After reaching a stage final seen in November 2020, the typical Ethereum fuel payment is now beneath $1.

Ethereum Gas Fees Falls

The Ethereum community skilled transaction charges as little as 69 cents on Saturday, which has not occurred within the earlier 19 months. The following day, fuel costs reached $1.57 or 0.0015 ETH, which is equal to December 2020’s numbers. Transaction prices on the community as we speak ranged from 20 cents to merely 20 cents, with 20 cents being the best.

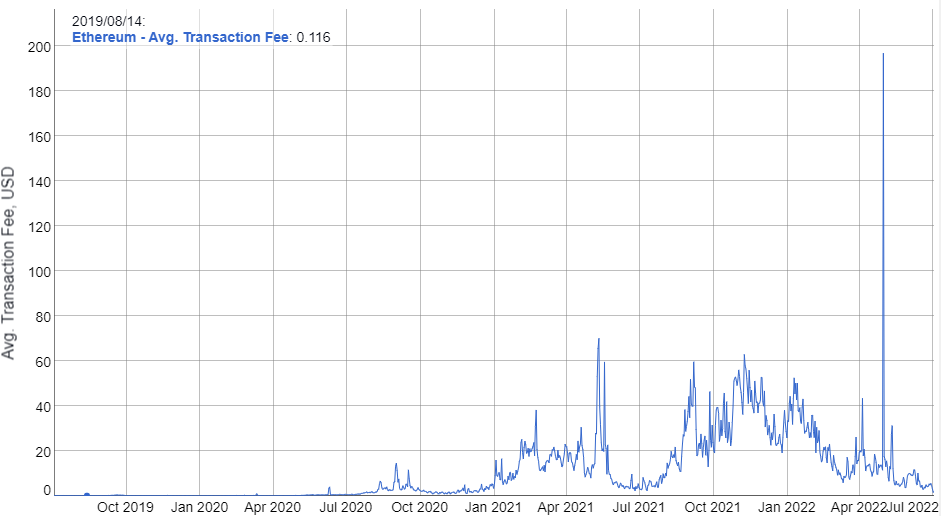

Gas costs within the Ethereum ecosystem ranged from $0.01 to $0.10 from July 2016 to May 2017. Users are actually assessed a considerable price; in May 2021, common transaction charges reached $69 per transaction. The highest fuel worth ever noticed was $196.683 in May 2022.

Notably, the Ethereum blockchain has struggled to turn out to be broadly used, a lot to the chagrin of customers, because of the excessive price of fuel or community charges, funds obligatory to finish a transaction on a blockchain. NFT holders are seen benefiting from the decline because the numbers dwindle.

Source: Bitinfo charts

DappRadar reviews that fifty,466 individuals have traded their belongings in OpenSea, up 10.14 p.c from yesterday. At the time of writing, the biggest NFT market’s buying and selling quantity elevated by 34.18 p.c to $15.92 million.

All of the highest 20 collections, led by Ethereum Name Service, DopeApeClub, God Hates NFTees, Bored Ape Yacht Club (BAYC), and Mutant Ape Yacht Club (MAYC), had been transacted inside Ethereum, in keeping with information from DappRadar.

Related studying | TA: Ethereum Close Below $1K Could Spark Larger Degree Downtrend

Price Slumps Further

The evaluation of the worth of ethereum is bearish resulting from consolidation close to $1,050 and rejection of additional restoration. As a consequence, ETH/USD is ready to say no even additional and surpass the $1,000 native help. After that’s completed, the prior swing low at $900 must be challenged the next week.

The decline approached the $1040–$1000 space that serves as a detailed help and was accompanied by a pointy enhance in demand strain. The quite a few smaller worth rejection candles at this level characterize makes an attempt by sellers to interrupt by way of this help that had been unsuccessful.

Therefore, the renewed constructive momentum may encourage patrons to once more assault the overhead barrier of $1260, offering ETH holders with an opportunity for a restoration.

ETH/USD consolidates above $1k. Source: TradingView

At the beginning of the week, a major new swing backside was established within the worth motion of ethereum. After falling by greater than 21%, the worth of ETH/USD hit a brand new low at $1,000.

From then, a swift upward response continued to the $1,115 stage, the place Friday’s rejection of additional restoration was noticed. Following sideways consolidation, decrease native highs and lows had been set.

Since then, the $1,050 stage has functioned as the primary buying and selling vary, with this morning’s denial of additional features. As a consequence, ETH/USD is ready to drop much more and attempt to surpass the present low of $1,000.

If the merchants proceed to be persuaded by the sellers to interrupt by way of the underside help, the following decline may drive the worth of ETH down by 12.56% to $880.

Related studying | Ethereum (ETH) Bends Toward $1,000 As Doubt Fills Crypto Markets

Featured picture UnSplash, chart from TradingView.com