Trading Guru Peter Brandt has lately commented on the Ethereum vs. Bitcoin chart, providing intriguing insights into market developments.

Brandt’s comment comes after his prior critiques of Ethereum, denigrating it as a “junk coin” and its proponents as “Etheridiots.” However, amidst Ethereum’s current descent to its lowest place in opposition to Bitcoin in almost three years, Brandt’s stance appears to have reworked.

Ethereum Plunges Against Bitcoin: A Bear Trap?

Upon analyzing the Ethereum-to-BTC chart, Brandt instructed the presence of a “bear trap,” indicating that the continued decline in Ethereum’s worth in comparison with Bitcoin would possibly entice sellers into further quick positions.

However, this might result in an unexpected reversal, turning the obvious breakdown in assist right into a false sign.

Bear entice? That is at all times a chance when value hits a brand new 35-month low. pic.twitter.com/aKQg9k7TcD

— Peter Brandt (@PeterLBrandt) April 8, 2024

Brandt’s commentary of a possible bear entice highlights the complexities throughout the cryptocurrency market and the significance of contemplating a number of components when analyzing value actions.

While Ethereum could also be experiencing a interval of relative weakness in opposition to Bitcoin, Brandt’s cautious optimism means that there could also be opportunities for a reversal shortly.

Bullish Signals Amid ETH/BTC Downturn

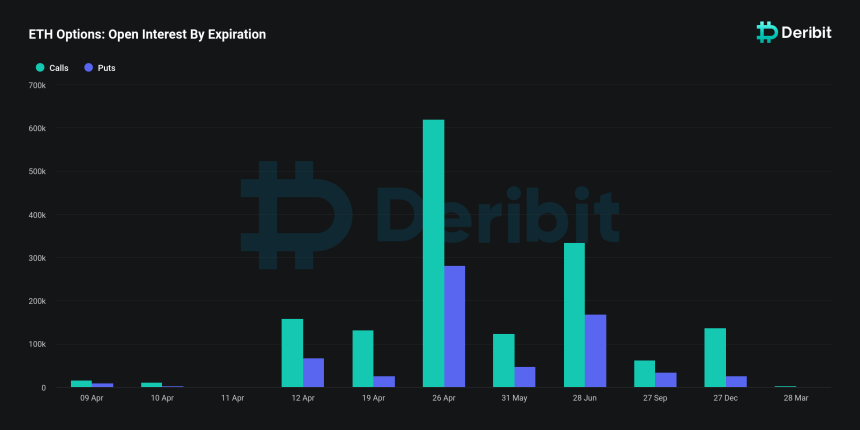

Despite Ethereum’s current challenges, bullish signals have emerged, hinting at a possible turnaround. The choices market, specifically, has proven optimism, with a good portion of Ethereum choices open curiosity expiring by the top of April being bullish bets on value.

Deribit knowledge reveals that about $3.3 billion value of notional ether choices are scheduled to run out, with roughly two-thirds of this sum allotted to calls. Moreover, the Ethereum put-call ratio for the April expiration stands at 0.45, signaling a barely extra bullish stance than Bitcoin choices.

Notably, a put-call choices ratio beneath one suggests bullish sentiment, with merchants favoring name choices over put choices. Moreover, the emergence of two new Ethereum whales, in response to the crypto monitoring platform Spot On Chain, recognized as 0x666 and 0x435, provides to Ethereum’s bullish sentiment.

These entities collectively withdrew a considerable quantity of ETH from a significant trade, suggesting rising confidence in Ethereum’s prospects regardless of its recent downtrend.

While Ethereum faces downward stress in opposition to Bitcoin, Bitcoin’s resilience available in the market is clear. Crypto analyst Ali has highlighted that Bitcoin seems to be breaking out, with a possible upside goal of $85,000 if it could maintain above $70,800.

#Bitcoin seems to be breaking out! If $BTC can maintain above $70,800, the following goal turns into $85,000! pic.twitter.com/JPLf18KZvt

— Ali (@ali_charts) April 8, 2024

When writing, Bitcoin trades above this important stage with a present market value of $71,621, indicating a potential climb in direction of $85,000 shortly.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal threat.