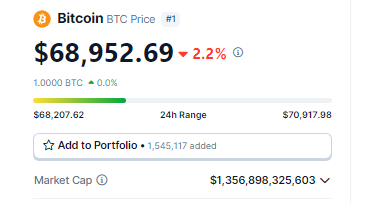

Bitcoin, the undisputed king of cryptocurrencies, is as soon as once more on a wild experience. After a surge over the weekend that introduced it near shattering its all-time excessive, the digital asset has dipped again under the essential $70,000 mark in the final 24 hours. This sudden correction has left buyers questioning if the predicted surge to $80,000 continues to be on the desk.

Source: Coingecko

Bitcoin Erases Weekend Gains

Just days in the past, Bitcoin bulls had been celebrating as the value climbed to close document highs exceeding $70,000. This bullish momentum fueled optimism, with analysts like Markus Thielen predicting a swift climb in the direction of $80,000.

However, that optimism has been tempered by the latest value drop. Bitcoin has plummeted roughly 6% from its peak, successfully erasing the positive factors made earlier this week. While the value has recovered barely to hover round $69,200, it stays under the psychological barrier of $70,000.

Is The $80,000 Dream Dead?

The latest correction has undoubtedly dampened spirits, however some analysts are nonetheless assured that Bitcoin’s journey to $80,000 is way from over. Proponents of this view level to some key components that proceed to gas their bullish sentiment.

Stablecoin Inflows: A Beacon Of Hope?

One issue cited by Thielen is the continued power of stablecoin inflows. Stablecoins, cryptocurrencies pegged to conventional property like the US greenback, are sometimes used as an entry level for buyers into the crypto market.

Total crypto market cap is at present at $2.5 trillion. Chart: TradingView

According to Thielen, these strong inflows counsel sustained investor curiosity regardless of the short-term value fluctuations. Additionally, he highlights a latest technical chart sample breakout, particularly a symmetrical triangle, as one other bullish indicator.

Technical analysts consider such breakouts typically sign a continuation of the prior development, which on this case can be optimistic for Bitcoin.

On-Chain Data Bolsters Bullish Case

Some analysts level to on-chain knowledge from IntoTheBlock, which reveals important shopping for assist at present value ranges.

This knowledge means that numerous addresses (primarily distinctive identifiers for cryptocurrency wallets) bought Bitcoin inside the vary of $68,200 and $70,325.

This shopping for exercise signifies potential resistance towards additional value dips, as these addresses would probably be hesitant to promote at a loss.

Bitcoin value motion in the final week. Source: Coingecko

Bullish And Bearish Forces

The present scenario presents a traditional tug-of-war between Bitcoin bulls and bears. While the latest value correction has shaken some confidence, robust stablecoin inflows and on-chain shopping for exercise counsel underlying bullish stress.

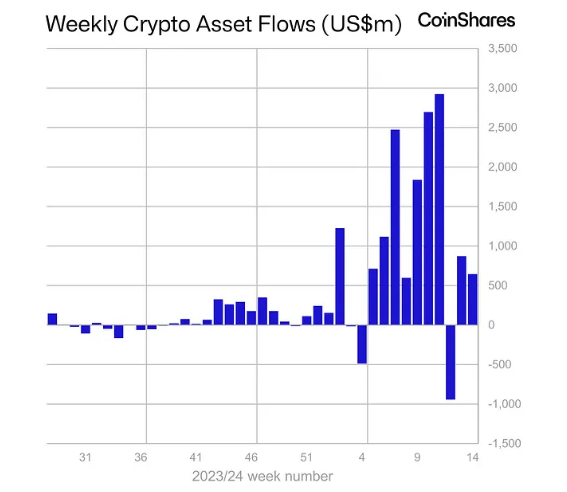

However, they continue to be cautious, pointing to the slowdown in investments particularly focused at spot Bitcoin ETFs (Exchange Traded Funds) as a possible concern. These ETFs enable buyers to realize publicity to Bitcoin’s value actions with out immediately proudly owning the cryptocurrency.

Source: CoinShares

Meanwhile, a report by CoinShares, a digital asset supervisor, highlights a big lower in inflows to such ETFs in latest weeks, suggesting that some institutional buyers is likely to be adopting a wait-and-see method.

The future trajectory of Bitcoin stays unsure. The coming days and weeks might be essential in figuring out whether or not the bulls can overcome the present resistance and propel the value in the direction of $80,000.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual threat.

Source:

Source:  Bitcoin value motion in the final week. Source: Coingecko

Bitcoin value motion in the final week. Source: Coingecko Source: CoinShares

Source: CoinShares