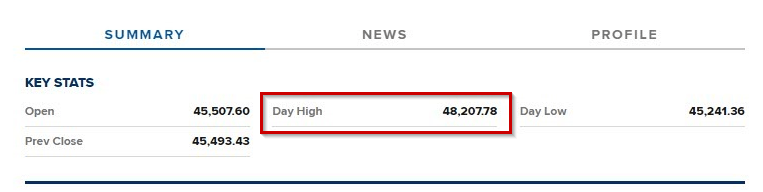

Bitcoin roared again this week, clawing its strategy to $48,207 – its highest level since early January. This fiery ascent follows weeks of muted buying and selling, fueled by issues about institutional outflows and a submit-ETF worth dip. But what’s sparking this sudden surge? And can the digital dragon overcome its subsequent hurdle?

Positive Winds Fill Bitcoin’s Sails

Several elements are propelling Bitcoin’s latest rally:

- Spot ETF Momentum: The lengthy-awaited launch of spot Bitcoin ETFs in January may be lastly delivering on its promise. Potential inflows and optimistic sentiment surrounding these new funding autos are driving curiosity.

- Halving Horizon: The Bitcoin halving, scheduled for May 2024, looms giant. Historically, this occasion, which reduces the speed of latest Bitcoin creation, has been linked to cost will increase, fueling investor optimism.

- Market Synergy: The S&P 500’s latest ascent to report highs appears to be spilling over to the crypto market, making a wave of optimistic momentum.

- Lunar Luck? Bitcoin usually experiences good points across the Chinese New Year, and this 12 months isn’t any exception. The “Year of the Dragon,” with its auspicious connotations, provides one other layer of bullish sentiment.

- ETF Absorption of Selling Pressure: Several ETFs have absorbed over a billion {dollars} value of Bitcoin promoting strain in latest weeks, indicating underlying demand regardless of pre-ETF issues.

Bitcoin presently buying and selling at $47,335 on the every day chart: TradingView.com

But Can Bitcoin Slay The Resistance Dragon?

While the outlook appears brilliant, challenges stay:

- Resistance at $48,500: Bitcoin faces a vital resistance stage at $48,500. Breaking by this barrier is vital for a possible new all-time excessive.

- Post-ETF Sell-off: Despite the latest surge, Bitcoin stays beneath its pre-ETF highs, sparking issues a couple of potential promote-off after the preliminary pleasure fades.

- Volatility Reigns: Crypto stays a notoriously unstable asset, and predicting future worth actions is fraught with issue.

Experts Weigh In: Bitcoin At $52K

Sylvia Jablonski, CEO of Defiance ETFs, attributes the value appreciation to “recent inflows into the spot ETFs, the prospect of the halving, and general market momentum.” However, she cautions that breaking by resistance ranges is rarely assured, and traders ought to strategy any funding with warning.

Meanwhile, Markus Thielen, the founding father of 10x Research and head of analysis at Matrixport, predicted extra rise in bitcoin costs utilizing Elliott Wave idea, a technical examine that makes the idea that costs transfer in repeating wave patterns.

The thought states that worth developments evolve in 5 phases, with waves 1, 3, and 5 serving as “impulse waves” that point out the first pattern. Retracements between the impulsive worth motion happen in waves two and 4.

According to Thielen, BTC has begun its last, fifth impulsive stage of its uptrend, aiming to achieve $52,000 by mid-March, after finishing its wave 4 retracement and correcting to $38,500.

Featured picture from Adobe Stock, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site completely at your personal danger.