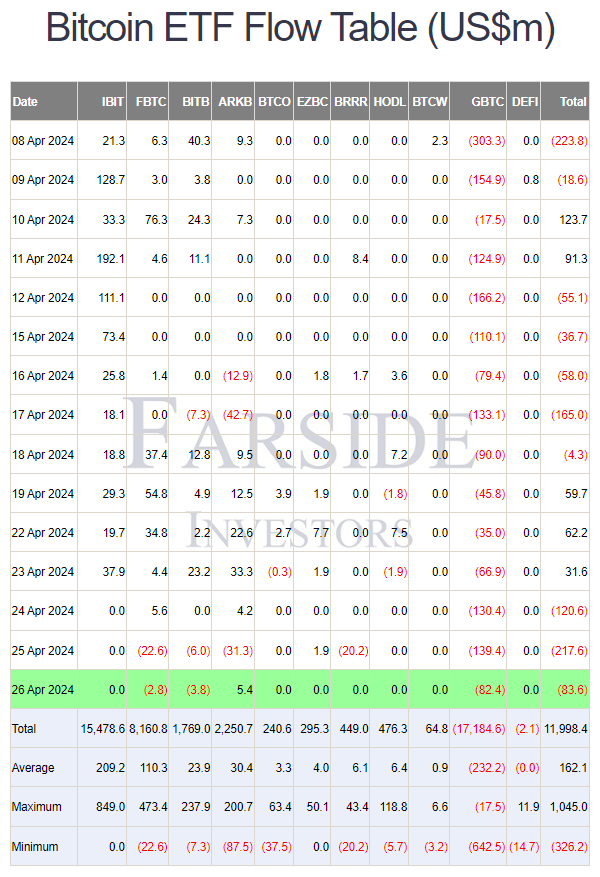

Bitcoin ETF: Spot Bitcoin ETFs within the U.S. proceed to carry out poorly, with a internet outflow of $83.6 million on the week’s final buying and selling day. Grayscale GBTC noticed an outflow of $82.4 million and a slightly decrease outflow than the previous two days, indicating the dearth of curiosity amongst institutional traders in Bitcoin ETF presently.

This comes principally resulting from month-to-month choices expiry and warmer PCE inflation amid Bitcoin’s poor efficiency in the previous couple of days. Moreover, DTCC’s replace on collateral values for sure securities, notably ETFs with Bitcoin or different cryptocurrencies as property, prompted panic within the monetary business.

Bloomberg analyst James Seyffart and Custodia Bank CEO Caitlin Long stated DTCC announcement on ETFs with Bitcoin publicity can have zero collateral worth for loans is definitely “healthy” for the crypto market.

Also Read: Binance v. SEC – US DOJ Filing Counters SEC, Stablecoins Are Not Securities

Spot Bitcoin ETFs Saw $83.6 Million Outflows

After exhibiting indicators of restoration earlier this week as Bitcoin ETFs noticed internet inflows, the outflows have once more shadowed the curiosity within the ETF market. The complete internet outflow of spot Bitcoin ETFs was $83.6 million, in keeping with knowledge reported by Bloomberg and Farside Investors on April 27. The 11 listed spot Bitcoin ETF witnessed a disappointing day once more volumes and shopping for exercise had been considerably down.

Ark 21Shares Bitcoin ETF (ARKB) was the one Bitcoin ETF with an influx. It noticed simply $5.4 million in influx amid expectations of shopping for from the ARK funds because it bought all its holdings in ProfessionalShares Bitcoin Strategy ETF (BITO). Shares value fell 1.84% however climbed 0.61% after market hours.

Fidelity Bitcoin ETF (FBTC) and Bitwise Bitcoin ETF (BITB) noticed outflows of $2.8 million and $3.8 million on Friday, respectively. This was the second consecutive day of outflows from the 2 largest Bitcoin ETFs with huge Bitcoin holdings.

BlackRock iShares Bitcoin ETF (IBIT) and different spot Bitcoin ETFs noticed zero flows, elevating considerations amongst retail and institutional traders as zero circulate knowledge recorded by some Bitcoin ETFs this week might additional degrade investor sentiment.

The outflows from Grayscale GBTC have slowed on Friday as in comparison with previous days. Outflow from GBTC decreased to $82.4 million from $139.4 million a day in the past. With this, the overall outflows from the Grayscale BTC ETF at present stand at $17.14 billion.

Also Read: XRP, ADA, BCH, LTC, STX Declared Zombie Among 20 Crypto By Forbes

Bitcoin Can Still Recover From Here

BTC price fell over 2% within the final 24 hours, with the worth at present buying and selling underneath $63,000. The 24-hour high and low of $62,424 and $64,789, respectively. Moreover, the buying and selling quantity has decreased by 24% as merchants cautiously search for additional alerts.

BitMEX co-founder Arthur Hayes predicts a restoration in shares, crypto market, Bitcoin subsequent week. The cause behind bullish outlook is tax receipts from US residents added $200 billion to the Treasury General Account (TGA) and the US Treasury Dept’s Q2 2024 refunding announcement subsequent week.

Meanwhile, Republic First Bank grew to become the primary regional financial institution this yr to succumb to pressures of upper rates of interest maintained by the U.S. Federal Reserve.

Also Read: Former Federal Reserve Adviser Calls Out Trump Allies’ Fed Remodeling Plans

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.