The crypto market witnessed a exceptional surge immediately, on February 28, 2024, propelling main cryptocurrencies like Bitcoin, Ethereum, Cardano, XRP, and meme cash corresponding to Pepe Coin to new highs. Notably, Bitcoin has surpassed the $60,000 mark, a degree unseen since November 2021, whereas Ethereum has reached its highest level since April 2022.

Meanwhile, this surge has sparked discussions in regards to the driving forces behind the rally. So, let’s discover the potential causes behind the surge in crypto costs.

Why Is the Crypto Market Rising Today?

The crypto market is abuzz with pleasure as Bitcoin, Ethereum, and several other different altcoins expertise a big surge in worth. Investors and fanatics are eager to decipher the components underpinning this exceptional rally.

Michael Saylor’s Bitcoin Accumulation Boosts Confidence

One main catalyst behind this surge is MicroStrategy’s continued accumulation of Bitcoin, led by its government chairman, Michael Saylor. This week, MicroStrategy revealed a recent buy of $155 million price of Bitcoin, additional bolstering its BTC holdings to a staggering 193,000.

Meanwhile, Michael Saylor’s strategic transfer, forward of the anticipated Bitcoin halving and amidst elevated accumulation by spot Bitcoin ETFs, has instilled confidence available in the market. According to filings with the U.S. Securities and Exchange Commission, MicroStrategy acquired almost 3,000 Bitcoins at a median value of roughly $51,813 between February 15 and February 25, 2024.

Notably, Saylor said that MicroStrategy, together with its subsidiaries, now holds 193,000 BTCs, acquired for almost $6.09 billion at a median value of $31,544 per Bitcoin. This transfer underscores a bullish sentiment in direction of Bitcoin’s future trajectory.

Notably, Michael Saylor additionally made a current X put up saying “You do not sell your Bitcoin”, which additionally has bolstered market confidence.

Also Read: How High Bitcoin Price Can Go In 2024; $200K Or Above?

Significant Inflow Into Spot Bitcoin ETF

Moreover, substantial inflows into Bitcoin Spot ETFs have additional fueled buyers’ confidence, signaling rising institutional curiosity within the flagship cryptocurrency. The week witnessed important inflows into Bitcoin ETFs, with notable contributions from BlackRock iShares Bitcoin ETF.

As CoinGape Media reported, Bitcoin Spot Bitcoin ETFs skilled a surge in investor curiosity, with a big $577 million internet influx recorded on February 27. This inflow, marking the third-largest till launch, underscores rising confidence amongst Wall Street gamers.

