Renowned monetary analyst John Bollinger has not too long ago issued a warning relating to the potential for a Bitcoin pullback. After BTC value surged from beneath $66,000 to nearly $72,000 originally of the week, Bollinger, the creator of the broadly utilized Bollinger Bands indicator, pointed to particular options within the Bitcoin value chart that recommend a consolidation or pullback could possibly be imminent, although he clarified that his perspective was not bearish on a long term.

The Bearish Argument By John Bollinger

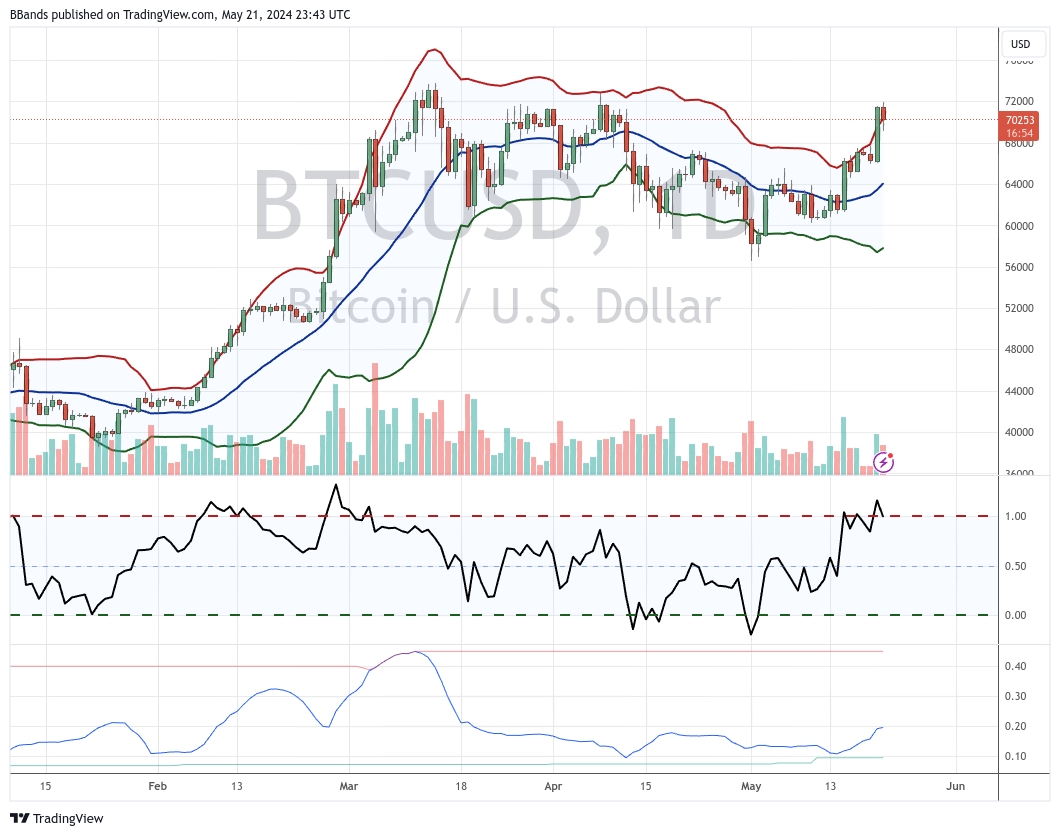

Bollinger’s analysis focuses on the every day BTC/USD chart. His fundamental concern facilities round a “two-bar reversal” sample noticed on the higher Bollinger Band. This sample, sometimes indicating a possible reversal in value path, happens when Bitcoin’s value first exceeds the higher Bollinger Band however then closes inside it through the subsequent buying and selling interval. Such actions can suggest that the upward momentum is perhaps shedding power.

The Bollinger Bands on the chart include three traces: the decrease band, the center band (20-day easy shifting common), and the higher band. These bands develop and contract primarily based on value volatility, with the higher and decrease bands set two normal deviations away from the center band. The Bitcoin price peaked at roughly $71,977 on Tuesday, momentarily pushing above the higher Bollinger Band earlier than closing again inside it, forming the famous reversal sample.

Related Reading

Further evaluation exhibits the 20-day shifting common, the center Bollinger Band, which at present sits at about $64,564 and acts as a possible assist stage within the occasion of a value decline. Historical knowledge from the chart signifies essential resistance close to the current highs round $71,500, whereas assist ranges could possibly be seen across the $64,500 mark, the place the center Bollinger Band lies, and additional at $58,300, coinciding with the decrease band.

The growth of the Bollinger Bands signifies elevated market volatility, significantly as the worth assessments resistance ranges. The Relative Strength Index (RSI) is at present simply at 63, which isn’t but within the overbought territory.

In his commentary, Bollinger has clearly said that whereas the setup isn’t basically bearish, the noticed technical sample warrants warning for short-term merchants. He advises monitoring for both a consolidation period the place the worth stabilizes, or a pullback the place it retreats from current highs. “I am not fond of the two-bar reversal at the upper Bollinger Band for BTCUSD. Suggests a consolidation or a pullback. Not bearish here, just short-term concerned,” Bollinger remarked.

The Bullish Argument

On the opposite, famend crypto analyst, Josh Olszewicz (@CarpeNoctom), shared a bullish outlook on Bitcoin by way of a special lens, specializing in the Ichimoku Cloud indicator within the every day chart. He highlighted a “Bullish TK Cross with Price Above Cloud” on the every day Bitcoin chart.

Related Reading

This specific sample is important inside the realm of technical evaluation, particularly for these using the Ichimoku Kinko Hyo indicator, a complete device that gives insights into market momentum, pattern path, and assist and resistance ranges.

The “Bullish TK Cross” Olszewicz refers to happens when the Tenkan-sen line (a short-term shifting common) crosses above the Kijun-sen line (a medium-term shifting common), indicating a possible uptrend. Typically, this crossover suggests that purchasing momentum is growing and may sign the beginning of a bullish part.

The significance of this bullish sign is additional enhanced by the truth that the worth of Bitcoin is above the “Cloud” or ‘Kumo’, which is taken into account an space of future assist or resistance. When the worth is above the cloud, it’s usually seen as a bullish sign, suggesting that the asset is in a robust uptrend and prone to proceed as such.

This setup offers a transparent bullish state of affairs that contrasts with the short-term warning advised by John Bollinger’s evaluation. At press time, BTC traded at $69,846.

Featured picture created with DALL·E, chart from TradingView.com