Despite the latest regulatory nod for the Spot Ethereum ETF by the U.S. Securities and Exchange Commission (SEC), Ethereum’s value has dipped. Notably, the latest drop in value displays that the traders are taking a cautious method earlier than placing their bets. However, amid this, a distinguished crypto analyst has outlined a number of components that might affect Ethereum’s efficiency within the coming days, predicting a possible dip to round $3.4K.

Analyst Unveils Potential ETH Movements

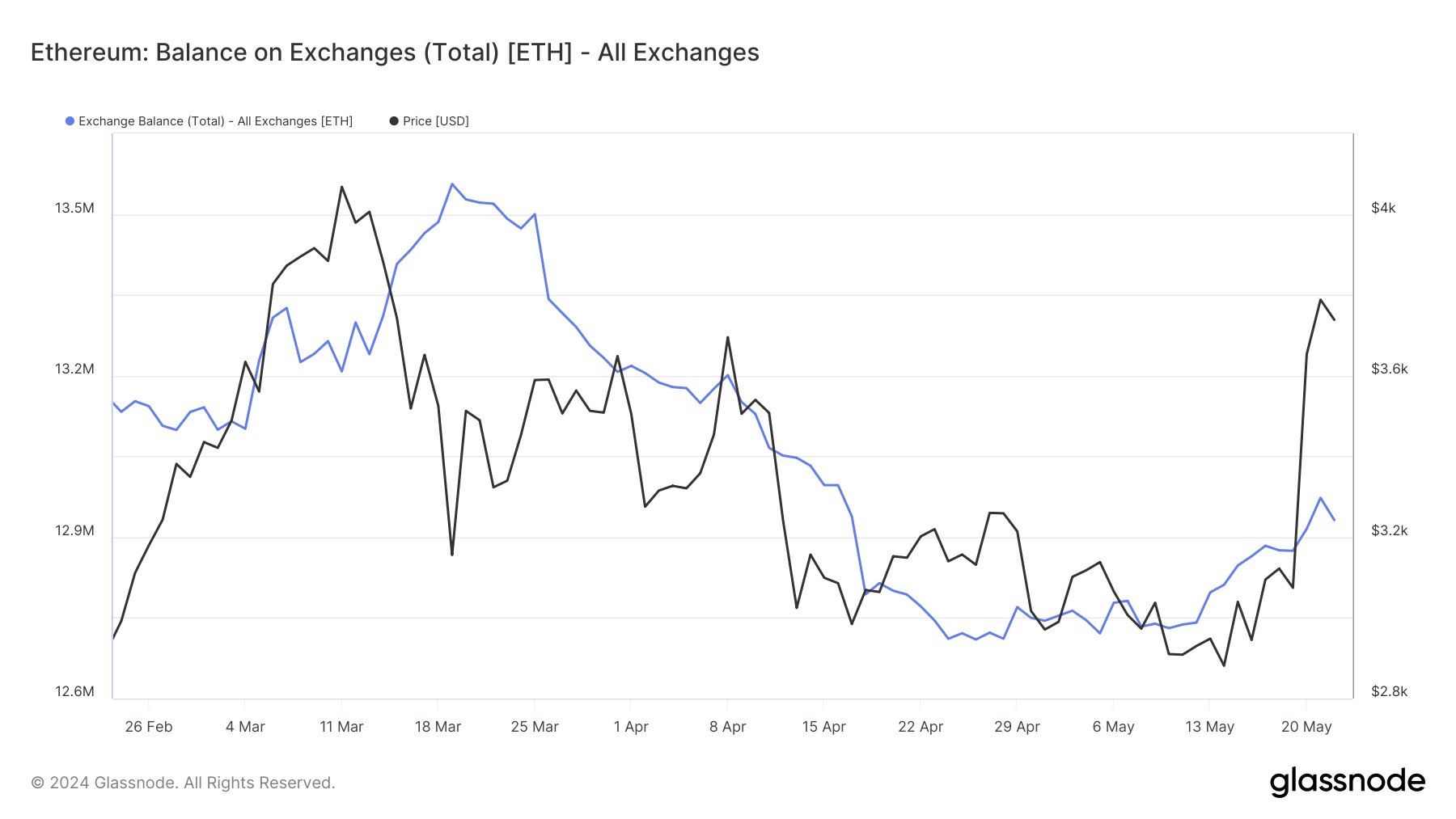

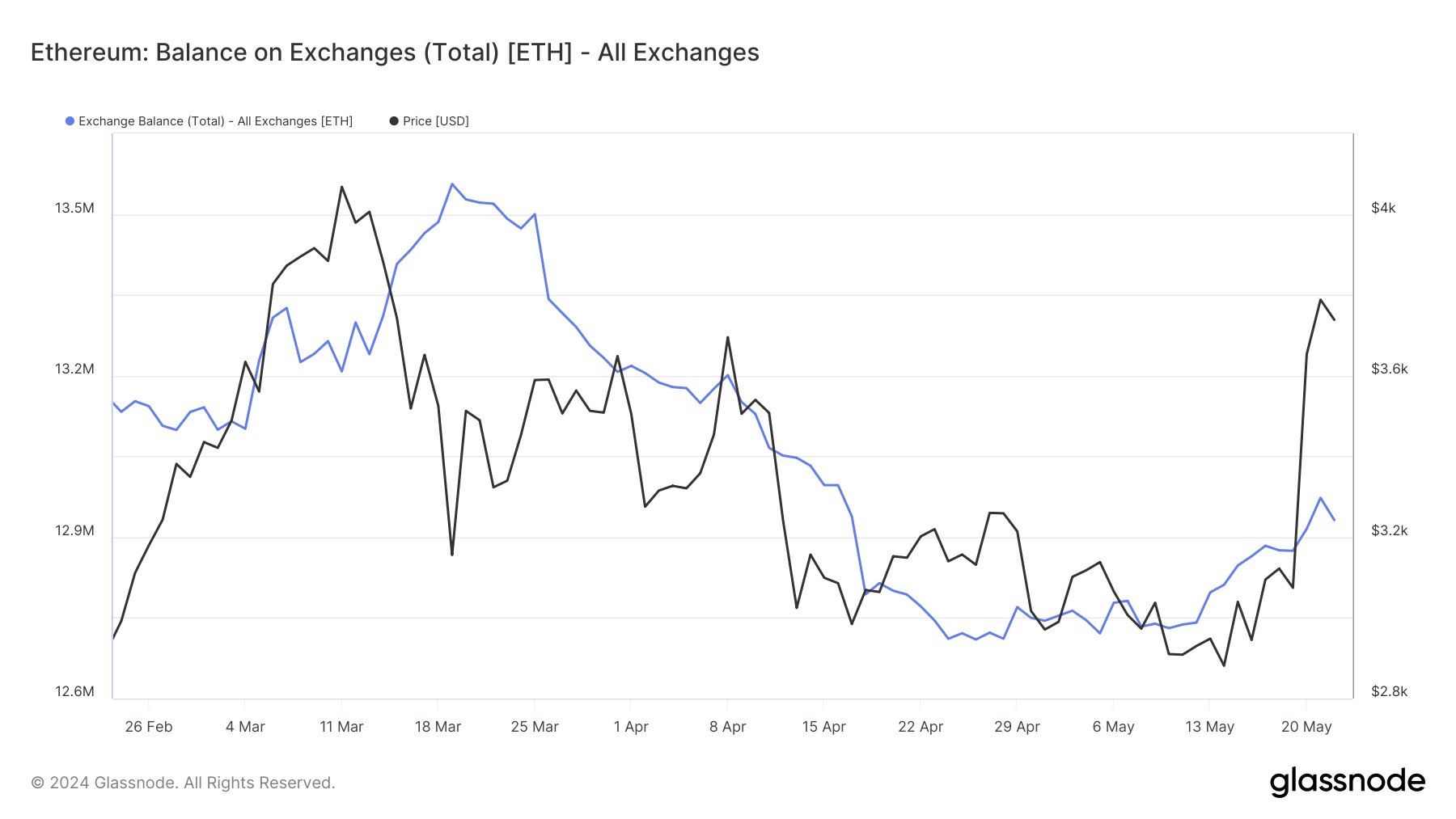

Prominent crypto market professional, Ali Martinez, lately examined Ethereum’s market actions and supplied some insights. He famous that substantial transfers of ETH to exchanges are elevating eyebrows. This exercise has spurred hypothesis about potential profit-taking, portfolio rebalancing, or mere market hypothesis.

