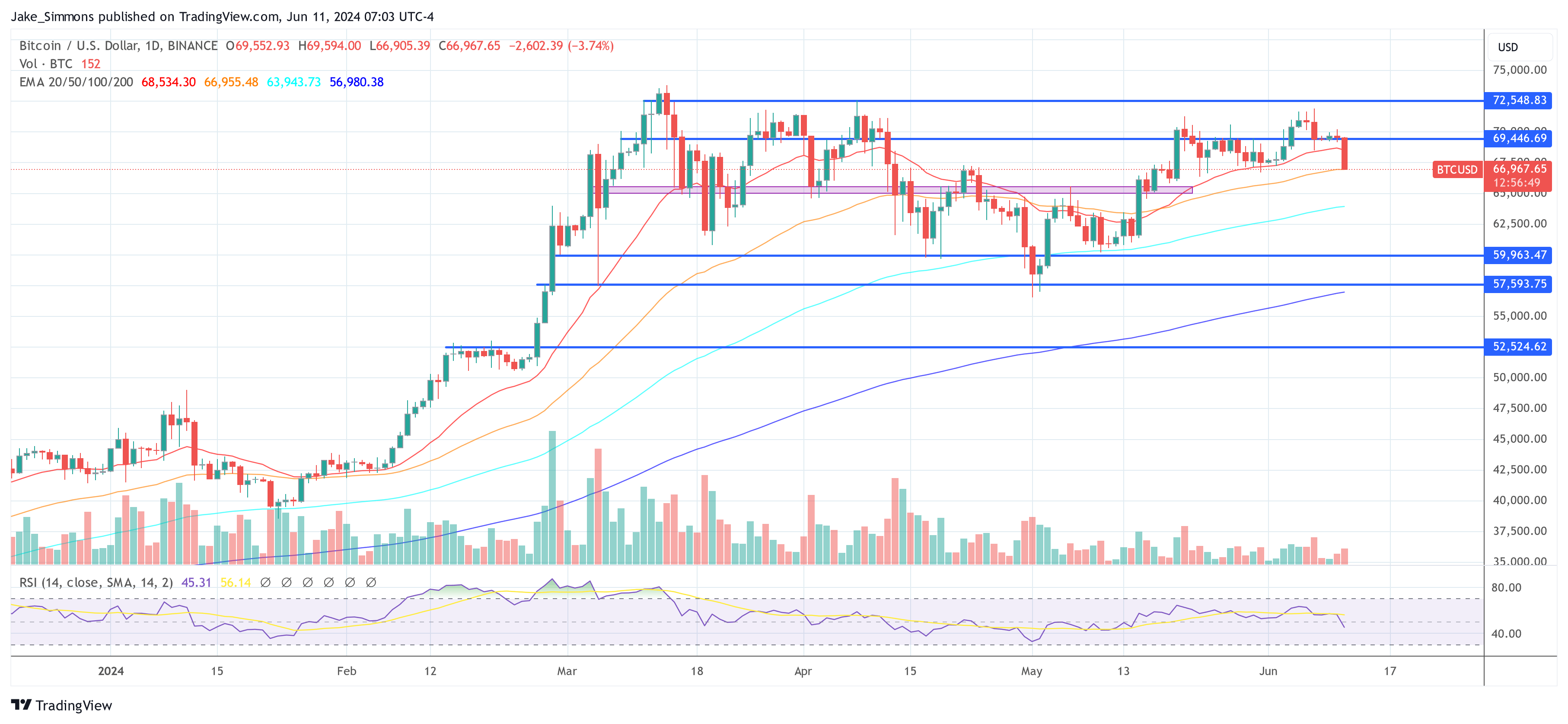

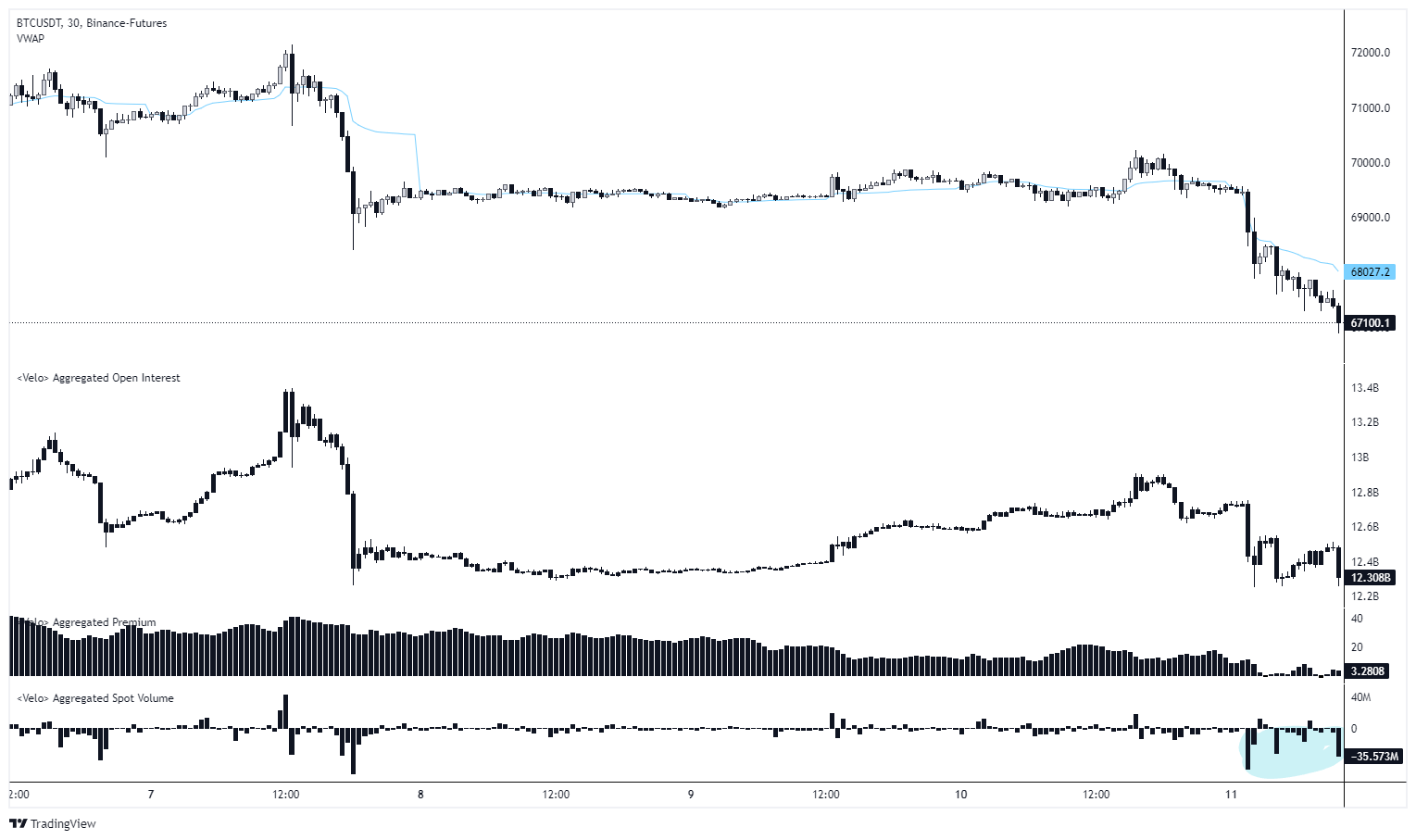

The rapid catalyst for the current worth drop seems to be a surge in spot promoting. Analysis from alpha dōjō reveals that heavy promoting stress was largely answerable for the slide all the way down to a low of $67,000. The market dynamics noticed throughout this era point out a transparent shift, with an elevated quantity of promote orders not met by ample purchase orders to maintain the value degree. This imbalance has led to a breach in what was beforehand thought-about a strong help zone round $68,000.

The analysts elaborated on the state of affairs, “Volatility has made a comeback, with BTC dropping as a lot as 3.5% to a low of $67k since yesterday. This selloff was primarily pushed by heavy spot selling pressure, which is kind of damaging. A significant concern is the shortage of liquidations whereas the selloff is going on. BTC is at the moment in a crucial space; the each day construction has been damaged. BTC must bounce right here, or it’s very doubtless we’ll fall again to the decrease $60ks.”

#3 Inflow Streak In Spot Bitcoin ETF Inflows Ends

The funding dynamics inside spot Bitcoin ETFs have additionally mirrored the market’s bearish flip. After 19 consecutive days of optimistic inflows, these funds skilled important outflows totaling $64.9 million yesterday. Notable amongst these was the Grayscale Bitcoin Trust, which noticed outflows of $39.5 million. In distinction, BlackRock registered smaller inflows of $6.3 million.

The efficiency of different ETF suppliers confirmed appreciable variation. Fidelity recorded outflows amounting to $3 million, whereas Bitwise registered inflows of $7.6 million. In distinction, Invesco skilled outflows of $20.5 million, and Valkyrie additionally reported outflows totaling $15.8 million.

At press time, BTC traded at $66,967.