The Bitcoin market skilled a slight downturn on Monday, April 1, grabbing the eye of traders worldwide. Notably, regardless of the looming optimism surrounding the forthcoming Bitcoin Halving occasion, the current fluctuations within the BTC worth actions have stirred each anticipation and concern amongst stakeholders.

Meanwhile, a distinguished crypto analyst has shared key insights on the Bitcoin worth, intensifying discussions about BTC’s future trajectory.

Analyst Provide Key Insights On Bitcoin Price

The current hunch within the Bitcoin worth has sparked discussions within the crypto market, particularly amid hovering optimism over the Bitcoin Halving scheduled for later this month. Now, with the value declining after touching its all-time excessive just lately, traders are eagerly searching for key insights amid the topsy-turvy state of affairs available in the market.

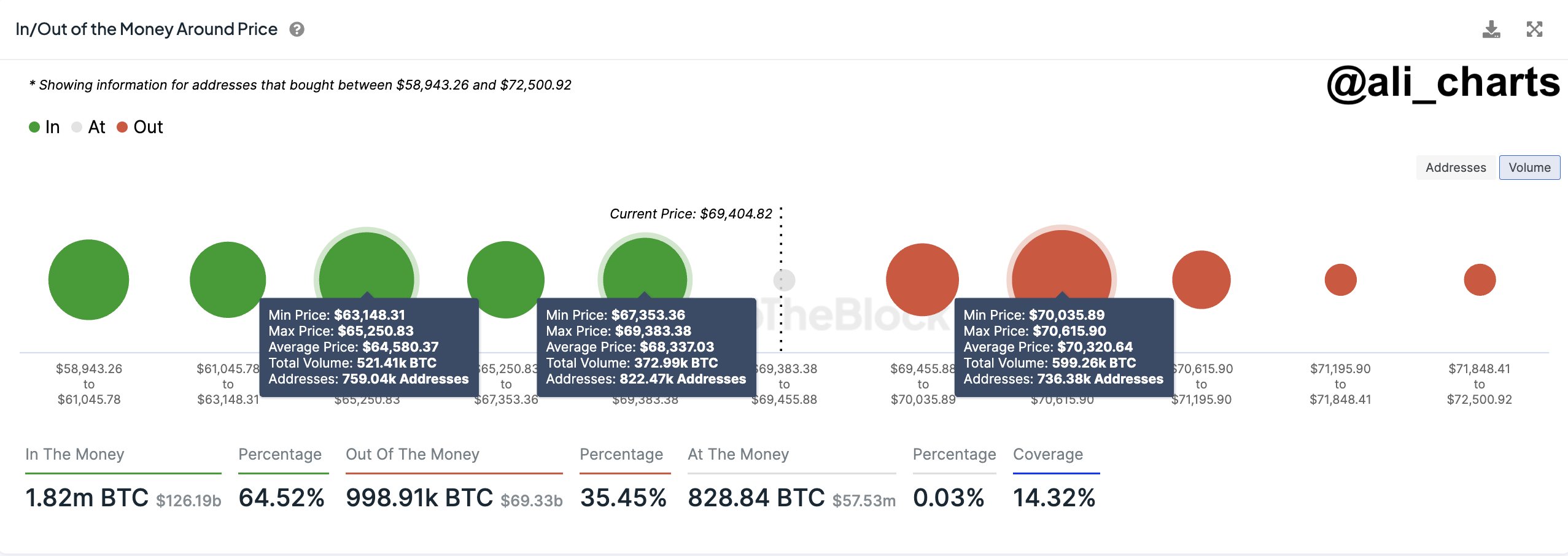

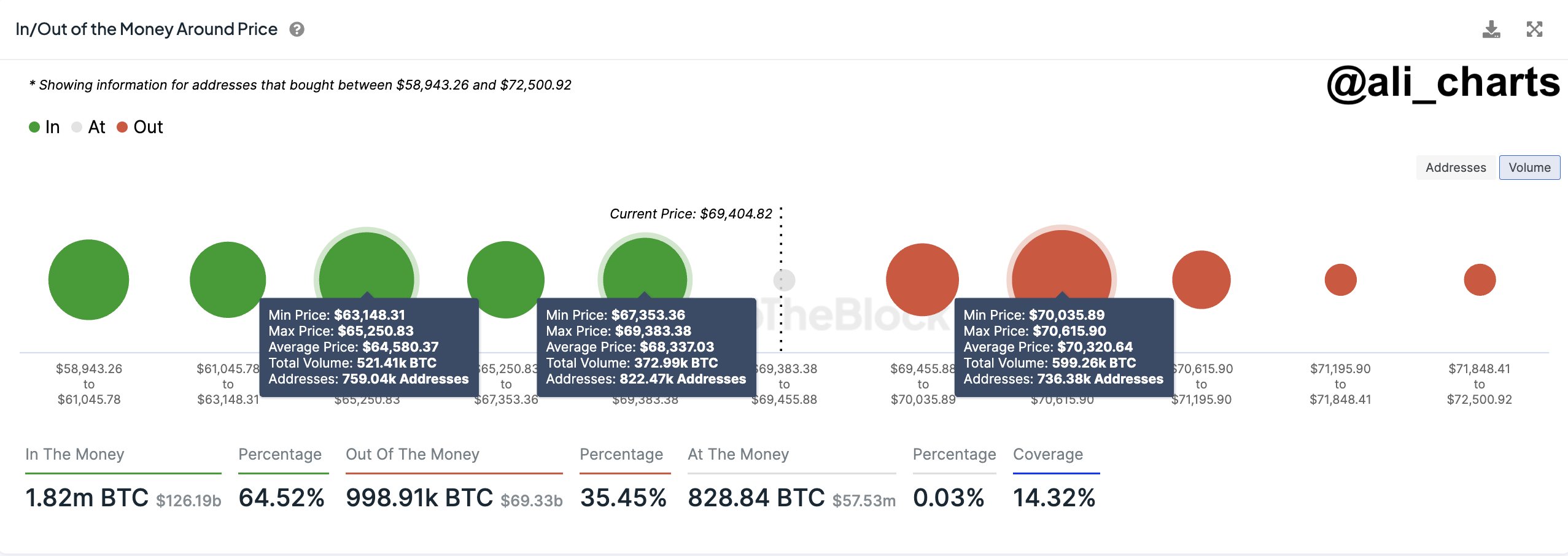

Meanwhile, as Bitcoin teeters getting ready to uncertainty, crypto market analyst Ali Martinez has supplied essential insights into potential worth actions. Martinez highlighted a vital assist degree at $68,300, emphasizing {that a} breach might set off a downward spiral towards the $65,250 to $63,150 vary. Notably, this vary, the place 760,000 wallets maintain 520,000 BTC, presents a big psychological threshold for Bitcoin’s trajectory.

In addition, Martinez’s evaluation underscores the significance of securing assist at $70,320 to propel Bitcoin towards its subsequent upward development. The dialogue sparked by Martinez’s observations displays the market’s sensitivity to Bitcoin’s present worth dynamics, particularly amid the backdrop of declining values.

