Decentralized finance protocol Lybra Finance’s LBR native token skilled heavy value volatility through the previous week as its main supporters dumped their belongings.

Lybra Finance, the creator of the yield-bearing eUSD stablecoin, goals to take care of a gradual $1 peg and generate earnings from collateralized liquid staking tokens. In January 2023, the DeFi protocol reached a peak TVL of virtually $400 million.

LBR Price Falls 50%

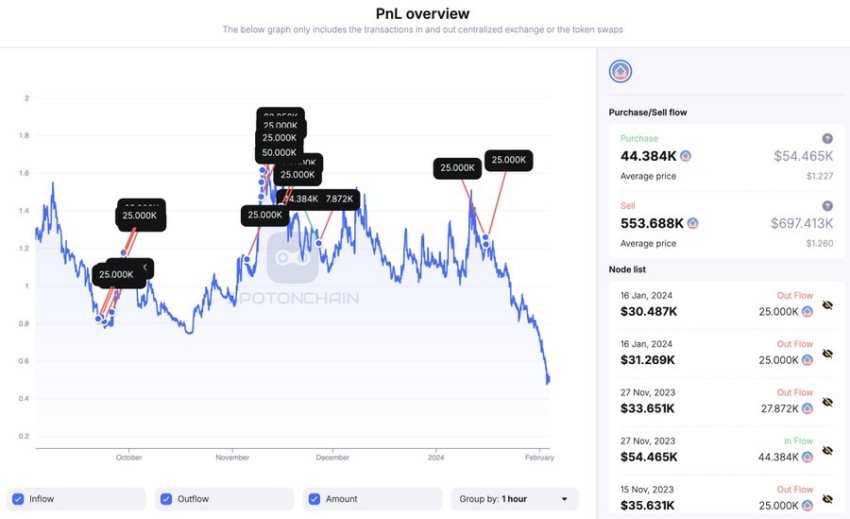

SpotOnChain, a outstanding blockchain analytical agency, reported that Key Opinion Leaders (KOLs) and nameless addresses holding substantial portions of LBR tokens managed a good portion of the community’s Total Value Locked (TVL).

LBR’s downward spiral started when these substantial holders started divesting their belongings. On January 15, the highest protocol’s staker, blurr.eth, eliminated all their 34,000 ETH ($70 million), whereas different main stakers—sifuvision.eth and czsamsunsb.eth—dumped 6,000 ETH ($13 million) and 4,000 ETH ($8 million), respectively, at the moment.

These actions resulted in LBR’s worth plunging by round 14% through the previous day to $0.4263 as of press time. Over the previous week, LBR skilled a considerable decline of round 50%.

“Influential Key Opinion Leaders (KOLs) have dumped their tokens. It’s uncertain if LBR can make a comeback,” blockchain analytical agency SpotOnChain wrote.

Meanwhile, the heightened promoting stress negatively impacted the eUSD stablecoin, which briefly deviated from its peg, dropping to as little as $0.97. While it has recovered to $1.01 as of press time, it’s value noting that its buying and selling quantity remained beneath $4,000 within the final 24 hours, in keeping with CoinMarketCap data.

DeFi TVL Dips 70%

As a results of these developments, the whole worth of belongings locked on the DeFi protocol quickly tanked by roughly 70% through the previous day to $79 million from $245.85 million, in keeping with DeFiLlama information.

Industry consultants recommended that the fast decline was triggered by whales withdrawing their ETH and shifting to different protocols with higher yields.

“People simply have better ways to use their ETH — that is all there is to it… why would people stick their ETH in Lybra when they can restake it, get a LRT, get tons of EL + other points, and borrow stables against those positions,” crypto analyst Yoki said.

Lybra Finance attributed the decline to consumer conduct, including that the protocol and its customers’ funds stay secure.

“We are aware of the sudden drop in TVL, which was caused by user behavior. The protocol is secure, and users’ assets are not affected. Please don’t panic,” the Lybra crew said.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. However, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.