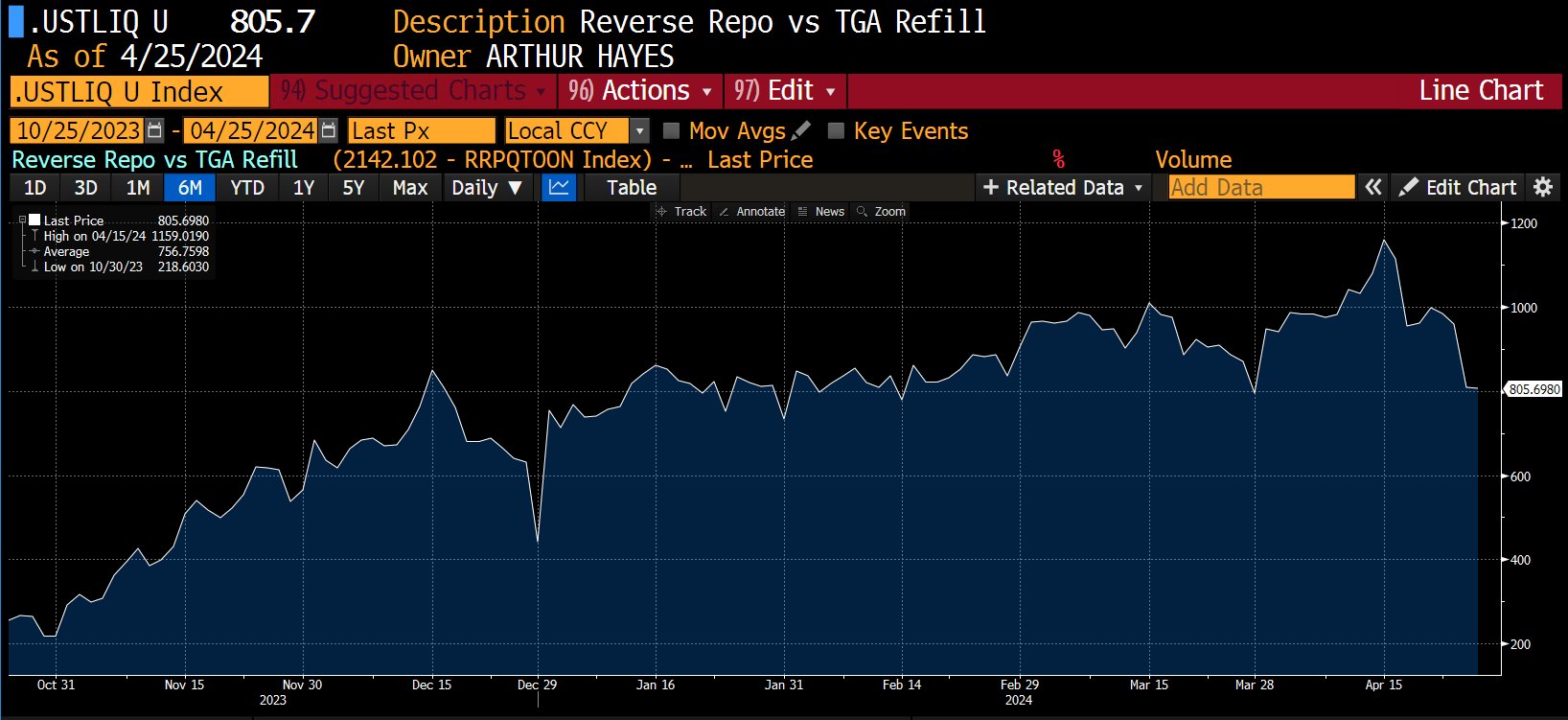

BitMEX co-founder Arthur Hayes reveals a serious bullish sign for the crypto and inventory markets. As macro components have been the first causes behind a drop in sentiment within the crypto market just lately, Hayes revealed tax receipts from US residents added $200 billion to the Treasury General Account (TGA) of the U.S. Treasury Dept and the subsequent steps can deliver a restoration within the markets.

Arthur Hayes Predicts Re-Acceleration of the Crypto Bull Market

BitMEX co-founder Arthur Hayes in a put up on X shared three attainable choices Treasury Secretary Janet Yellen would think about because the Q2 2024 refunding announcement comes subsequent week. The Treasury General Account (TGA) is restocked at $941 billion as US tax funds added $200 billion to the TGA.

Janet Yellen will set off a rally in shares and crypto markets if any of the beneath three choices are thought-about:

- Stop issuing treasuries by lowering the TGA to zero, which will likely be a $1 trillion liquidity injection.

- Shifts extra borrowing to Treasury payments to take away cash from RRP, which is $400bn injection of liquidity.

- Combination of 1 and a couple of, which will likely be $1.4 trillion liquidity injection. Treasury might cease long run bonds and concern on payments whereas operating down TGA and RRP.

“If any of these three options happen, expect a rally in stocks and most importantly a re-acceleration of the crypto bull market,” stated Arthur Hayes.

The liquidity from individuals to the federal government is internet unfavorable for threat belongings. Moreover, the anticipated liquidity “boost” within the subsequent coming weeks can be internet constructive for threat belongings. The shares and crypto markets are anticipated to see an enormous rally, particularly as a post-halving rally is triggered.

Also Read: Shiba Inu (SHIB) Teases Hardfork To Unlock New Capabilities, Price Reacts

Bitcoin Price to Rally?

Currently, the key headwinds for the bitcoin value rally are crypto market expiry and PCE inflation information right now. The crypto market is predicted to see muted value motion as merchants be careful for these occasions.

BTC price jumped 1% previously 24 hours, with the worth at the moment buying and selling at $64,302. The 24-hour high and low are $62,783 and $65,275, respectively. Furthermore, the buying and selling quantity has elevated barely within the final 24 hours.

Coinglass information confirms muted motion in derivatives buying and selling forward of $9.4 billion in Bitcoin and Ethereum choices expiry on Deribit.

Also Read:

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.