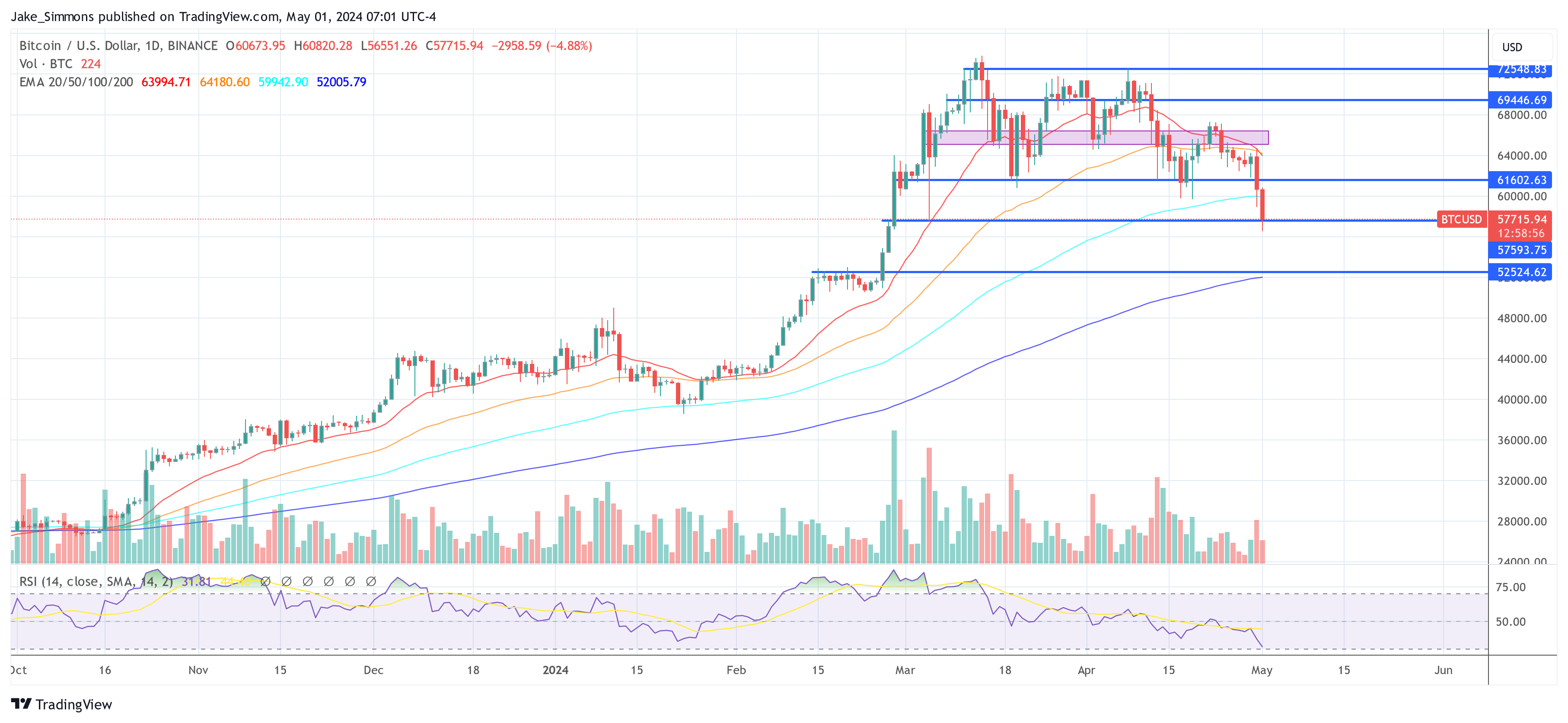

Bitcoin (BTC) has witnessed a big drop, falling to $56,556 throughout Wednesday morning in Europe, marking the bottom level since late February. This downturn represents the sharpest month-to-month decline since November 2022, with BTC tumbling roughly 7.5% inside the final 24 hours and breaching the beforehand secure $60,000 help late Tuesday.

#1 Derisking Before Today’s FOMC Meeting

Anticipation and nervousness are excessive in monetary circles because the Federal Open Market Committee (FOMC) is ready to announce its rate of interest determination later right this moment. This occasion is essential because the crypto market, notably Bitcoin, has grown more and more reactive to macroeconomic alerts.

Recent knowledge, reflecting a slowdown in GDP development coupled with persistent inflation, has considerably decreased expectations of rate of interest cuts by the Federal Reserve. “Bitcoin and other risk assets are currently feeling the pressure from a stagflationary environment, geopolitical tensions, and seasonal liquidity variations,” remarked Ted from TalkingMacro.

