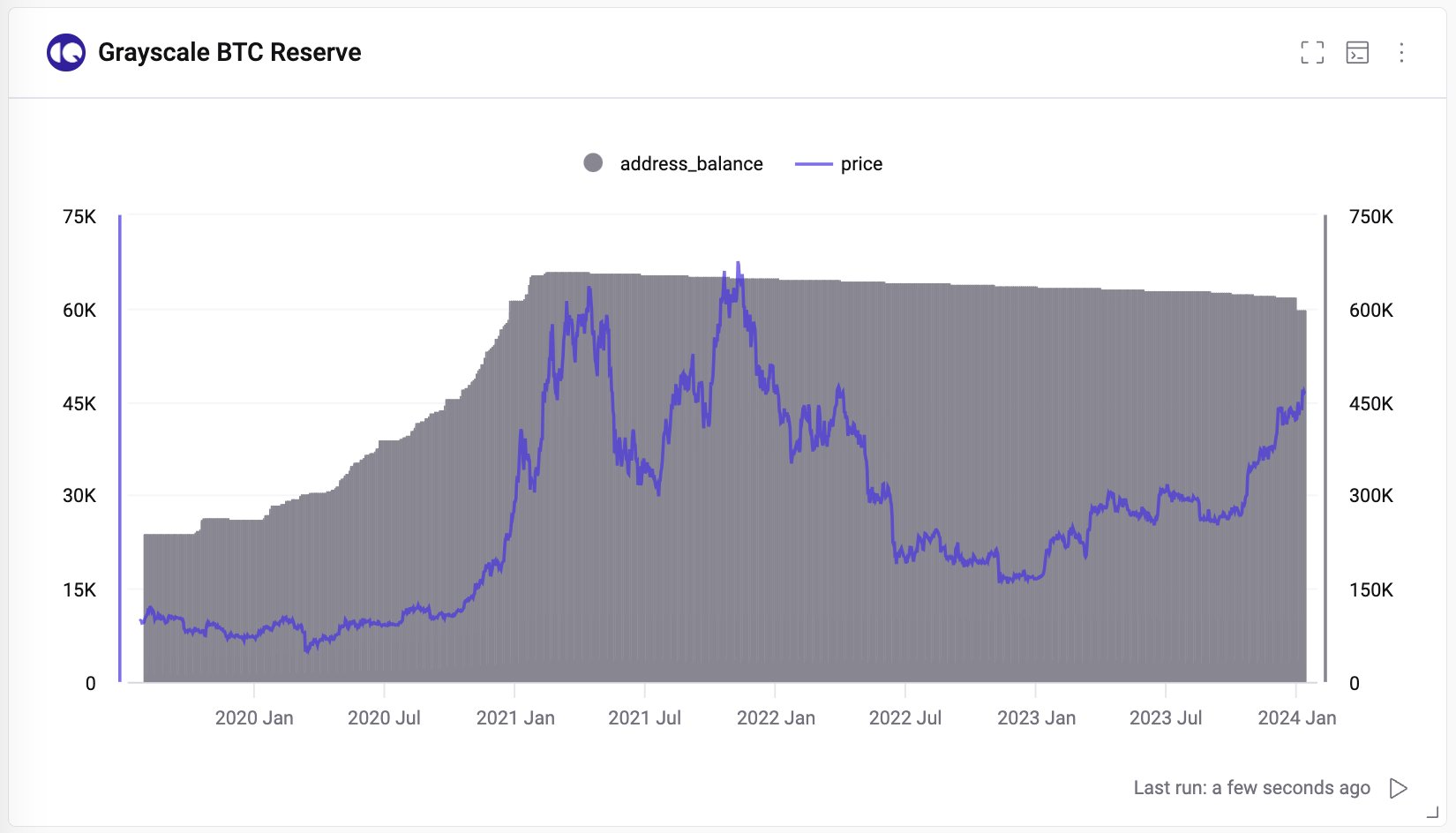

After the U.S. Securities and Exchange Commission (SEC) permitted all 11 Spot Bitcoin ETFs on the similar time, SEC Chair Gary Gensler admitted that Grayscale’s court docket victory was the important thing motive behind approving spot Bitcoin ETFs. However, Grayscale has been transferring Bitcoin to a number of addresses together with crypto exchanges within the final 30 days.

Grayscale Dumping Bitcoin During Spot Bitcoin ETF Speculation

The first day of spot Bitcoin ETF was sturdy when it comes to $4.6 billion in complete buying and selling quantity. However, consultants imagine the Bitcoin inflows had been a lot decrease than anticipated, with GBTC recording $95 million of outflow. The complete web move for the day into the brand new ETFs was $625.8 million.

BitMEX Research information confirmed that on the second day of itemizing of the spot Bitcoin ETF, GBTC outflows had been $484 million, and the entire GBTC outflows within the earlier two days had been $579 million.