Besides, including to the priority, Ethereum co-founder Jeffrey Wilke lately transferred 10,000 ETH, value roughly $37.38 million, to the Kraken trade. This important switch might point out a possible sell-off, which could set off value volatility.

According to Spot On Chain knowledge, Wilke’s transfer is a part of a broader pattern the place over 242,000 ETH have been transferred to trade wallets prior to now two weeks. Notably, it additionally provides to the spike in Ethereum buying and selling exercise in latest days.

Meanwhile, Martinez additionally identified that the TD Sequential indicator is flashing a promote sign on Ethereum’s each day chart. This indicator, recognized for predicting market developments, means that ETH would possibly face promoting strain. He mentioned that the inexperienced 9 candlestick on the each day chart might result in a value retracement or even a brand new downward part earlier than any potential uptrend resumes.

Also Read: Ethereum-beta Ondo Finance (ONDO) Price Touches New All-Time High, What’s Cooking?

Key Ethereum Price Levels

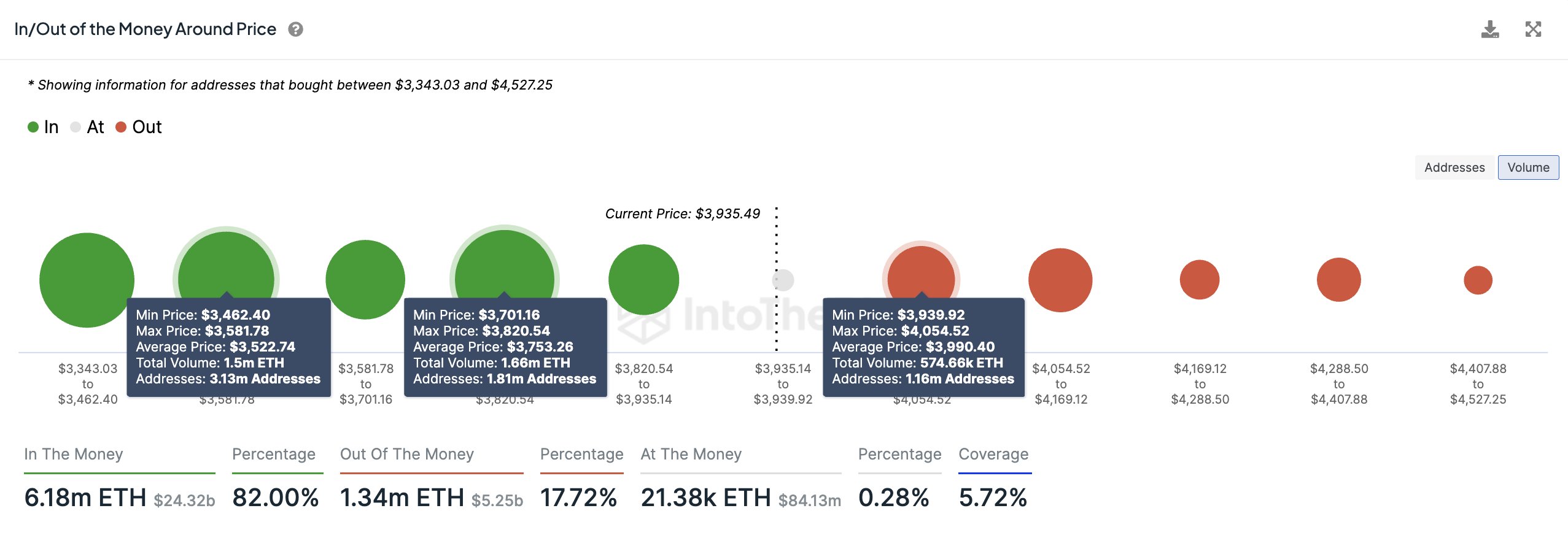

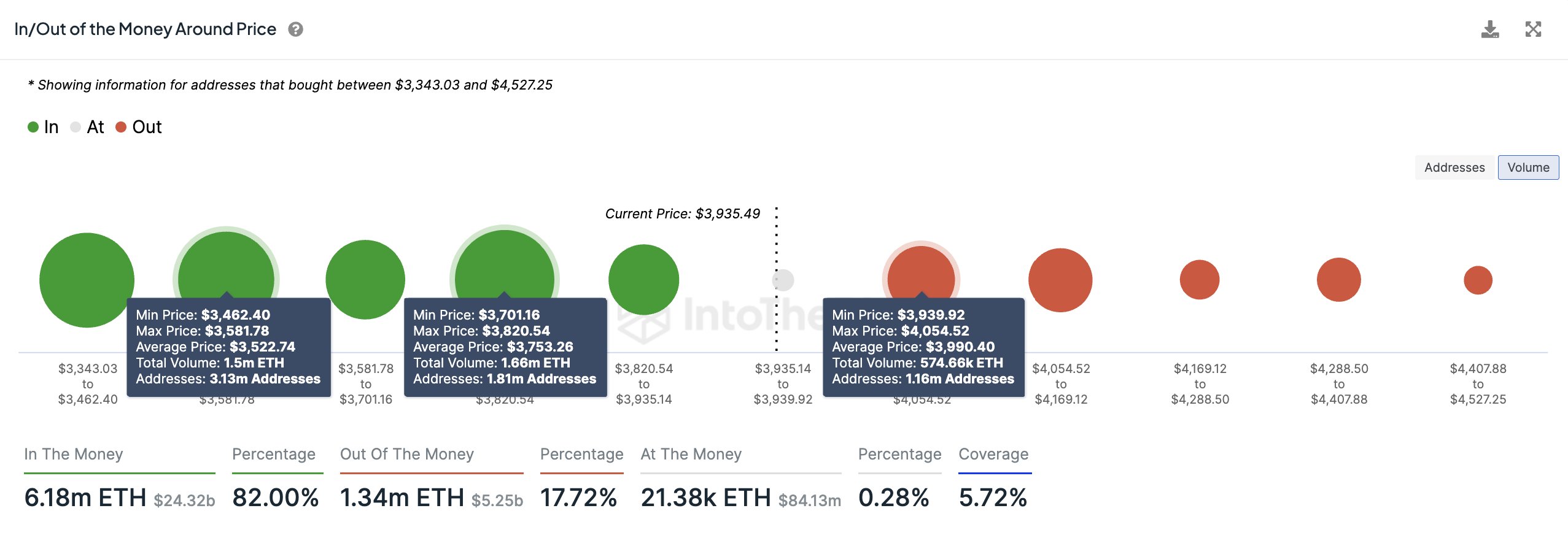

According to IntoTheBlock knowledge, a big variety of Ethereum addresses might present essential help if the worth dips additional. Around 1.81 million addresses purchased about 1.66 million ETH between $3,820 and $3,700.

