In an interview with Yahoo Finance’s “Wealth,” Ric Edelman, founding father of the Digital Assets Council of Financial Professionals and $291 billion asset supervisor Edelman Financial Services, supplied a placing forecast for the Bitcoin worth. Edelman argued that Bitcoin’s worth may surge to $420,000, attributing this potential rise to a modest international asset allocation in direction of Bitcoin.

Why Bitcoin Price Will Reach $420,000

During the interview, Edelman delved into the benefits of investing in Spot Bitcoin ETFs. He famous that these devices make Bitcoin accessible in the identical method as conventional ETFs, that are commonplace and acquainted to buyers utilizing unusual brokerage accounts.

“They’re incredibly inexpensive, 20-25 basis points cheaper than going to say Coinbase or other crypto exchange and being in a brokerage account, you can rebalance, you can dollar cost average, you can tax loss harvest,” Edelman highlighted. This setup simplifies the funding course of, making it akin to managing every other asset class, thus broadening its attraction to a wider viewers.

Related Reading

However, Edelman was additionally candid concerning the challenges and dangers related to Bitcoin. Despite the benefits supplied by ETFs, the inherent nature of Bitcoin as a risky and dangerous funding persists. “It’s still Bitcoin, which means it’s still very volatile, it’s still very risky. You could still lose everything,” he cautioned.

Edelman pointed to ongoing regulatory uncertainty, potential lawsuits, and prevalent fraud as important dangers that buyers must handle cautiously. He additionally criticized the pattern of investing attributable to concern of lacking out (FOMO), labeling it as a poor funding rationale.

Looking forward, Edelman mentioned the regulatory panorama, notably regarding different cryptocurrencies like Ethereum. He famous that there are a number of purposes pending for Ethereum ETFs, and whereas he anticipates preliminary rejections, approvals may comply with by yr’s finish.

Related Reading

“After you have the Bitcoin ETFs and the Ethereum ETFs, I’m not sure how quickly you’ll see anything else after that, but these two will kind of open the doors long term. Five years from now, there will be dozens, perhaps even hundreds of crypto ETFs,” Edelman speculated. This perspective underscores a major shift in direction of mainstream acceptance and integration of cryptocurrencies into conventional monetary merchandise.

Edelman’s prediction of Bitcoin reaching $420,000 relies on an assumption of global asset diversification. By his calculations, if all international asset holders allotted simply 1% of their property to Bitcoin, this could translate to a market cap of $7.4 trillion for Bitcoin alone.

“It’s remarkably simple. If you take a look at the world’s global assets, the value of the stock market, globally, the bond market, the real estate market, the gold market, you just look at all the assets everybody in the world owns, it’s about $740 trillion,” he defined. Such an allocation would dramatically enhance Bitcoin’s market cap, driving its worth up considerably.

Moreover, Edelman highlighted a shift within the notion of Bitcoin from a transactional forex to a retailer of worth, just like gold. “The use case of Bitcoin, although it’s strong for transmittal, is not the strongest argument. It’s now like gold, a store of value,” he acknowledged. This notion shift has attracted extra institutional buyers, who view Bitcoin as a hedge or an alternate asset class, akin to different non-traditional investments like art work or collectibles.

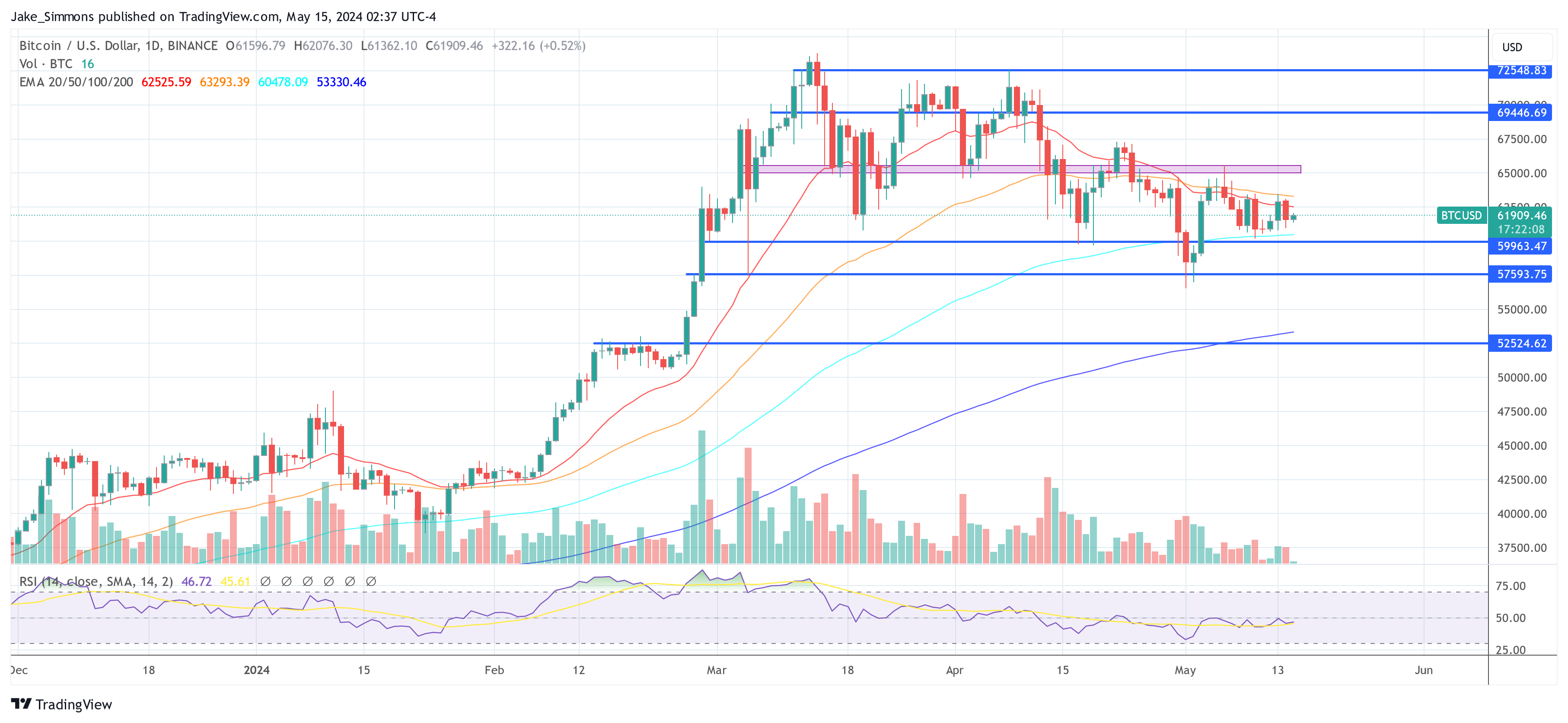

At press time, BTC traded at $61,909.

Featured picture from Wealth Management, chart from TradingView.com