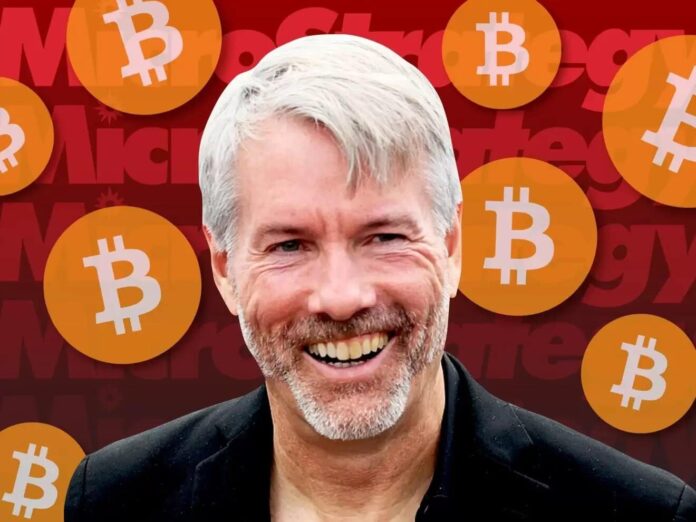

Bitcoin advocate Michael Saylor stated the yr 2024 could be “The Year of Bitcoin” forward of the potential approval of the spot Bitcoin ETF round January 10, 2024. Along with the Bitcoin Halving occasion, the launch of spot ETF may go away 2024 with a historic footprint within the crypto house.

Also Read: BTC Price On Verge Of Touching $50K Ahead Of Bitcoin ETF Approval?

MicroStrategy BTC Accumulation In 2024

MicroStrategy, the enterprise intelligence and software program firm, holds the distinctive distinction within the crypto house with being the biggest institutional holder of Bitcoin ($BTC). Adding on to its Bitcoin wager, the corporate is continuous so as to add to its large BTC holding. As latest as December 27, 2023, the corporate purchased 14,620 BTC value $615 million, CoinGape reported. With this addition, MicroStrategy’s whole Bitcoin holdings reached 189,150 BTC, as of December 26, 2023.

Wishing on the brand new yr 2024, Saylor said,

“Welcome to 2024, The Year of Bitcoin.”

However, MicroStrategy’s pole place because the main Bitcoin holding firm might be challenged when the likes of Blackrock and Fidelity launch the spot ETFs. Meanwhile, the MicroStrategy stock ($MSTR) may proceed its streak of positive aspects in 2024 owing to the 2 key occasions, Halving and ETF approval. In the final one yr, MSTR inventory moved up by an enormous 336%, in comparison with the 172% positive aspects for BTC value throughout the identical interval.

2024 Could Be Year Of Mainstream Crypto Adoption

Thanks to the participation of monetary establishments like Blackrock and Fidelity within the spot ETF house, the move of institutional cash into crypto is extremely possible in 2024. However, the questions on retail shopping for of cryptocurrencies nonetheless stays unanswered because the U.S. Securities and Exchange Commission (SEC) is but to offer clear steering across the similar.

This continues regardless of the authorized setbacks within the type of XRP lawsuit defeat earlier in 2023, that cripples the SEC’s narrative that the cryptocurrencies bought on crypto exchanges quantity to be funding contracts. Yet, the spot ETF approval, which supplies oblique publicity to Bitcoin for retail traders, may go into historical past as an necessary milestone for crypto business.

Also Read: What Are Chances Of Bitcoin ETF Approval Before January 6, 2024?

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.