Bitcoin worth’s exceptional surge previous the $50,000 mark for the primary time in over two years has created a buzz throughout each the crypto market and conventional monetary segments. Meanwhile, the beneficial properties in Bitcoin worth have additionally triggered a rally in a number of different altcoins. However, amid this meteoric rise, the query on everybody’s thoughts: will this crypto rally be sustained or will the worth face a big pullback?

As indicators flicker between bullish and cautionary alerts, traders are on edge, monitoring each transfer. So, let’s discover the information and knowledgeable opinions to decipher Bitcoin’s potential subsequent transfer.

Crypto Market Rally To Continue?

Amid the thrill surrounding Bitcoin price’s latest ascent, technical indicators paint an image of optimism. Bitcoin Futures Open Interest (OI) has witnessed a notable surge, reflecting rising curiosity and exercise out there. As per CoinGlass data, the OI spiked by 7.58% to achieve $23.48 billion or 468.20K BTC, with exchanges like CME and Binance witnessing important upticks. In addition, the Coinbase Premium Gap soared to 24.54 on February 12, indicating sturdy demand and premium costs for Bitcoin.

Meanwhile, traders are additionally conserving a detailed watch on indicators just like the Fear and Greed Index, and Relative Strength Index (RSI) for extra cues on the potential upcoming motion of Bitcoin worth. Meanwhile, Bitcoin’s Fear and Greed index alerts excessive greed amongst traders, hovering close to the 80 mark, whereas the general crypto market stood at 72.

However, as Bitcoin worth surges, warning looms with its RSI hitting 78, signaling an overbought state. So, the market sentiment stays inclined to volatility, with profit-taking and worry, uncertainty, and doubt (FUD) lurking within the shadows. Analysts urge traders to train prudence amidst the frenzy, emphasizing the necessity for a balanced method to decision-making within the unpredictable crypto sphere.

Also Read: MicroStrategy’s Bitcoin Boom, Saylor’s Bold Moves Yield 46% Surge in a Week

Expert Insights And Market Dynamics

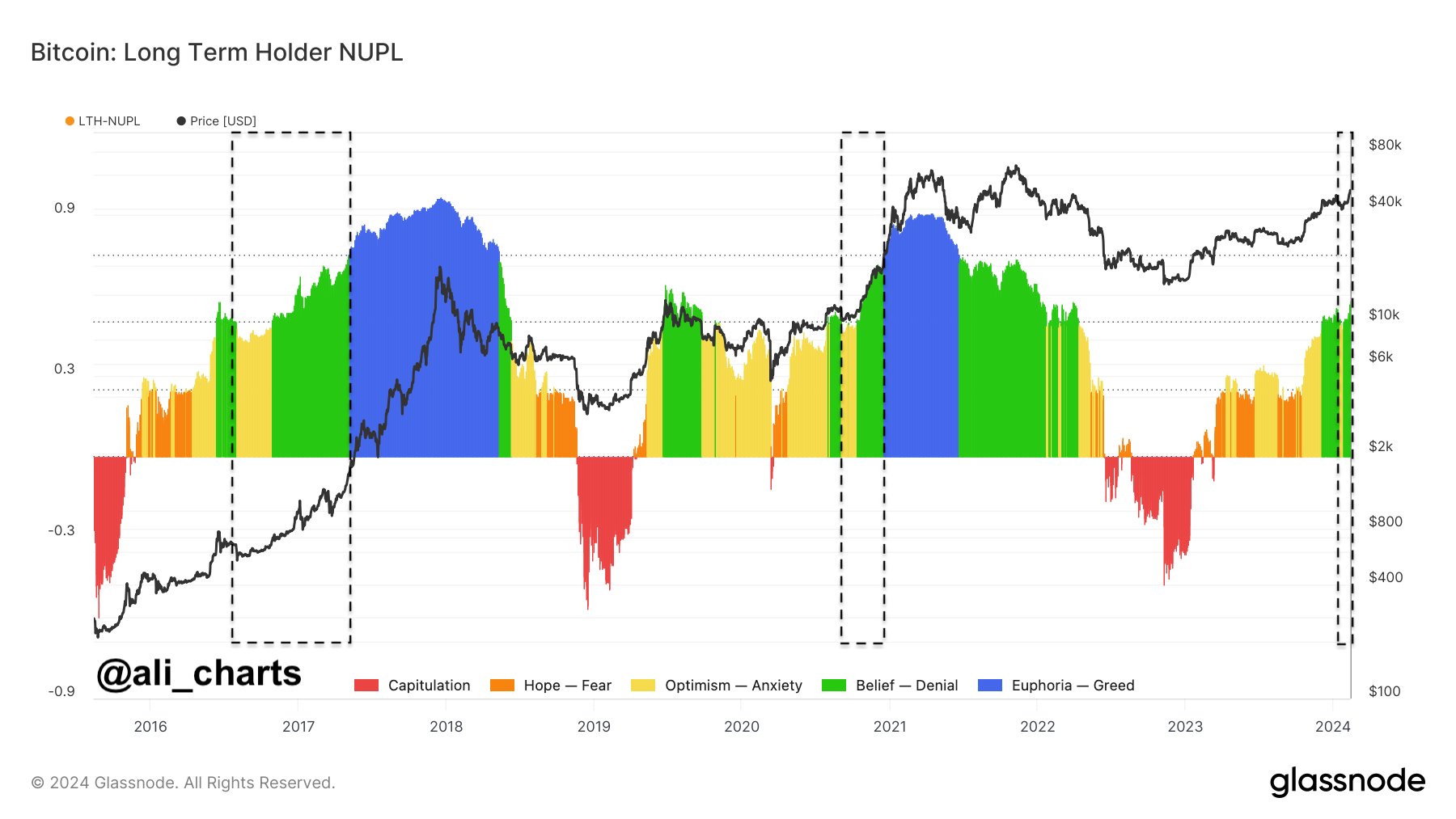

Prominent crypto market analysts are suggesting that Bitcoin’s present trajectory signifies additional upward momentum. According to Ali Martinez, a distinguished analyst, Bitcoin holders sometimes bear a cycle of feelings throughout bullish intervals, not too long ago transitioning from anxiousness to perception.

Notably, this sentiment aligns with Stockmoney Lizards’ remark that “$50k is not the end.” However, il Capo Of Crypto anticipates a possible rejection on the $50k degree for Bitcoin, with altcoins persevering with to surge. These insights trace at a dynamic market panorama, with Bitcoin poised for continued development amidst fluctuating sentiments and evolving tendencies.

Meanwhile, a number of different market pundits are anticipating an additional rally in Bitcoin anticipating the impression of the upcoming Bitcoin halving occasion. Looking on the historic knowledge, earlier Bitcoin halving has triggered a big rally in Bitcoin worth.

In addition, the market contributors brace because the U.S. anticipates the discharge of essential financial knowledge. Today, the U.S. Consumer Price Index (CPI) might be unveiled, adopted by the Producer Price Index (PPI) on Friday.

Notably, these indices function important indicators of the nation’s inflationary tendencies. Despite expectations for a number of fee cuts by the U.S. Federal Reserve, elevated inflation figures might bitter market sentiment. Considering that such knowledge might doubtlessly spark important sell-offs throughout international monetary sectors, together with the crypto market.

As Bitcoin continues its dizzying ascent, the stage is ready for a showdown between bullish optimism and cautious skepticism. While technical indicators and knowledgeable opinions provide divergent narratives, the crypto market stays a risky area, inclined to sudden shifts and exterior influences.

The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.