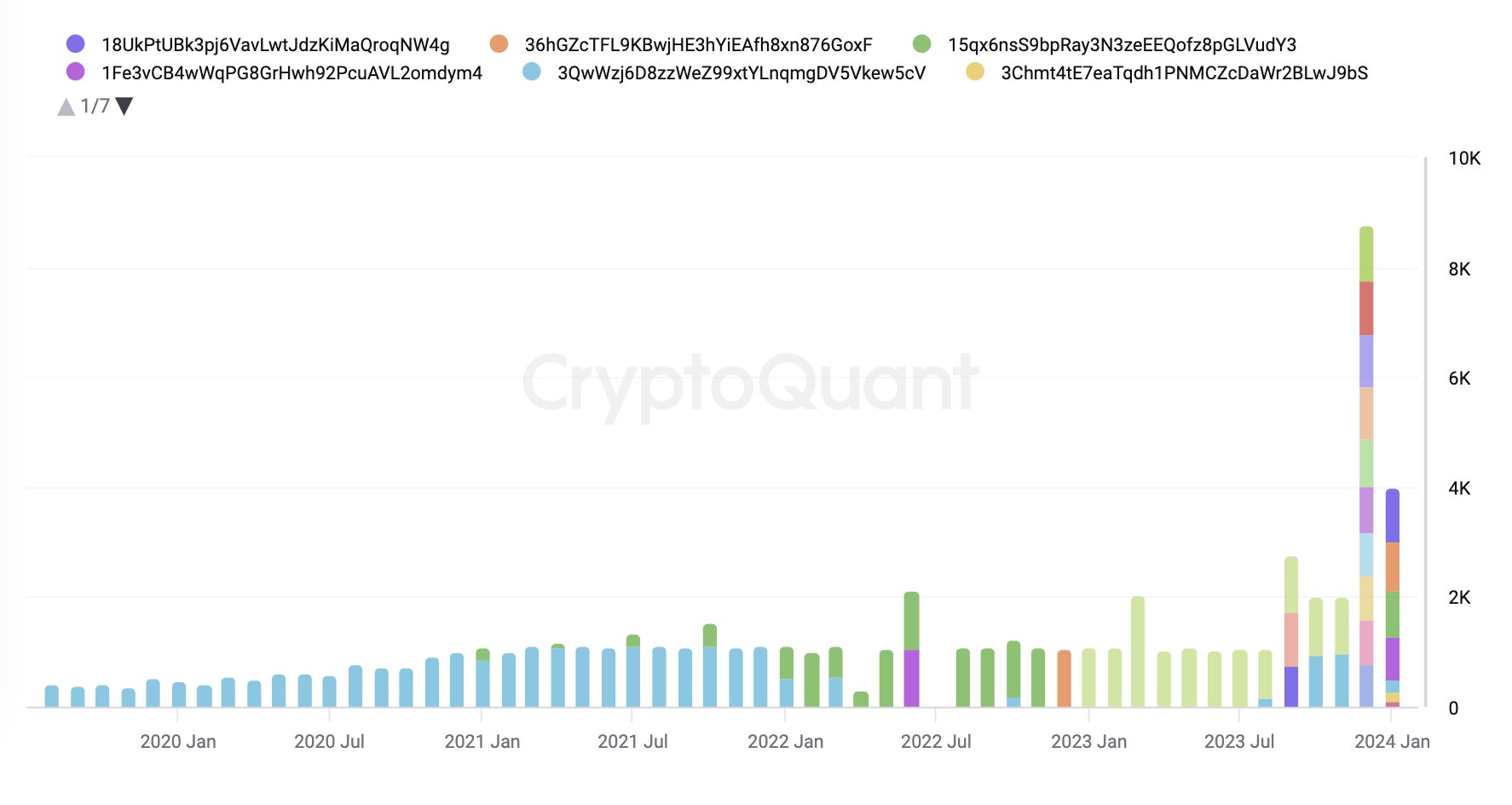

CryptoQuant founder and CEO Ki Young Ju in a submit on January 13 revealed that Grayscale moved 21,400 BTCs price over 900 million within the final 30 days. Grayscale despatched bitcoins to a number of addresses together with Coinbase, which signifies holders are promoting as spot Bitcoin ETF approval got here close to.

Moreover, a breakdown of outflows from Grayscale wallets exhibits that the Grayscale BTC reserve pockets stability modified most not too long ago. Grayscale despatched 4,000 BTC price $183 million to a Coinbase Prime deposit handle yesterday. This could possibly be on account of buyers switching their belongings to different spot Bitcoin ETFs because it has the very best charge of 1.5%.

BTC price tumbled over 6% previously 24 hours, with the worth at the moment buying and selling at $42,846. The 24-hour high and low are $0.643 and $0.664, respectively. Furthermore, the buying and selling quantity has decreased within the final 24 hours, indicating a decline within the curiosity of merchants.

Also Read:

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.