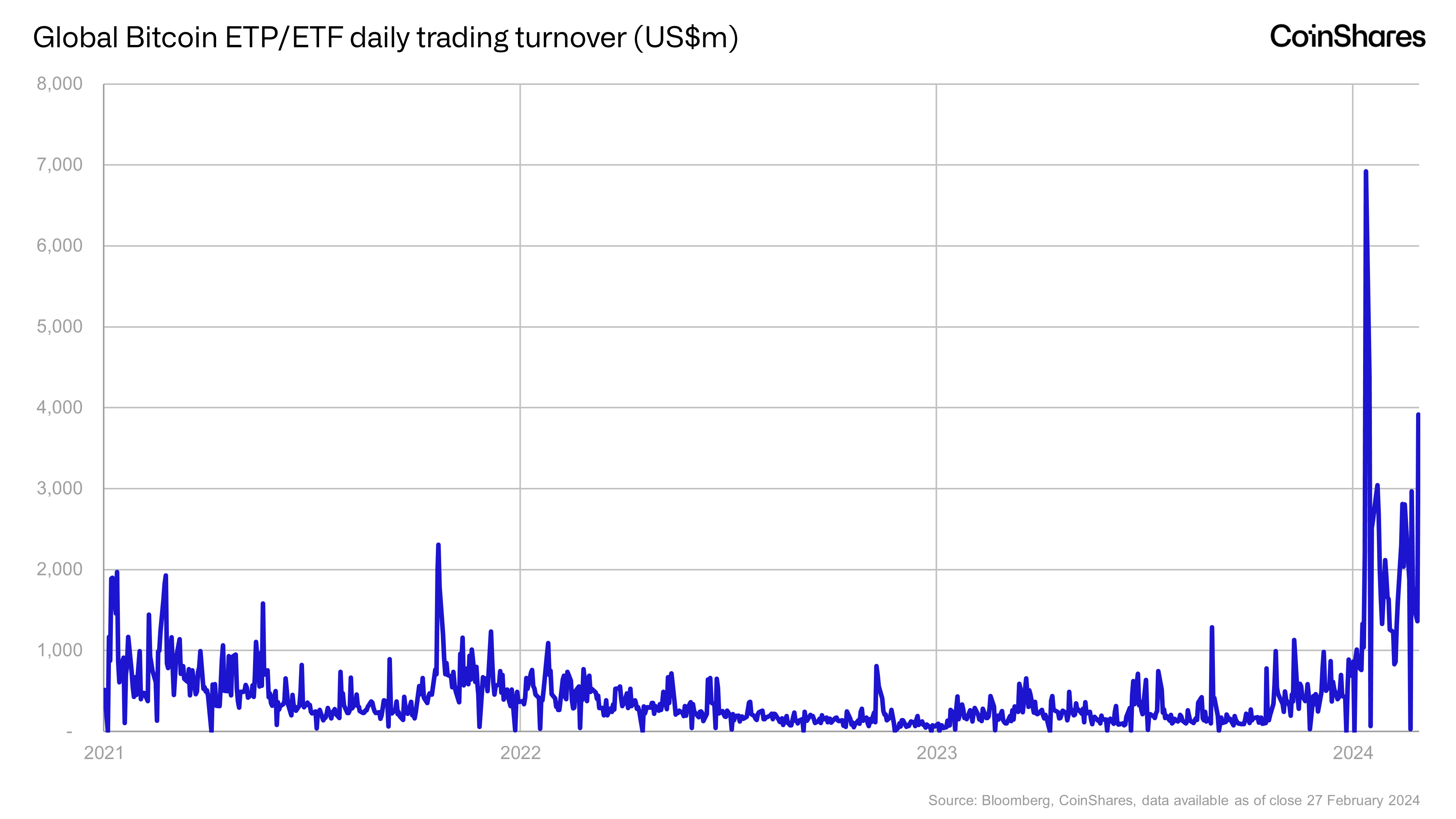

Meanwhile, the uptick follows BlackRock iShares Bitcoin ETF’s $520 million influx, hinting at a possible rally. CoinShares’ Head of Research James Bitterfill praised the sturdy weekly influx whereas noting a shift from Global Bitcoin ETPs’ $34 million in each day buying and selling common in 2023 to $2 billion in 2024.

Bitcoin Halving & Ethereum ETF Anticipation

Anticipation surrounding the upcoming Bitcoin halving, anticipated in roughly 50 days, has contributed to optimistic market sentiment. Historical knowledge signifies that earlier Bitcoin halving occasions have triggered important value rallies, driving optimism amongst crypto fanatics.

Although historic knowledge doesn’t assure future efficiency, the market contributors appear to stay optimistic over the potential influence of the Halving rally.

Similarly, expectations surrounding the approval of an Ethereum ETF by the U.S. SEC have added to the market’s buoyancy, mirroring the success of Bitcoin ETFs and projecting a optimistic outlook for Ethereum.

Regulatory Developments

Amid the market rally, regulatory developments are additionally shaping investor sentiment. Ripple’s ongoing authorized battle with the SEC, which is anticipated to achieve its climax in 2024, has garnered consideration, with speculations of a possible settlement between the events.

Notably, after Ripple fulfilled all discovery necessities associated to cures, the U.S. SEC has requested an extension for the deadline for remedies-related briefing not too long ago. This extension prolongs the anticipation throughout the XRP neighborhood for particulars regarding XRP.

On the opposite hand, the Digital Chamber’s advocacy in help of Kraken in its lawsuit towards the SEC underscores the broader regulatory panorama’s influence on market dynamics.

Also Read: Cardano (ADA) Network Witnesses Remarkable Surge with 4.6 Million New Wallets

Positive Market Trends

In a big improvement, Bitcoin Futures Open Interest (OI) has surged dramatically, contributing to the present surge in cryptocurrency costs. Over the previous 24 hours, Bitcoin’s OI spiked by 3.42% to achieve 447.43K BTC, equal to a staggering $26.61 billion, CoinGlass data confirmed.

Although the CME change noticed a slight dip, different platforms like Binance and Bybit witnessed exceptional will increase of seven.64% and 6.59% respectively. In addition, Ethereum’s Open Interest additionally climbed by 1.82%, reaching a powerful $11.64 billion.

These surges point out heightened investor curiosity and exercise within the crypto market, probably driving up costs.

Meme Coins Rally

The meme coin sector has additionally famous a bull run immediately, amid an upward development within the broader market. Pepe Coin was one of many high share gainers within the phase, including about 60% in its value over the past 24 hours.

Notably, the meme coin sector has witnessed a surge of over 13% in its market cap to $25.08 billion, whereas the buying and selling quantity rocketed 195.8% to $3.70 billion.

Price & Performance Amid The Rally

As of writing, the Bitcoin price was up 6.33% over the past 24 hours and traded at $60,453.68, whereas its buying and selling quantity over the past 24 hours decreased by 5.82% to $47.36 billion. Over the final seven days, the BTC value added over 19%, whereas noting a 43% month-to-month leap.

Simultaneously, the Ethereum price was about 1.31% to $3,298.02, after touching a 24-hour excessive of $3,366.61. The XRP price additionally soared almost 4% immediately and traded at $0.5795, whereas its buying and selling quantity over the past 24 hours soared 64% to $2.58 billion.

The Pepe Coin price, being one of many high share gainers within the meme coin area, added almost 60% in its value and traded at $0.0000034. Notably, the worldwide crypto market cap was up 3.38% to $2.22 trillion as of February 28, with a decline of round 5% in its buying and selling quantity from yesterday.

The worry and greed index stayed at 80, suggesting an excessive greed situation hovering over the market.

Also Read: Top Analyst Predicts XRP To $0.91 Amid SEC’s Remedies Deadline Extension Buzz

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.