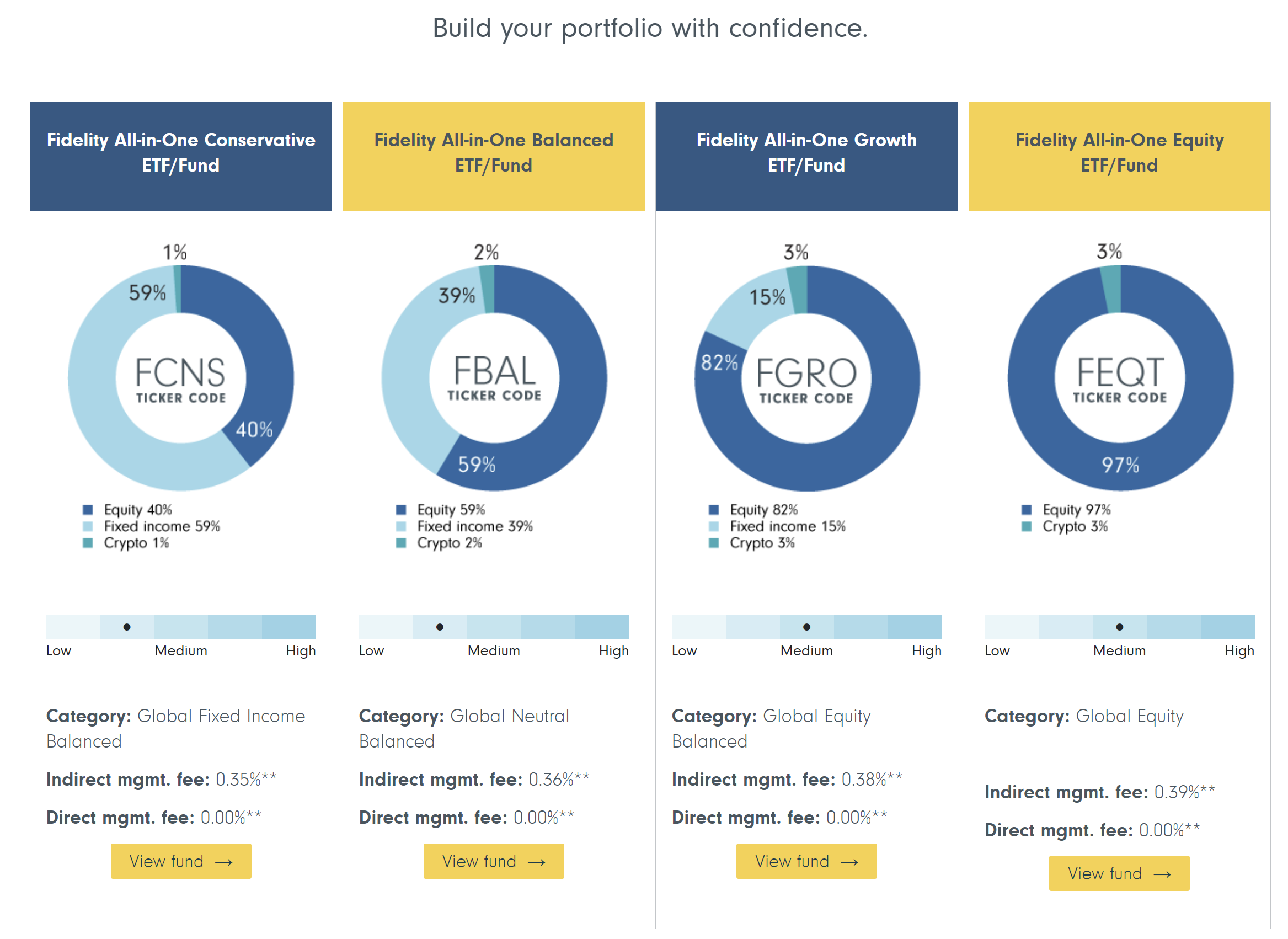

In a serious shift inside the monetary business, Fidelity Investments, with its colossal $12.6 trillion in property below administration, is now recommending that the normal 60/40 portfolio mannequin ought to evolve to incorporate a 1-3% allocation to crypto, particularly via its spot Bitcoin ETF (FBTC). This groundbreaking transfer is not only a nod to the burgeoning crypto market however a possible catalyst for unprecedented demand, doubtlessly channeling tons of of billions of {dollars} into Bitcoin.

Matt Ballensweig, Head of Go Network at BitGo, took to X (previously Twitter) to precise his anticipation, stating, “I’ve said this since the day of ETF approval – now that Pandora’s box has been opened, the multi-trillion dollar asset managers will sell BTC and crypto through their massive distribution channels for us. Fidelity now creates blueprint portfolios with 1-3% crypto.”

Echoing this sentiment, Will Clemente III, a famend analyst, remarked on the potential ripple results of Fidelity’s suggestion. “Fidelity now recommending a 1-3% crypto allocation in your portfolio. Gateway drug. What happens when that 1-3% becomes 3-6%? Slowly then suddenly,” Clemente famous, highlighting the potential for development in crypto allocation.

What This Could Mean For Bitcoin Price

Adam Cochran, a accomplice at CEHV, additional elaborated on the implications of Fidelity’s transfer for Bitcoin’s adoption and price trajectory. In an in depth evaluation shared on X, Cochran laid out an formidable future the place the inclusion of crypto in conventional portfolios might result in a considerable reevaluation of Bitcoin’s worth. “How fucking wild is this to see. 60/40 portfolios are now 59/39/2,” Cochran started, underlining the historic milestone of crypto changing into a core asset class.

Cochran compares the adoption charges of the web to cryptocurrency, stating, “Hell, the internet was 30 years in the making and didn’t reach 10m users till 1995. But the most non-conservative estimates put crypto ownership at 450M worldwide (conservative is more like 200M) that’s like the internet in 2001.”

He highlights the outsized financial influence of digital developments, “Today the internet has somewhere around 5.5B users – 12x what it did in 2001. But according to BEA, the impact of the digital economy has been exponentially outsized with each year of growth.” By drawing this parallel, Cochran units the stage for a crypto market that would see exponential development in worth and affect.

Cochran’s strategy to calculating Bitcoin’s future valuation entails analyzing the potential inflow of funds from conventional investments. “If that follows the change to 59/39/2, you’re looking at $1.6T in new buying… Given the current market is $2.24 trillion total marketcap… we get a cash to value rate of 9.3%.”

The core of Cochran’s evaluation lies in his valuation prediction, the place he states, “Prorata between coins at their current ratios and that’s $748,500 BTC and $43,635 ETH in raw spot buying. But since we know notional causes things to run, and we’ve got things like ETH’s yield demand and burn, we’re usually several multiples above the price of our raw spot demand.”

Cochran’s conclusion displays a powerful perception within the transformative potential of cryptocurrencies inside conventional funding portfolios. “At the end of the day, even gold hasn’t broken into the 60/40 portfolio in a meaningful way, so I think blowing past the $12T mcap of gold by a good multiple over time is a no-brainer.”

At press time, BTC traded at $57,175.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site fully at your individual danger.