Also Read: Thailand’s Top Crypto Exchange Bitkub Gears Up for IPO

Optimism & Uncertainty Ahead Of Halving

Despite considerations over potential worth declines, optimism prevails inside the crypto group, fueled by the anticipation of the Halving event. Notably, historic information signifies that Bitcoin usually experiences a rally post-halving, main many analysts to forecast new highs within the coming months.

Meanwhile, because the market braces for potential volatility, the overarching sentiment stays considered one of cautious optimism. Investors are carefully monitoring Bitcoin’s worth actions, weighing the implications of vital assist ranges and historic tendencies in anticipation of future developments.

In different phrases, as Bitcoin navigates by way of a interval of uncertainty, insights from consultants like Ali Martinez provide beneficial steerage for traders. The delicate steadiness between assist ranges and market sentiment will doubtless dictate Bitcoin’s short-term trajectory, with the forthcoming halving occasion including an additional layer of anticipation to the combination.

Meanwhile, the Bitcoin price slipped 1.02% throughout writing and traded at $69,549.96, whereas its one-day buying and selling quantity soared 47% to $25.57 billion. Notably, the flagship crypto has touched a excessive of $71,377.78 and a low of $68,986.95 within the final 24 hours.

Also Read: Wall Street Projects 48% Decline In Coinbase Q1 EPS Despite Bull Run

The offered content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.