Initially, as much as seven price cuts had been anticipated by the top of 2024, a sentiment that has shifted dramatically with the market now pricing in just one potential minimize by December 2024. This shift comes amidst an setting the place inflation knowledge is trending upwards, difficult the Federal Reserve’s place and doubtlessly resulting in a extra cautious strategy from Jerome Powell, the Fed Chairman.

“For the first time in recent memory, the market is calling the Fed’s bluff, quickly front-running the idea that the Fed may not cut at all in 2024,” famous Ted.

#2 Cyclical Bitcoin Correction Phase

Following an distinctive rally for the reason that yr’s begin, the market is present process a pure correction section. Prior to the worth crash, Charles Edwards, founding father of Capriole Investments, noted: “We are a day short of breaking the record set in 2011 for days without a meaningful dip [-25%],” emphasizing the extraordinary nature of Bitcoin’s latest efficiency.

Scott Melker, generally known as “The Wolf Of All Streets,” highlighted technical indicators that advised an impending correction. “Broke and retested range lows as resistance. […] My biggest concern I have been discussing for months [was] that RSI never made the trip to oversold. Almost there now, all lower time frames oversold. This is still ONLY A 23% correction, very shallow for a bull market and consistent with other corrections on this run. We are yet to see a 30-40% pull back during this bull market, like those of the past.”

$BTC Daily

Broke and retested vary lows as resistance. Nothing however air till round $52,000 on the chart.

My greatest concern I’ve been discussing for months (in publication) is that RSI by no means made the journey to oversold.

Almost there now, all decrease time frames oversold.

This… pic.twitter.com/5YZTWipBo8

— The Wolf Of All Streets (@scottmelker) May 1, 2024

#3 Profit-Taking

Traditional finance markets and seasoned traders are seizing the chance to take earnings following substantial positive aspects. (*4*) defined crypto analyst RunnerXBT.

This pattern confirms a broader profit-taking technique put up important occasions just like the ETF approval and the anticipation across the Bitcoin halving. “That […] confirms my thesis that a lot of these guys longed in October 2023 because of ETF approval and BTC halving, trade played out and now they are taking profits (yes they are still up a lot), because they longed BTC not dead altcoins.”

TradFi/Boomers are taking earnings ✅

CME Open Interest is reducing quickly

April twenty ninth 135,6k cash

April thirtieth 123,9k cashTopped round 170.4k cash (March twentieth)

That a minimum of for me confirms my thesis that numerous these guys longed in October 2023 due to ETF approval… pic.twitter.com/M8KY1NfCtK

— RunnerXBT (@RunnerXBT) May 1, 2024

#4 US ETF Flows And Hong Kong Disappointment

The dynamics surrounding spot Bitcoin ETFs have proven important strains, evidenced by latest actions in each US and Hong Kong markets. In the United States, Bitcoin exchange-traded funds (ETFs) confronted substantial outflows, indicating a cooling investor sentiment.

According to latest data, the overall outflows from US spot Bitcoin ETFs amounted to $161.6 million. Notably, the Grayscale Bitcoin Trust (GBTC) skilled outflows of $93.2 million, whereas Fidelity and Bitwise registered outflows of $35.3 million and $34.3 million, respectively. BlackRock had zero internet flows as soon as once more. These numbers recommend a retreat in institutional curiosity, which has historically been a bulwark towards worth volatility.

Parallel to the US, the debut of Bitcoin ETFs in Hong Kong additionally faltered considerably under expectations. Six newly launched ETFs, supposed to seize each Bitcoin and Ethereum markets, collectively reached simply $11 million in buying and selling quantity, starkly underperforming towards the anticipated $100 million. The spot Bitcoin ETFs accounted for $8.5 million in buying and selling quantity. This was markedly decrease than the launch day volumes of US-based spot Bitcoin ETFs, which had reached $655 million on their first day.

#5 Long Liquidations

The market has additionally been impacted by substantial lengthy liquidations, with a complete of $451.28 million liquidated within the final 24 hours alone. The largest single liquidation was an ETH-USDT-SWAP on OKX valued at $6.07 million, however Bitcoin-specific liquidations had been important as nicely, totaling $143.04 million, in accordance with data from CoinGlass. These liquidations have amplified the promoting strain on Bitcoin.

At press time, BTC traded at $57,715.

Featured picture from iStock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site completely at your personal threat.