Bitcoin bulls are again in cost, with the world’s main cryptocurrency surging past $52,000 on Wednesday following an extended hiatus.

This rally comes on the heels of a quick dip under $50,000 triggered by hotter-than-expected US inflation information, however traders shrugged it off, demonstrating resilient confidence within the digital asset’s future. Bitcoin is up greater than 21% to this point this 12 months.

Bitcoin Shows Mettle With $52K Breach

This newest surge marks a big milestone, not only for Bitcoin however for the whole cryptocurrency ecosystem. After 26 months, the top crypto asset has formally surpassed the coveted $1 trillion market cap, a testomony to its rising adoption and mainstream enchantment.

Bitcoin breaks previous the $52k degree. Source: Coingecko

But what’s driving this renewed optimism? Several components appear to be fueling the flames. Firstly, there’s the bullish sentiment surrounding Bitcoin, with many analysts and merchants anticipating additional value beneficial properties. Options merchants are significantly optimistic, inserting bets that one BTC might attain $75,000 within the coming months, including gas to the fireplace.

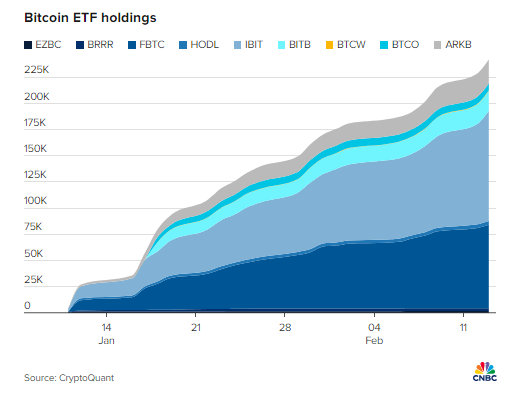

Secondly, the current launch of spot exchange-traded funds (ETFs) within the US has performed a big function. These ETFs enable traders to realize publicity to Bitcoin with out instantly holding it, attracting institutional traders and driving vital inflows.

Nearly $10 Billion Flows Into The Crypto Market

Data from CryptoQuant reveals {that a} staggering $9.5 billion has poured into the Bitcoin market by means of these ETFs since their debut in January. In reality, over 70% of latest cash invested in Bitcoin up to now two weeks has originated from these spot ETFs, highlighting their rising impression.

Looking forward, the upcoming halving occasion in April looms giant. This programmed halving, occurring each 4 years, reduces the quantity of latest Bitcoin getting into circulation, doubtlessly impacting its value resulting from elevated shortage. Historically, Bitcoin has witnessed vital rallies following halving occasions, and lots of analysts consider this time will likely be no totally different.

BTCUSD reclaiming the important thing $52k degree on the each day chart: TradingView.com

“The upcoming halving will further tighten supply,” famous Duncan Ash, head of product go-to-market technique at Coincover. “If history repeats itself, we can expect continued growth in BTC price in the months ahead.”

However, not everyone seems to be singing a completely bullish tune. While analysts at Swissblock agree that the uptrend is more likely to proceed, they warning towards overexuberance, warning of potential slowing momentum and the inherent volatility of the market.

Ultimately, the way forward for Bitcoin stays unsure, as with all cryptocurrency. However, this current surge, pushed by bullish sentiment, ETF inflows, and the upcoming halving, means that the bulls are firmly in management for now.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site fully at your personal threat.