In a latest interview on the way forward for Bitcoin, Anthony Scaramucci, the founder and managing accomplice of Skybridge Capital, has made a compelling prediction that the Bitcoin value may doubtlessly attain $200,000 following its forthcoming halving occasion. This forecast comes at a time of appreciable volatility throughout the crypto markets, exacerbated by latest geopolitical tensions and broader financial uncertainty.

Bitcoin Poised To Hit $200,000

During the interview, Scaramucci offered insights into the forces he believes will drive Bitcoin’s value within the coming months. “Well, I mean, look, you could get shocks like wars and you could get, you know, God forbid a terrorist calamity or something like that that could take Bitcoin down 10 or 15%,” he defined. Despite potential short-term setbacks, Scaramucci emphasised the underlying demand dynamics bolstering Bitcoin’s value, significantly highlighting the affect of latest financial products like ETFs and the rising curiosity from institutional traders.

He elaborated on his bullish outlook, linking it to the anticipated Bitcoin halving, an occasion that traditionally impacts the provision facet of Bitcoin economics by lowering the reward for mining new blocks, thereby constraining provide. “But long term with the halving coming this week, I think this thing trades to $170,000, possibly to $200,000,” Scaramucci asserted.

The dialogue additionally veered into the broader implications of Bitcoin’s integration into conventional monetary merchandise, equivalent to ETFs. Scaramucci argued that these devices play a important function in broadening Bitcoin’s investor base.

He dismissed issues over the potential for ETFs to result in centralization of Bitcoin possession. “In terms of adoption vis-a-vis the ETF, you look out your four-year time horizon. […] It will still be less than 10 % of the overall ownership of Bitcoin. So this whole notion that the ETFs are gonna overly centralize Bitcoin, I don’t buy it. I think what the ETFs are, though, is they’re a great conduit for people that are used to buying them.”

BTC Is Still In The Web 1.0 Era

Scaramucci in contrast Bitcoin’s trajectory to the early web period, significantly drawing parallels with important tech shares like Amazon throughout the dot-com bubble. “In 1999, Amazon was an emerging stock on an emerging technology, and it was quite volatile. And you lost 20 to 50 % eight times on Amazon. You lost 80%. Yeah, that one time in March of 2020, it went down 80%. But if you held Amazon over that period of time, $10,000 is worth a little over $14 million today.”

He additionally addressed issues about Bitcoin’s sensible makes use of, contrasting its present utility with extra conventional belongings like gold, which additionally don’t provide direct money circulate. Scaramucci highlighted modern monetary practices throughout the crypto ecosystem that present returns just like conventional money circulate, equivalent to yield-generating accounts and borrowing agreements out there by means of platforms like Galaxy Digital.

Regarding potential market downturns akin to the dot-com bust, Scaramucci acknowledged the dangers however remained optimistic about Bitcoin’s resilience and long-term worth proposition. “I think if we go through a dot-com bust in the broader market in the next year or two, I think you’ll have a price shock in Bitcoin consistent with a dot-com bust. However, if you’re willing to hold that asset, which we are over a rolling four-year period of time, no one has ever lost money in Bitcoin,” he famous, underscoring the significance of a long-term funding horizon.

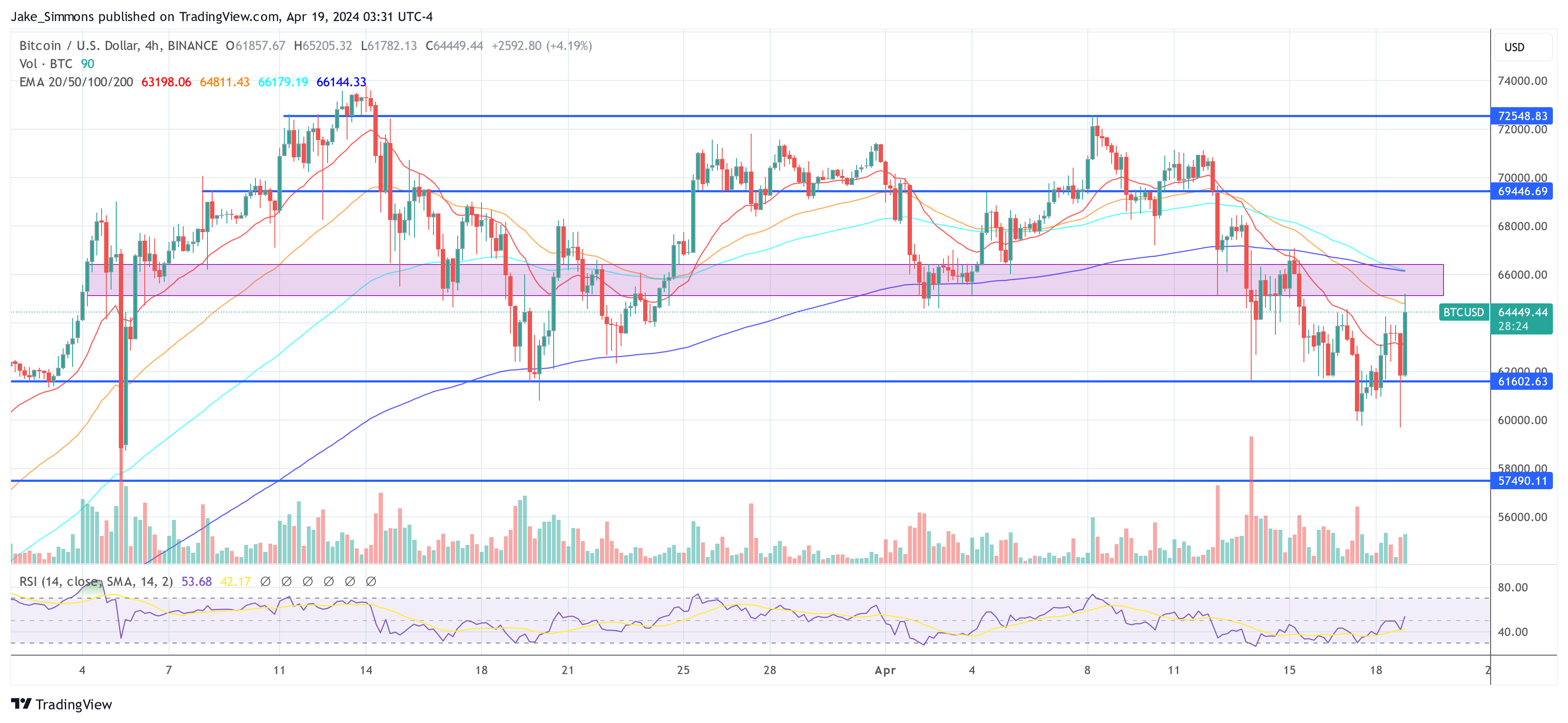

At press time, the BTC value rallied again above $64,000.

Featured picture from Bloomberg, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site completely at your personal danger.