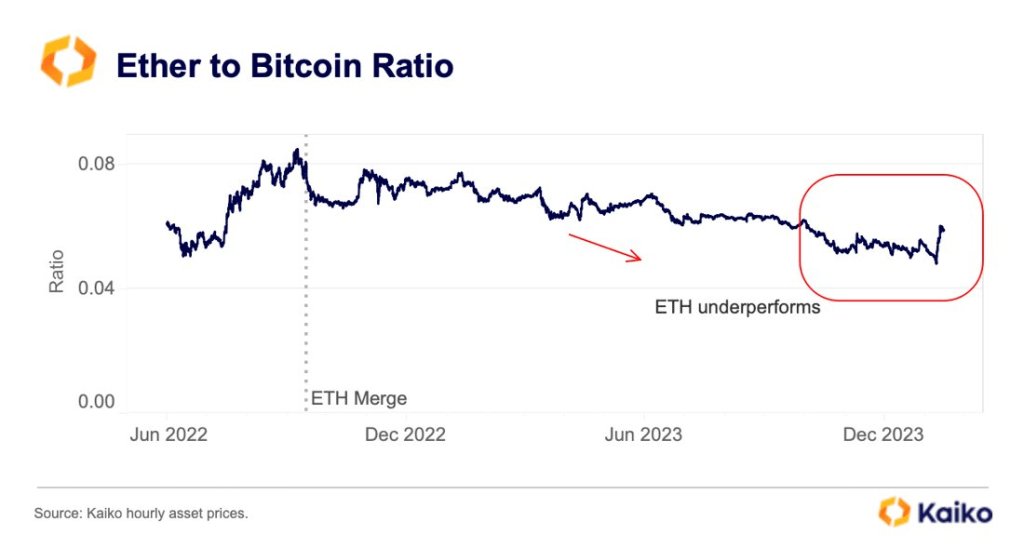

Amidst a risky crypto market, Ethereum (ETH) is gaining momentum, outperforming its long-time rival Bitcoin (BTC). According to Kaiko data, the ETH/BTC ratio has steadily risen, rebounding from multi-year lows.

ETH/BTC Ratio Rising, ETH Momentum Building

The ETH/BTC ratio technically gauges market sentiment in direction of these two main crypto. The current rebound signifies traders are more and more bullish on Ethereum’s potential relative to Bitcoin.

This upward trajectory is fueled by rising optimism surrounding the potential approval of spot Ethereum ETFs and the overall confidence that markets will pattern greater in 2024. The prospect of this product getting into the market has additionally injected contemporary vitality into the ETH ecosystem, lifting the second most dear coin by market cap.

Related Reading: Institutional Inflows Into XRP Surges 244% Amid ETF Speculation

After protracted decrease lows, the ETH/BTC ratio started rising instantly after the United States Securities and Exchange Commission (SEC) accredited 11 spot Bitcoin ETFs final week. This surprising shift, analysts observe, is primarily due to rising confidence within the SEC approving the same product for ETH.

Spot Ethereum ETFs, which would supply direct publicity to the Ethereum market, would make it simpler for institutional traders to learn from the volatility of ETH. So far, the SEC has accredited an Ethereum Futures ETF, which, not like the spot ETF, tracks an index, not the direct worth of this asset.

Blackrock is among the many main Wall Street giants fascinated by issuing a spot Ethereum ETF. Considering its historical past of success, the choice by one of many world’s main asset managers to use for this product is an endorsement of its prospects. Earlier, Larry Fink, the CEO of BlackRock, said Ethereum, regardless of its scaling problem, would possibly spearhead the tokenization drive within the years forward.

US SEC Yet To Clarify Whether Ethereum Is A Commodity Or Security

Even so, the SEC has but to make clear whether or not ETH, a coin pre-mined with some property distributed to the Ethereum Foundation, is a commodity like Bitcoin. Earlier, Gary Gensler, the chairperson of the SEC, was cornered by the United States policymakers to present the company’s stand on the coin however didn’t.

Nonetheless, with the prospect of recognizing Ethereum ETFs and the dominance of Ethereum in decentralized finance (DeFi) and non-fungible tokens (NFTs), ETH will seemingly proceed outperforming BTC within the coming months. Price motion information exhibits that ETH is already up 20% versus BTC previously buying and selling week.

Feature picture from Canva, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal danger.