The analyst suggests that this vary might act as a buffer towards rising promoting strain. However, if Ethereum’s value falls under this zone, the following help stage lies between $3,580 and $3,462. Notably, on this vary, 3.13 million addresses had been acquired over 1.50 million ETH.

On the opposite hand, the vital resistance barrier for Ethereum stands between $3,940 and $4,054. More than 1.16 million addresses beforehand bought round 574,660 ETH on this vary. If Ethereum can surpass this resistance and shut above $4,170, it might invalidate the bearish outlook and doubtlessly provoke a brand new upward pattern towards $5,000.

Meanwhile, in keeping with market consultants, the Ether ETF might propel an Ethereum value rally in the long term, as seen within the Bitcoin efficiency after the U.S. Spot Bitcoin ETF approval. However, regardless of this, the pundits have warned about potential volatility within the short-term, the place a number of traders would possibly e-book revenue given the latest surge in ETH value.

As of writing, Ethereum price slipped about 4.5% and exchanged arms at $3,659.16, with its buying and selling quantity hovering 93.23% to $47.91 billion. Over the final 30 days, the second-largest crypto by market cap noticed a excessive of $3,943.55 and a low of $2,815.92. Notably, the Ethereum Open Interest slumped 5.90% to $15.33 billion amid the worth dip, CoinGlass knowledge confirmed.

Also Read: Dogecoin Community Mourns As Iconic Dog ‘Kabosu’ Passes Away At 17

The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.