Bitcoin worth’s current actions have stirred consideration amongst buyers, with indicators of a modest restoration following a pointy decline. Amid this shift, a outstanding crypto dealer’s bullish outlook on Bitcoin’s future, fueled by vital whale accumulation, has sparked discussions within the crypto neighborhood. Notably, as market sentiments sway, the highlight stays on Bitcoin’s resilience amid ongoing volatility.

Crypto Experts Bullish On BTC As Whale Accumulation Continues

Amid Bitcoin’s current worth turbulence, crypto dealer Satoshi Flipper has offered an optimistic forecast, highlighting substantial whale accumulation as a constructive indicator for Bitcoin’s restoration. Satoshi Flipper emphasised the notable shopping for exercise by Binance and Bitfinex whales in the course of the present dip, indicating robust investor confidence in Bitcoin’s long-term potential.

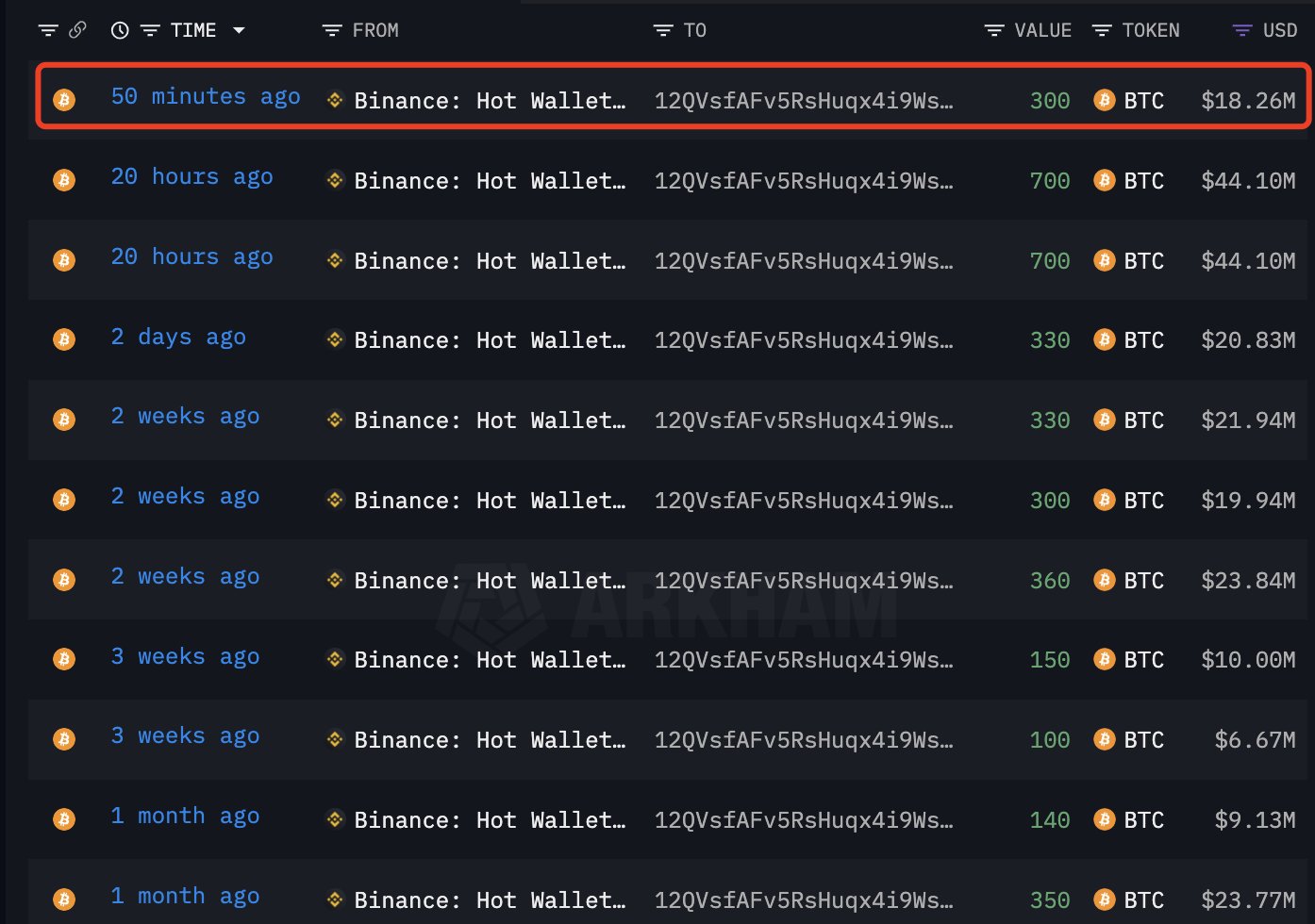

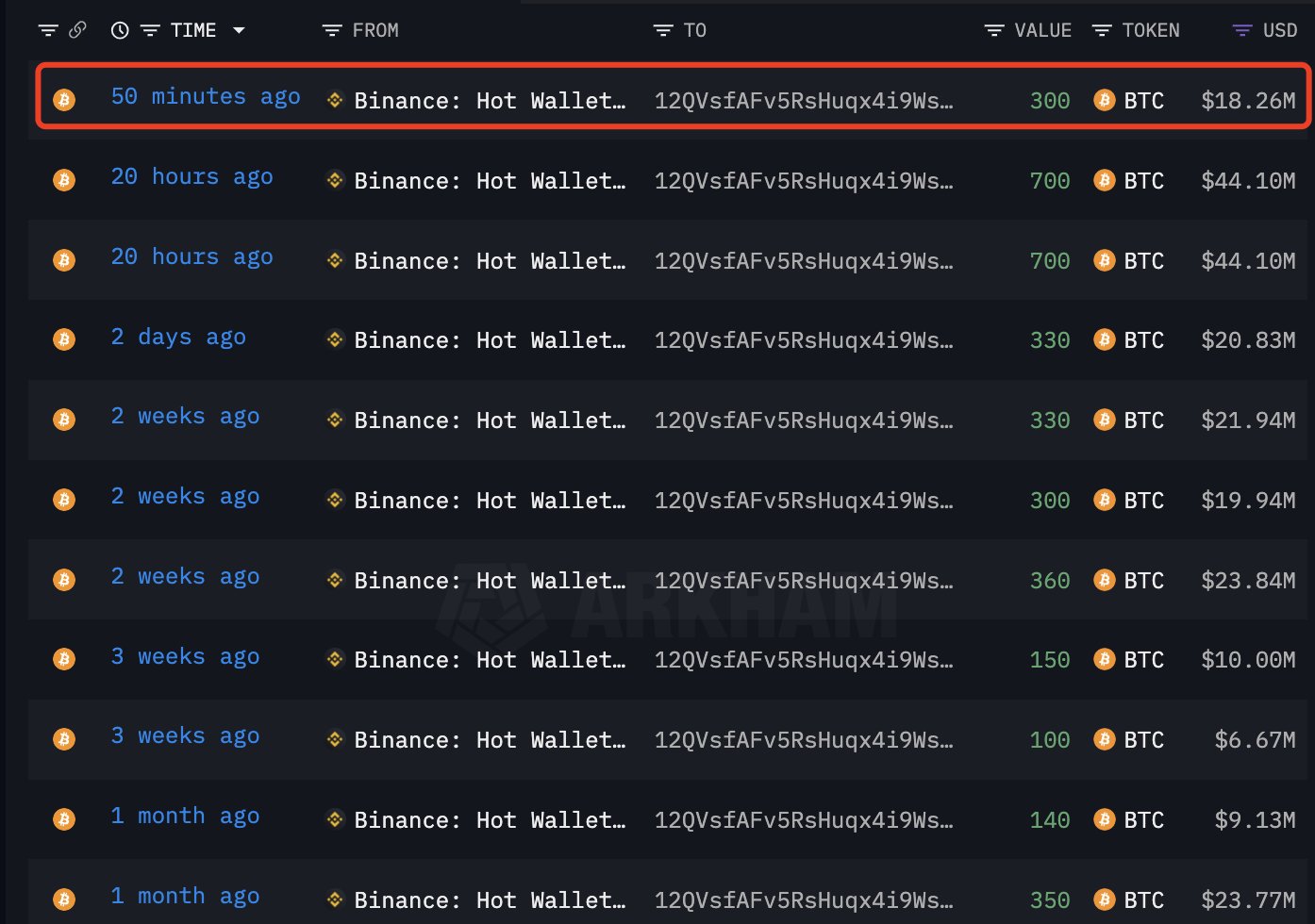

Meanwhile, the crypto dealer has offered this optimistic outlook whereas sharing insights from the on-chain knowledge monitoring platform Lookonchain. The current Lookonchain report revealed a major whale withdrawal from Binance, totaling 3,760 BTC valued at roughly $242.55 million since March 21.

This accumulation pattern, exemplified by the whale buying 1400 BTC price $88.2 million yesterday and 300 BTC price $18.26 million as we speak, is perceived by analysts as a strategic “buy the dip” alternative utilized by savvy buyers in response to market downturns.

