The Bitcoin market is at present experiencing a turning level, largely pushed by latest developments in Bitcoin exchange-traded funds (ETFs). Yesterday, Bitcoin’s value rose above $43,000, a motion carefully tied to altering dynamics in ETF inflows and outflows, notably involving the Grayscale Bitcoin Trust (GBTC).

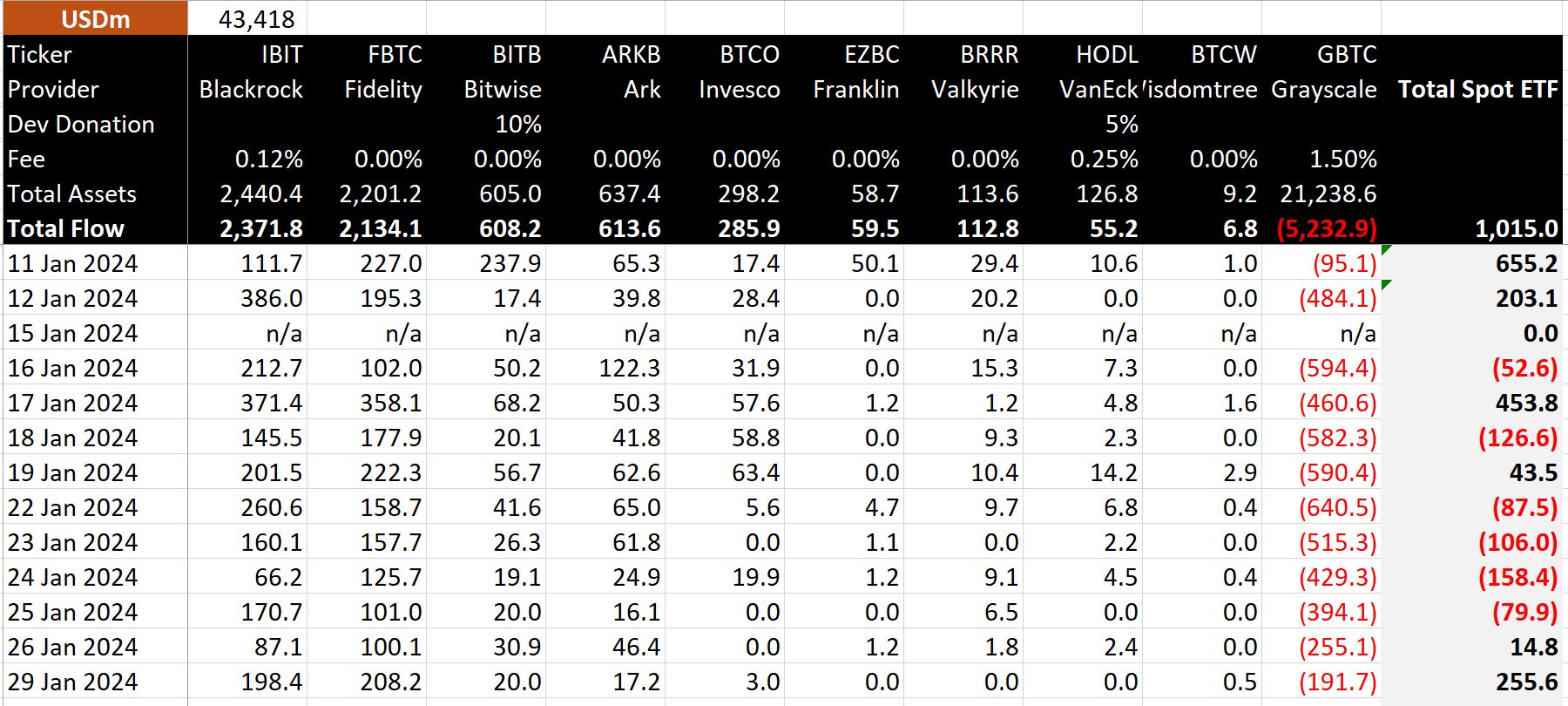

On January 29, (Bitcoin ETF Day 12), a notable shift occurred. The Bitcoin spot ETFs witnessed a considerable web influx of US$255 million, whereas Grayscale’s GBTC skilled a big web outflow of $191 million. The different 9 ETFs, led by Fidelity and BlackRock, noticed a mixed web influx of $446 million, making it the third-highest influx day for Bitcoin ETFs.

New All-Time High Until Bitcoin Halving?

