The crypto market noticed large retracement after the spot Bitcoin ETFs listings, with market cap tumbling again to $1.66 trillion from $1.82 trillion. Altcoins reminiscent of Ethereum rebounded amid Bitcoin dominance slipping beneath 50%.

Bitcoin worth has traded sideways close to $42,500 all through the week and merchants look to build up beneath $40,000, however specialists predict the times of the short-term impression of Bitcoin ETF approval are largely over.

Why Crypto Market Is Down Today

The buying and selling volumes throughout cryptocurrencies took a success because of components together with volatility, earnings season, and macro. Strong US greenback inflicting promoting stress on Bitcoin. The US greenback index (DXY) reverses again above 103.50 from 101 in early January.

However, Coinglass information and newest macro information point out that Bitcoin promoting stress is easing steadily. In the final 24 hours, the crypto market noticed over $100 million in complete liquidation, with 75% longs and 25% shorts liquidated. Bitcoin recorded $22 million liquidation and Ethereum noticed $20 million liquidation. However, the pattern is altering as brief liquidation is rising within the final 12 hours.

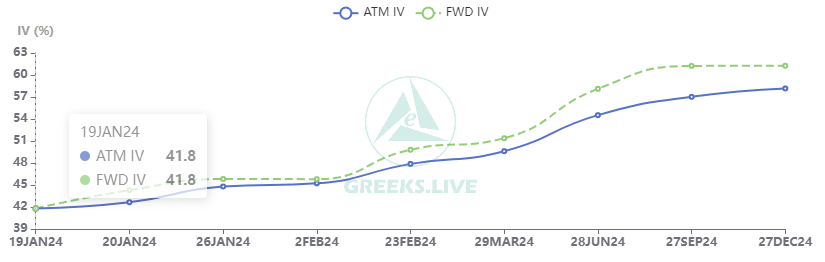

BTC’s volatility stage dropped to a brand new low prior to now month, with each main phrases RV and IV exhibiting vital declines, and short-term IV plummeting to beneath 45%.

According to futures and choices information, the short-term impression of the spot Bitcoin ETF is basically over. The funding fee appears to be like engaging to merchants and a shopping for will begin quickly. BTC futures and choices open pursuits (OI) each are rising once more within the final 4 hours. BTC OI throughout exchanges together with CME, Binance, and Coinbase are recovering, with a 0.35% leap to $18.31 billion of complete BTC futures open curiosity.

In distinction, Ethereum open curiosity (OI) fell over 2% within the final 24 hours, with a complete ETH OI of $8.85 billion. However, Solana and XRP OI are rising once more and costs might make a comeback quickly.

Also Read: GBTC Outflows Make Way Into Spot Bitcoin ETFs, Bitwise Records $68 Million Inflows

Bitcoin and Crypto Looks Promising

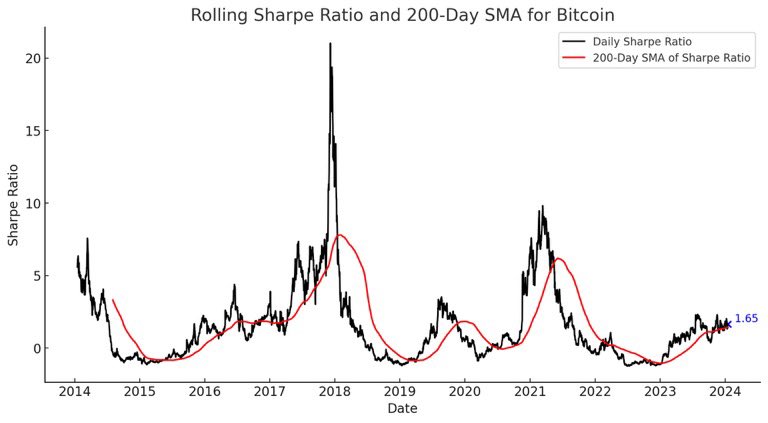

Popular analyst Crypto Birb mentioned the cyclical nature of risk-adjusted returns of Bitcoin appears to be like promising for the following 12-18 months. He predicts that if historic patterns come into impact, holding BTC after the 4th halving and till 2026 is tremendous bullish.

Top analyst and dealer Michael van de Poppe mentioned “People are bearish on Bitcoin and have a negative outlook. Don’t be like that. Buy the dip and hold.”

The ETFs on #Bitcoin have a internet influx of $782 million over the primary three days.

That’s greater than 50% increased than ALL ETFs mixed have achieved in 2023 by way of quantity.

People are bearish on #Bitcoin and have a damaging outlook.

Don’t be like that. Buy the dip and maintain.

— Michaël van de Poppe (@CryptoMichNL) January 17, 2024

BTC price is at present buying and selling at $42,745. The 24-hour high and low are $42,189 and $42,880, respectively. The buying and selling quantity stays low forward of Friday’s expiry. Bitcoin gaining upside momentum will convey a pullback throughout altcoins, with the primary trace of Ethereum open curiosity falling.

Also Read: Bitcoin Miners On A Aggressive Selling Spree, BTC Hashrate Tanks 34%

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.