The Bitcoin value has slumped over 4% right now amid a selloff within the broader cryptocurrency market, sparking discussions over the longer term trajectory of the flagship crypto. Amid the latest crash, a distinguished crypto market analyst warned over a possible dip in BTC value to $59,000.

However, in line with a number of different market consultants, this dip might current a profitable shopping for alternative for the market contributors. So, let’s take a more in-depth take a look at the analysts’ predictions to grasp the present market pattern.

Analyst Predicts Bitcoin Price Dip To $59K

The latest decline within the Bitcoin value has weighed on the buyers’ sentiment globally. Given the latest crypto market crash, many are speculating over the potential state of affairs of the broader market within the coming days.

Amid this, a distinguished analyst Ali Martinez shared an essential BTC analysis. According to Ali Martinez, Bitcoin faces two vital promote indicators: a loss of life cross between the 50 and 100 SMA, and a crimson 9 candlestick from the TD Sequential. Notably, Martinez’s evaluation means that if Bitcoin falls under $63,300, it might plummet to $61,000 and even $59,000, sparking hypothesis over a possible breach of the $60,000 mark.

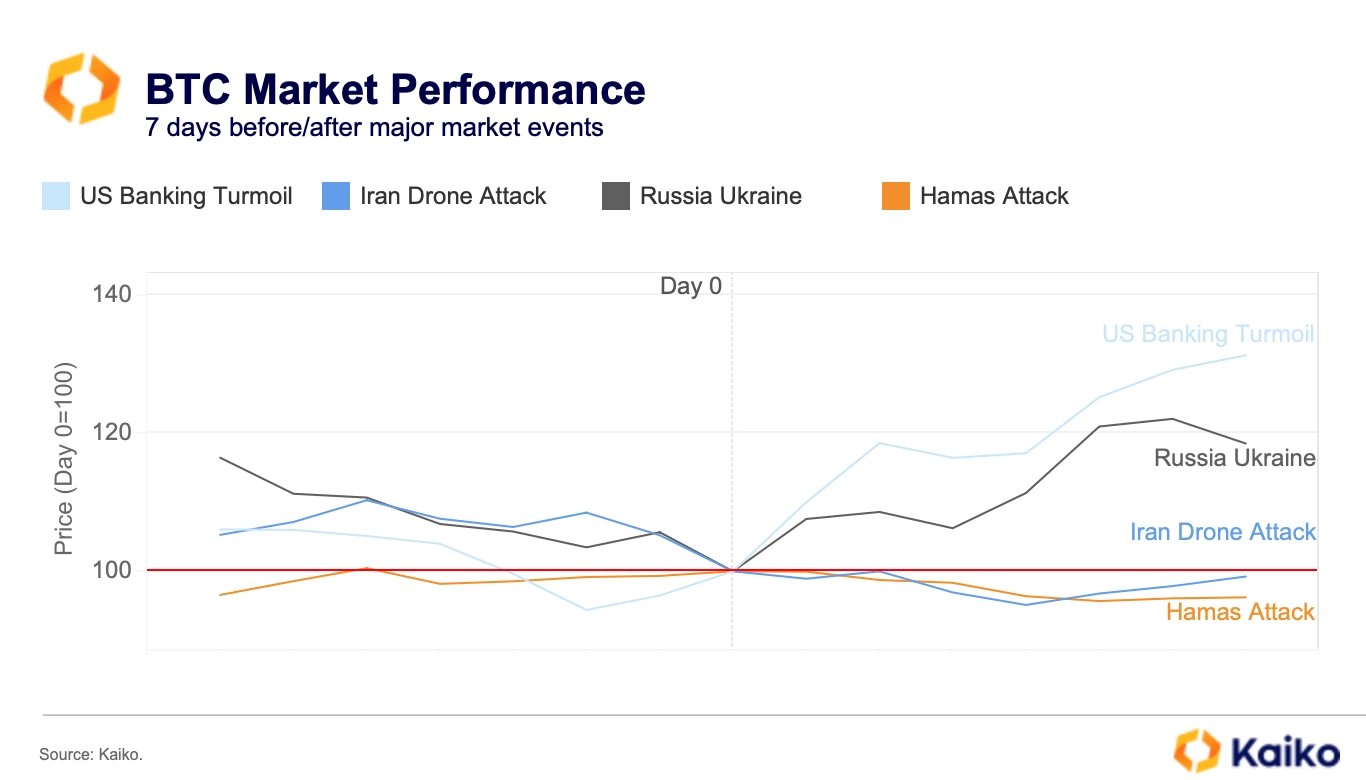

Simultaneously, Kaiko, an on-chain analytical agency, additionally shared a bearish sentiment, attributing Bitcoin’s latest 6% drop in April to geopolitical turmoils. While conventional safe-haven property like gold and the US Dollar rallied, Bitcoin didn’t capitalize on market turbulence, fueling issues over its resilience amidst world uncertainty.