This situation of excessive inflows and diminished outflows from Grayscale’s GBTC presents an intriguing change from earlier days, the place GBTC outflows dominated and weighed closely in the marketplace sentiment.

Crypto analyst @WhalePanda, who’s a part of the “Magical Crypto Friends” YouTube channels (together with Samson Mow, Charlie Lee, and Riccardo Spagni), commented on this growth, stating, “Net inflow of $250 million in a day is crazy. That’s 5800 Bitcoin being removed from the market in just one day.”

He highlighted the importance of this quantity, particularly when in comparison with the each day Bitcoin mining price of 900 BTC. MicroStrategy bought $615 million BTC between November 30 and December 26.

While WhalePanda acknowledged that inflows will decelerate sooner or later, he expects this to occur in a while. “The increased price is driving more exposure, leading to more inflows, which in turn pushes the price even higher. This is a classic example of the bull cycle flywheel mechanics at play, even before the halving,” he remarked.

The famend crypto skilled additional elaborated that “the amount of Bitcoin float will significantly drop over the next couple of days and once the price starts moving with limited supply left… Things can go crazy. No, not $1 million crazy. Crazy for me is breaking ATH before halving.”

In a separate post on X, @WhalePanda expressed his outlook for the week, “This is going to be a big week for #Bitcoin. With GBTC outflows decreasing and a strong inflow day last Friday, we might be seeing the beginning of a new trend.” He emphasised the potential of this momentum to change into a self-fulfilling prophecy, driving Bitcoin’s value increased.

Spot BTC ETFs Remain The Focus

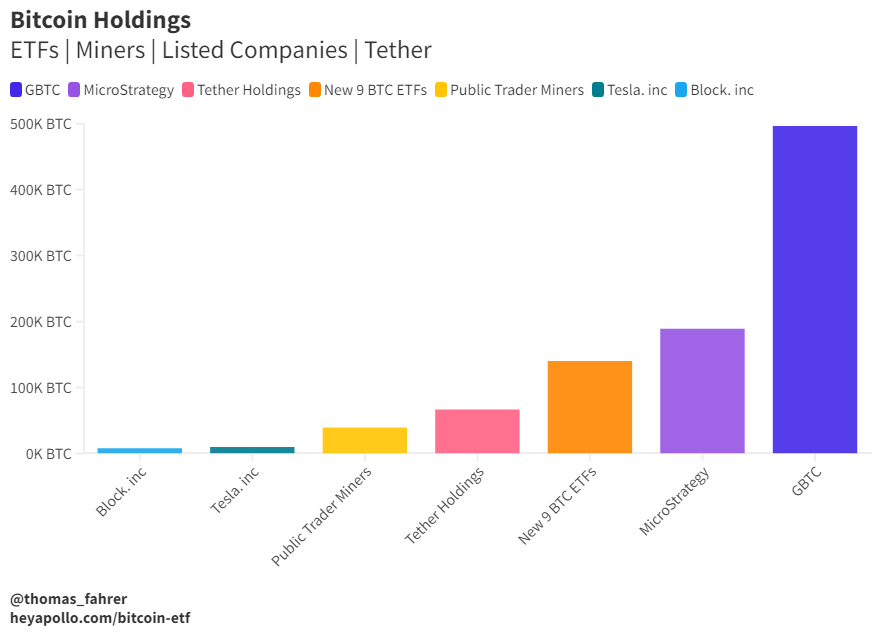

Thomas Fahrer, co-founder of Apollo Sats, added context to those huge spot BTC figures, noting, “The 9 New ETFs hold more BTC than Tether, Tesla, Block, and all of the Public Miners combined. Soon they will surpass MSTR, and later even GBTC.”

Alex Thorn, head of analysis at Galaxy, commented on the potential implications for BTC’s value trajectory, particularly in relation to ETH: “With Grayscale outflows appearing to slow down and other Bitcoin ETF flows remaining positive, I’m curious about the future direction of the ETHBTC cross. A lower trajectory seems like the path of least resistance in the near term.”

with grayscale outflows seeming to abate and different #bitcoin etf flows now showing holding optimistic, i’m once more questioning the place the ETHBTC cross is headed. decrease once more seems like the trail of least resistance near-term pic.twitter.com/DVPi1pdWP0

— Alex Thorn (@intangiblecoins) January 30, 2024

This confluence of ETF inflows, lowering outflows from Grayscale, and the anticipation of the upcoming Bitcoin halving are creating a novel bullish market atmosphere. However, at press time, BTC is buying and selling beneath a key resistance at $43,444.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site fully at your personal danger.