A crypto analyst, Eric, believes Ethereum (ETH) might spike to $20,000 within the upcoming bull run. The analyst mentioned the potential launch of spot Ethereum exchange-traded funds (ETFs) within the United States will propel this upswing.

Ethereum To $20,000 Possible

In a publish on X, Eric cited Ethereum’s historic tendency to reflect Bitcoin (BTC), albeit with a one-cycle lag. In the earlier bull market, the analyst famous that Bitcoin surged 22-fold from $3,100 to $69,000. Therefore, if Ethereum follows the same trajectory, reaching $20,000 can be a sensible risk.

As the analyst famous, Ethereum’s latest bear market backside of $880 in 2022, if extrapolated utilizing the 22x progress charge seen in BTC, locations the coin at $19,360. However, the analyst believes Ethereum would possibly surpass expectations, making $20,000 a base and a psychological spherical quantity to observe carefully.

Supporting this forecast is the potential approval of a spot Ethereum ETFs. Like the spot Bitcoin ETF, this authorization will probably appeal to institutional buyers and considerably enhance Ethereum costs and liquidity. Institutional buyers can acquire publicity to Ethereum by way of these complicated by-product merchandise with out the complexities of instantly buying and selling or storing the coin.

While the optimism stays, the United States Securities and Exchange Commission (SEC) will probably comply with the identical path it took earlier than approving the primary spot of Bitcoin ETFs in January. For context, the strict company didn’t approve any spot Bitcoin ETF for over ten years, citing market manipulation dangers and the absence of correct monitoring instruments.

Will The US SEC Approve A Spot Ethereum ETF?

However, in a latest assertion by The Block, Standard Chartered, a worldwide financial institution, mentioned the US SEC will probably approve Ethereum ETF’s first spot in May 2023. By then, the financial institution added, ETH costs can be buying and selling at round $4,000, propelled by normal market optimism.

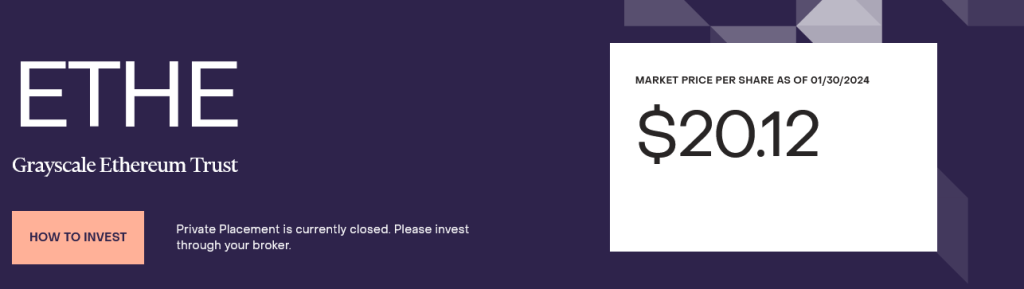

The financial institution notes that the failure of the company to categorise ETH as a safety additional provides weight to this expectation. At the identical time, Grayscale Investments, which is issuing Grayscale Ethereum Trusts (ETHE), desires to transform this product into an ETF. Each share traded at round $20 as of January 30.

Earlier, Grayscale gained towards the US SEC’s arguments, wishing to forestall the conversion of their Bitcoin Trust into an ETF. This win set the ball rolling for the eventual approval of the primary spot Bitcoin ETFs within the United States.

Additionally, the truth that Ethereum Futures ETFs had been lately accredited and listed on the Chicago Mercantile Exchange is a internet constructive, paving the way in which for a possible itemizing in May 2024.

Feature picture from Canva, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal danger.