Also Read: CryptoQuant CEO Slams DoJ For Charges Against Samourai Wallet Founders

Is The Recent Dip Flashing A Buying Signal?

Amid discussions surrounding a possible downturn in Bitcoin’s value under the $60,000 mark, market consultants are heralding it as a purchase sign for savvy buyers. Despite short-term volatility projections after the latest Bitcoin Halving occasion, long-term forecasts paint a promising image of BTC’s trajectory.

For context, Spot On Chain’s evaluation, powered by Google Cloud’s Vertex AI, forecasts BTC costs fluctuating between $56k to $70k all through May, June, and July 2024, with a 48% likelihood of dipping under $60k. However, trying additional forward, they anticipate vital motion within the second half of 2024, with a 63% probability of hitting $100K and a 42% likelihood of surpassing $150k within the first half of 2025.

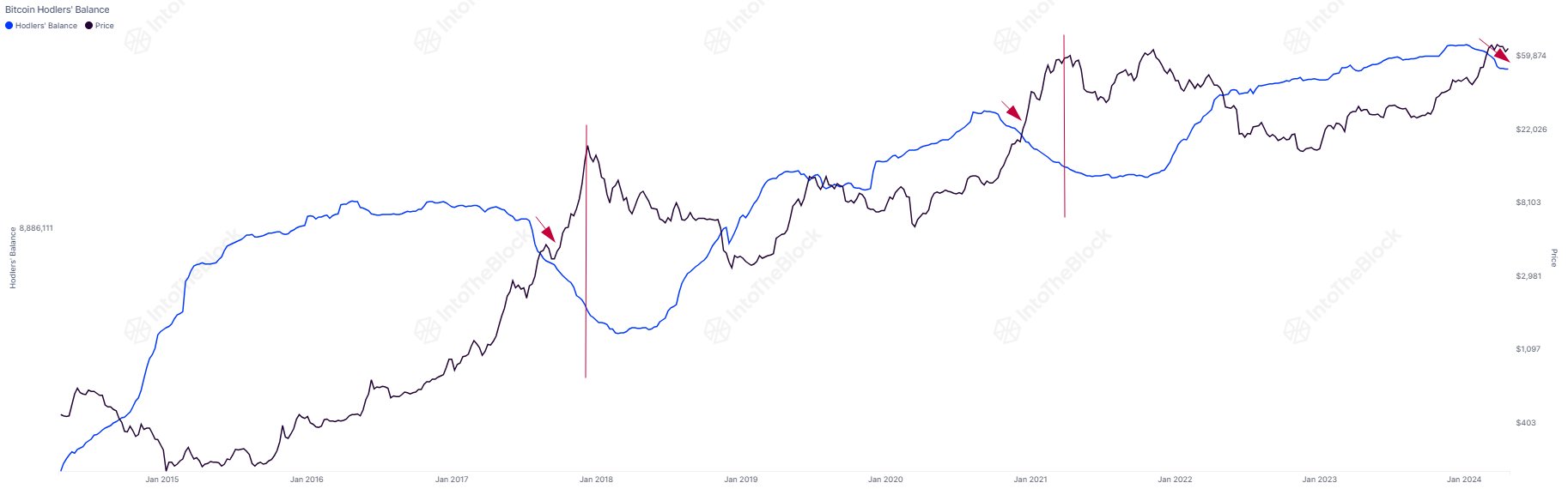

Echoing this sentiment, IntoTheBlock notes that seasoned Bitcoin holders have begun promoting off their holdings, a pattern sometimes noticed on the onset and peak of bull markets. Meanwhile, regardless of preliminary issues, they reassure buyers that this conduct aligns with historic market cycles and stress that ample time stays in comparison with earlier cycles.

What’s Next?

CryptoQuant knowledge reveals a damaging flip within the Bitcoin Coinbase Premium Gap, suggesting vital promoting strain from US buyers on Coinbase. Notably, as of April 24, the hole stood at -33.81.

While this sentiment might sign a bearish pattern, it presents a possible shopping for alternative for buyers eyeing Bitcoin at a reduced value. Besides, contemplating the optimistic long-term outlook for Bitcoin, this dip might function a strategic entry level for buyers aiming to capitalize on future development.

As of writing, the Bitcoin price was down 4.39% and traded at $63,486.12, whereas its buying and selling quantity soared 35.40% to $32.42 billion. The flagship crypto has touched a excessive of $66,730.43 within the final 24 hours, reflecting the extremely unstable state of affairs within the cryptocurrency market.

Also Read: XRP Whales Shift 150M Coins As Price Dips To $0.52, What’s Next?

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.