A crypto investor, Fred Krueger, thinks Ethereum is overvalued at spot charges. Referring to X, Krueger added that Ethereum supporters are “detached from reality” after ETH, the native foreign money, lately broke above $3,000.

The investor pointed to the overall declining on-chain exercise, fierce competitors from alternate options like Solana and Avalanche, for example, and regulatory uncertainty that makes holding the coin dangerous.

Ethereum Is Slow And Usage Is Shrinking

Krueger argues that Ethereum’s on-chain transactions may very well be quicker and cheaper. In the present panorama marked with scalable and low-fee alternate options, both constructed on Ethereum or present as impartial chains, the chain’s challenges not justify ETH buying and selling at spot charges of about $3,000.

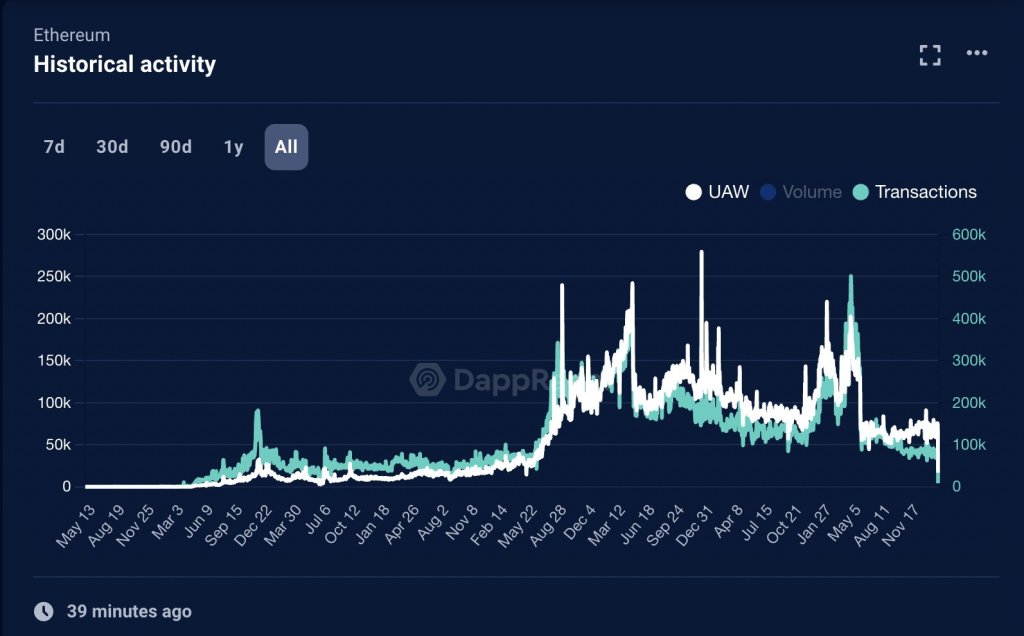

Beyond scaling and throughput challenges, the investor additionally refers back to the sharp decline in each day energetic customers (DAUs) on the mainnet. Since 2021, Ethereum and altcoin costs have peaked, and energetic DAUs have fallen from round 120,000 to roughly 66,000 in February 2024.

Though community supporters stated there had been developments like layer-2 platforms like Arbitrum pinning their safety on Ethereum, Krueger notes that even essentially the most energetic and largest protocols by complete worth locked (TVL) have seen consumer losses.

To illustrate, Uniswap V3, the third model of certainly one of Ethereum’s largest decentralized exchanges, Uniswap, now information round 16,000 each day energetic customers, considerably decrease than earlier years.

Alternatives Like Solana Offer Better: Is ETH Expensive?

The investor argues that the decline in DAUs, pointing to energetic utilization, sharply contrasts with Ethereum’s rising market capitalization and spot charges. In Krueger’s opinion, this rising state of affairs is why Ethereum has turn into a bloated “meme coin like Shiba Inu,” taking a look at its excessive market cap.

It within the investor’s evaluation that quicker and cheaper alternate options like Solana, Avalanche, and Near Protocol supply higher worth for particular use instances like decentralized finance (DeFi) and video games.

Krueger additionally took situation with the dearth of regulatory readability on Ethereum. The United States Securities and Exchange Commission (SEC) lately accredited the primary spot Bitcoin exchange-traded funds (ETF) batch. Primarily, it’s because SEC officers acknowledge Bitcoin as a commodity.

Gary Gensler and the SEC have did not classify ETH in the identical class as BTC. Accordingly, although the broader crypto group is optimistic in regards to the eventual authorization of a spot Ethereum ETF, Krueger thinks it’s unlikely.

Still, time will solely inform how Ethereum and its market valuation will evolve within the coming months. Supporters are optimistic, regardless of criticism, that rising adoption and ETH’s deflationary nature will raise costs in the direction of 2021 highs of $5,000.

Feature picture from DALLE, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site solely at your personal danger.