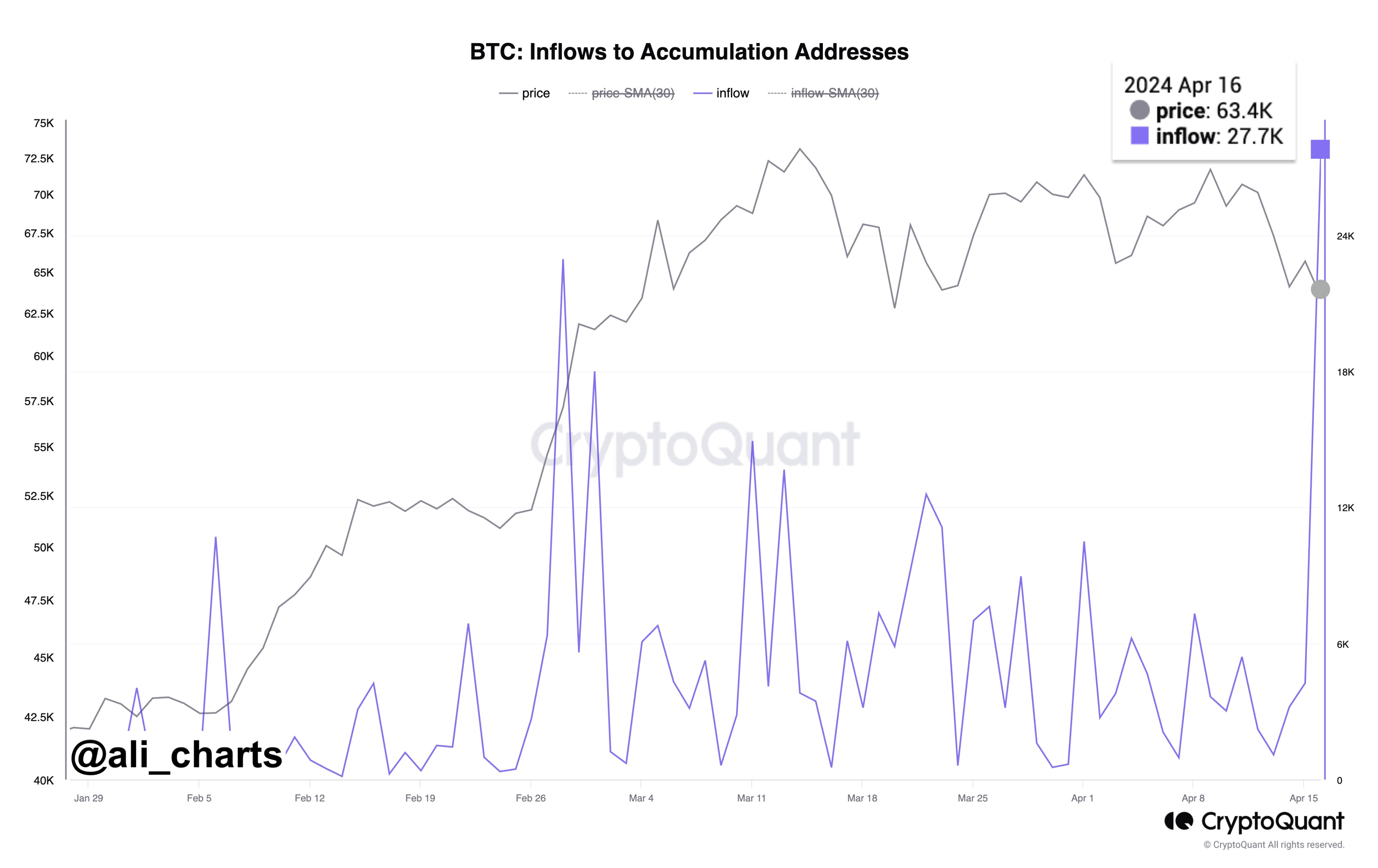

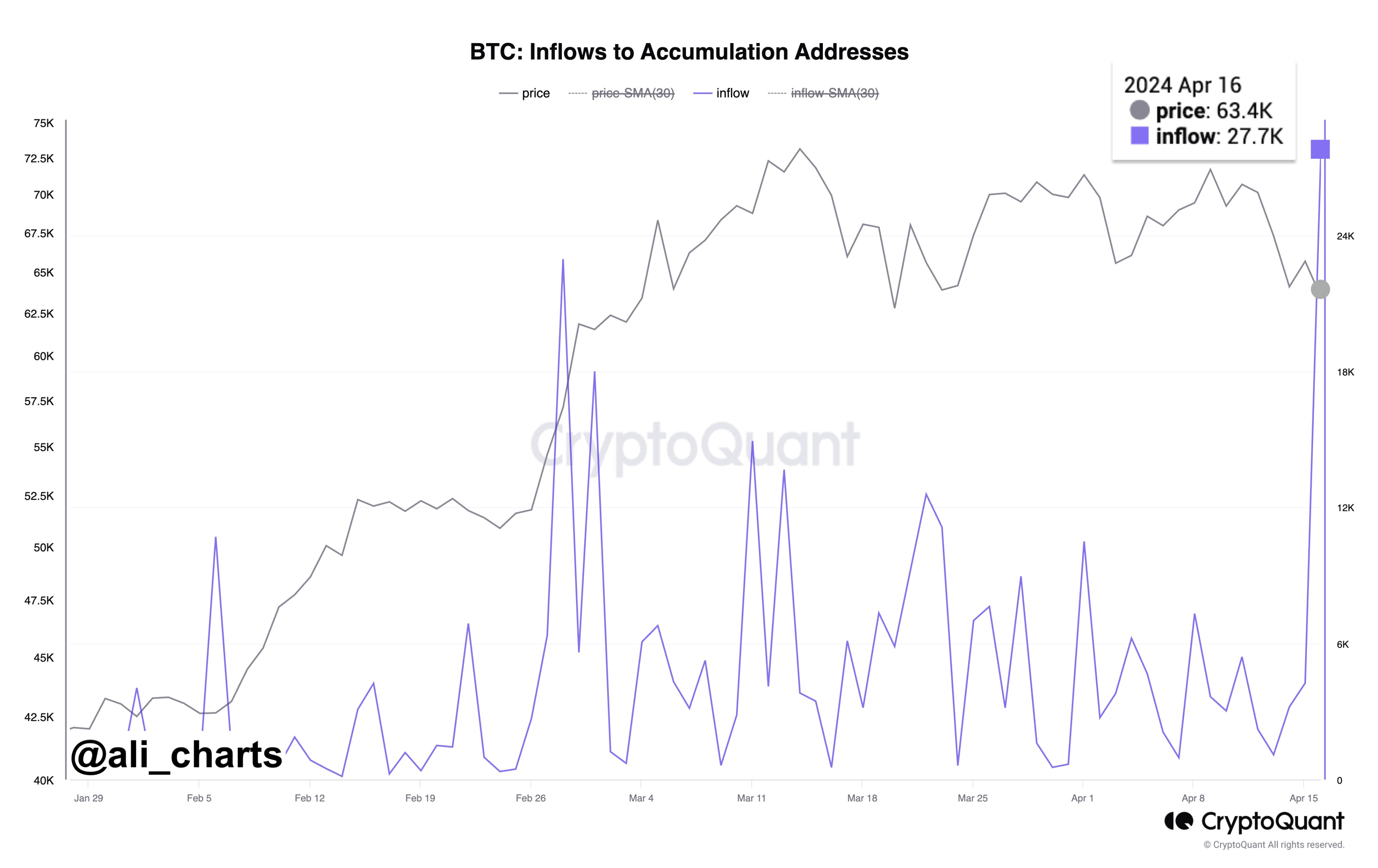

Meanwhile, echoing sentiments of optimism, crypto market analyst Ali Martinez highlighted substantial Bitcoin accumulation, with over 27,700 BTC price roughly $1.72 billion flowing into accumulation addresses in the course of the current worth dip under $63,000. This inflow of BTC into accumulation addresses underscores investor confidence in Bitcoin’s long-term worth proposition, regardless of short-term market fluctuations.

Also Read: Toncoin Teases Major Announcement, What’s Next For TON Price?

Caution Prevails Amid Halving Optimism

Amid these constructive indicators, consultants warning that the BTC’s current sharp decline could also be attributed to volatility surrounding the Bitcoin Halving occasion. Historically, BTC, together with the broader crypto market, experiences heightened volatility throughout Halving occasions, a phenomenon anticipated to persist amid the present market panorama.

Meanwhile, with the BTC Halving occasion looming this week, market analysts anticipate continued volatility in Bitcoin’s worth trajectory. The Halving occasion, which reduces the speed at which new Bitcoins are created, usually triggers fluctuations in Bitcoin’s supply-demand dynamics, influencing market sentiments and worth developments.

As buyers brace for potential market swings, the resilience displayed by BTC amid current challenges, coupled with optimistic outlooks from outstanding merchants and analysts, underscores the enduring enchantment of Bitcoin as a number one cryptocurrency.

Notably, the Bitcoin price was up round 0.17% and traded at $62,958.96 throughout writing, with its one-day buying and selling quantity hovering 21.49% to $43.90 billion. However, regardless of the slight restoration, the BTC worth has misplaced over 12% within the final seven days.

Also Read: Solana Meme Coin MEW Unveils Major Listing, A Price Recovery Ahead?

The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.