The story has not been any a lot totally different for Bitcoin, with its value nonetheless stuck in a consolidation range up to now week. The sluggishness of the premier cryptocurrency – and the final market – has continued regardless of the completion of the halving occasion over per week in the past.

The halving event, which noticed mining rewards take a big reduce, was anticipated to usher in one other spherical of bullishness for the Bitcoin value. On the opposite, traders seem like getting annoyed with the gradual exercise of the market, with many calling for the dump of BTC.

Bitcoin Sell Calls At Increased Rate: Blockchain Firm

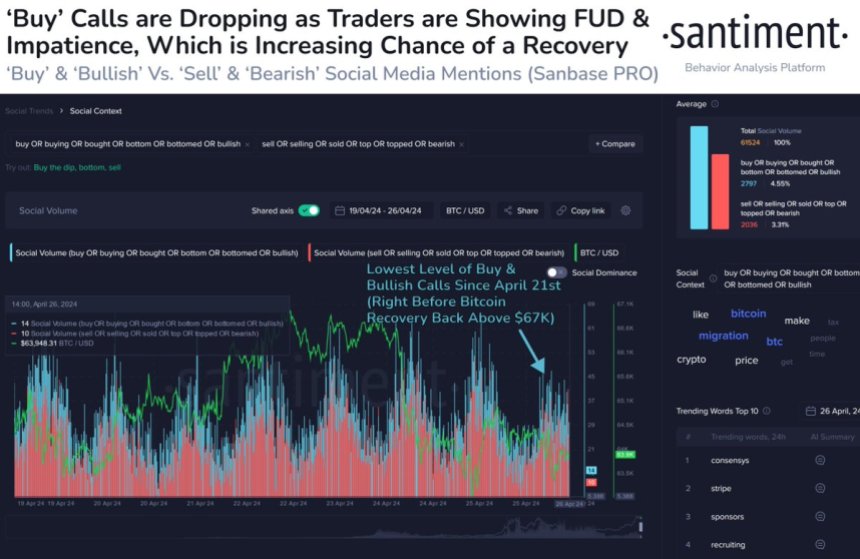

According to a recent report by on-chain analytics agency Santiment, traders are more and more calling for the sale of Bitcoin throughout social media following its newest drop towards $63,000. The related metric right here is the “social volume” indicator, which tracks the variety of distinctive posts and messages on totally different social platforms that point out a selected subject.

Santiment aggregated knowledge of “buy or bullish”, “sell or bearish,” or associated mentions for the premier cryptocurrency over the previous week. The on-chain analytics then highlighted a shift within the development, with the bearish calls seeking to drown out the bullish noise on social media.

According to Santiment, Bitcoin’s current fall to $63,000 resulted within the lowest degree of purchase and bullish calls since April twenty first (simply earlier than BTC recovered again above $67,000). As proven within the chart above, the social volume for phrases associated to “sell” shot up after the value decline.

Typically, the elevated bearish mentions of Bitcoin counsel a rising degree of FUD (worry, uncertainty, and doubt) amongst traders. However, when merchants seemingly develop into annoyed and impatient, there may be normally a better probability of a market rebound.

Almost 90% Of Circulating BTC In Profit – Impact On Price

According to current on-chain data, about 90% of Bitcoin in provide is in revenue. On the floor, this principally implies that probably the most present holders of the premier cryptocurrency purchased at a cheaper price in comparison with the present value.

However, this level of profitability will also be an overbought sign, particularly after bullish intervals just like the one which occurred between October 2023 and March 2024. Ultimately, this implies traders might see Bitcoin shed extra of its value features over the following coming weeks.

As of this writing, Bitcoin is valued at $63,077, reflecting a 2% value decline up to now 24 hours.