The second-largest crypto token by market cap, Ethereum (ETH), appears to be like set to make an enormous market restoration following current buys suspected to be made by Tron’s founder, Justin Sun. Sun’s accumulation spree once more highlights crypto whales’ current bullishness on Ethereum regardless of fluctuating costs.

Sun Allegedly Buys $405 Million Worth Of ETH

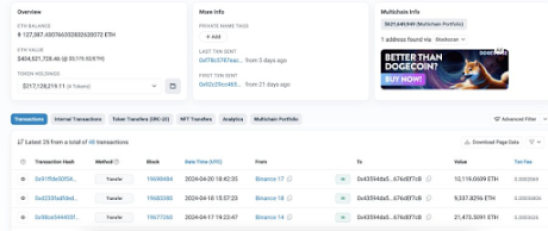

In an X (previously Twitter) post, the on-chain analytics platform Lookonchain drew the crypto group’s consideration to a mysterious pockets suspected to belong to Justin Sun. This pockets is claimed to have purchased 127,388 ETH ($405.19 million) from Binance and decentralized exchanges (DEXs) since April 8 at a mean value of $3,127.

Source: Etherscan

Meanwhile, Lookonchain tried to show additional its concept that this pockets probably belonged to Justin Sun. The platform alluded to a earlier tweet mentioning {that a} suspected Justin Sun wallet bought 168,369 ETH at $2,894 from Binance and a DEX between February 12 and 24. It famous that the “transaction behavior” of each wallets was related, which means that they’re each probably owned by Justin Sun.

If certainly each wallets are owned by Justin Sun, which means the Tron founder has collected 295,757 ETH ($891 million) at a mean value of $3,014 since February 12. Like each whale activity, Sun’s alleged transactions have caught the crypto group’s consideration, with many questioning why he’s gaining a lot publicity to the second-largest crypto token.

Ethereum Whales Are Bullish

Sun’s actions highlighted the bullish sentiment that Ethereum whales have in direction of the crypto token regardless of its current unimpressive value motion. Bitcoinist recently reported about an Ethereum whale who, regardless of already dropping $4.5 million, opened another long position on the second-largest crypto token.

This whale additionally borrowed 17.3 million USDT simply to extend their publicity to the crypto token. In a current X post, Lookonchain once more highlighted how Ethereum whales are nonetheless making bullish strikes available in the market. On-chain information exhibits a recent pockets (0x9EB0) that withdrew 7,182 ETH ($23.06 million) from Binance, which suggests long-term holding by this whale.

Another pockets (0x1958) withdrew 5,181 ETH ($16.28 million) from Binance and put their ETH holdings to work by staking it into Bedrock and Pendle whereas anticipating additional value positive aspects within the crypto token.

Such bullish sentiment in direction of Ethereum might be good for ETH’s value as whales are identified to have a major impression on a token’s value discovery. It may additionally show essential throughout this era when Ethereum is experiencing declining network growth, which implies that the speed at which new customers come into the ecosystem has slowed.

At the time of writing, Ethereum is buying and selling at round $3,170, down over 1% within the final 24 hours, in line with data from CoinMarketCap.

ETH value strikes towards $3,200 | Source: ETHUSDT on Tradingview.com

Featured picture from Bitcoin News, chart from Tradingview.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal threat.