Samson Mow, a developer and founding father of a crypto undertaking, has attributed the present Bitcoin worth stability to the launch of spot Bitcoin exchange-traded funds (ETFs) within the United States. Taking to X on February 22, Mow argued that these spot ETFs have prevented a big worth drop.

Bitcoin Remains Higher Because Of Spot ETFs

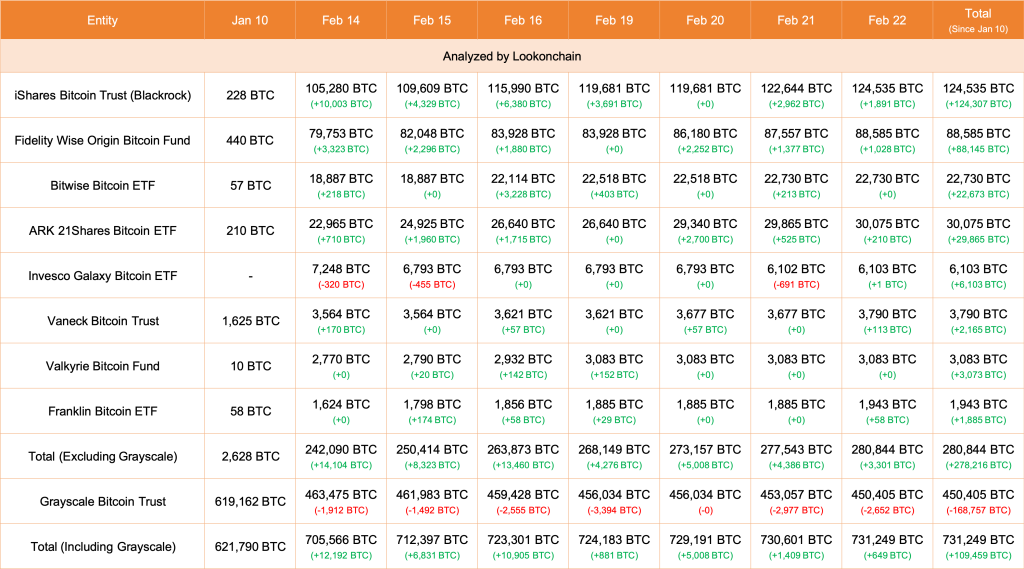

The founder believes that with out the inflow of capital from spot Bitcoin ETFs, the cryptocurrency would have been “down between 10-20%,” doubtlessly inserting it beneath $40,000. So far, and when writing in mid-February, the varied derivatives have injected billions of {dollars} into the Bitcoin market. Subsequently, the asset’s liquidity has elevated.

Related Reading: FTX’s Sam Bankman-Fried Is Back In Court: Here’s Everything You Should Know

The relationship between liquidity and volatility is advanced however being established, particularly within the crypto and Bitcoin markets. However, the rule of thumb is that the extra there are patrons and sellers, that’s, merchants, the upper there may be circulating capital, growing liquidity. Liquidity, in easy phrases, is a measure of how simple it’s to commerce.

In an illiquid market, circulating capital is comparatively decrease, which means it may be exhausting to swap belongings. Since the launch of spot Bitcoin ETFs, billions of {dollars} have been funneled to the market, in response to Lookonchain data. As of February 18, BlackRock purchased over $96 million price of BTC via its ETF product.

As such, the consensus is that Bitcoin is now extra liquid, which Mow agrees with. So far, CoinMarketCap information reveals that Bitcoin instructions over 50% of the whole market cap. The worth of all circulating cash, together with irrecoverable ones, stands at over $1 trillion.

That Bitcoin, as Mow highlights, is now extra steady can assist appeal to extra traders. Usually, institutional-grade traders search stability, a attribute that Bitcoin now reveals. However, rising liquidity will imply Bitcoin is much less risky, making the asset much less enticing for speculators.

Price Finds Support At $50,500: Will It Hold?

The Bitcoin worth day by day chart reveals that the coin stays inside a good vary however is bullish. After the transient retest of $53,000, the coin cooled off to identify charges however discovered assist at round $50,500.

If the uptrend is legitimate, the coin will seemingly reject makes an attempt for decrease lows and break above $53,000. Subsequently, this may anchor the leg up in direction of $70,000. Analysts are additionally trying on the upcoming Bitcoin halving as a doable accelerant.

Even so, whether or not this would be the case stays to be seen. Bitcoin, regardless of its growing liquidity, remains to be a brand new asset class. The international market remains to be adapting, and extra establishments will seemingly undertake the asset as they diversify their portfolios.

Feature picture from Canva, chart from TradingView