A crypto analyst is bullish on Bitcoin (BTC), saying the market ought to count on a “supply shock of all supply shocks” when the community halves its miner rewards in roughly two months.

The Bitcoin Mining Event In Focus

Taking to X, Ted believes BTC costs will float increased after Bitcoin halves in April 2024. This occasion, set on the protocol stage and scheduled roughly each 4 years (or after 240,000 blocks), will considerably scale back the quantity of cash getting into the market.

The discount on this provide will make BTC deflationary, probably rising costs. This outlook is contemplating the anticipated demand that may proceed to rise in 2024.

The Bitcoin community disburses 6.25 BTC roughly each 10 minutes, that means 900 BTC is mined every day. After halving, that quantity will drop to 450 BTC.

This sharp contraction will result in a provide shock, particularly contemplating current developments, such because the United States Securities and Exchange Commission’s (SEC) approval of spot Bitcoin exchange-traded funds (ETFs) in mid-January 2024.

Spot Bitcoin ETFs permit buyers to realize direct publicity to the world’s most precious coin with out the trouble of storing non-public keys. This position is delegated to a regulated custodian like Coinbase Custody.

Spot Bitcoin ETF Issuers Buying More Coins

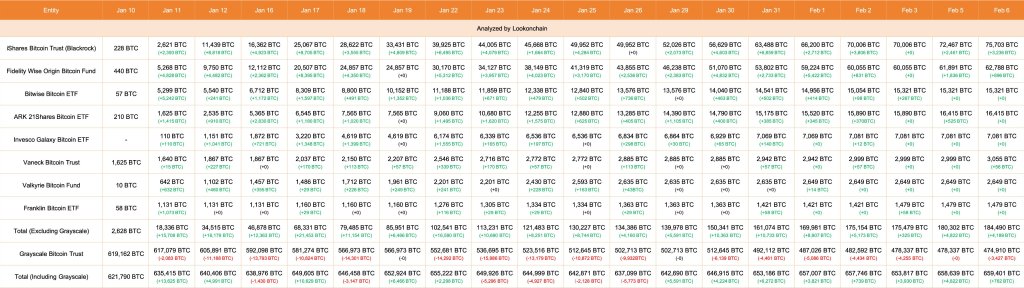

Since their launch in January, Ted notes that spot Bitcoin ETF issuers have accrued over 160,000 BTC. According to Ted, the vital level is the speed at which these ETFs accumulate Bitcoin.

Specifically, if the present every day influx of 5,800 BTC persists, Ted predicts it might simply surpass newly mined cash after halving. For this motive, it will create what the analyst describes as a “supply shock of all supply shocks,” the place demand far outweighs out there provide, probably driving the worth up.

Ted additional factors out that cash held by spot Bitcoin ETF issuers like BlackRock and Fidelity are catching up with these held by MicroStrategy, the enterprise intelligence agency. Bitcoin Treasuries data reveals that MicroStrategy controls 190,000 BTC. On February 6, the general public agency purchased 850 BTC.

The newest knowledge from Lookonchain shows that spot Bitcoin ETF issuers purchased 4,189 BTC on February 6. Meanwhile, Grayscale offloaded 3,427 BTC.

BlackRock, Fidelity, Bitwise, and different issuers management 659,401 BTC as of February 6. The quantity retains rising and now surpasses these of MicroStrategy. However, the determine contains these held by the Grayscale Bitcoin Trust (GBTC), which is progressively being liquidated.

Feature picture from Canva, chart from TradingView