Bitcoin’s historic chart patterns and traits point out that Bitcoin has four-year cycles, divided into bull and bear cycles. Historically, this interprets to 3 years of bullish run adopted by one yr of bearish correction. In the final bear market, BTC value tumbled from $68.8k in November 2021 to $16.4k in December 2022.

Bitcoin Bull Run To Continue Another Two Years

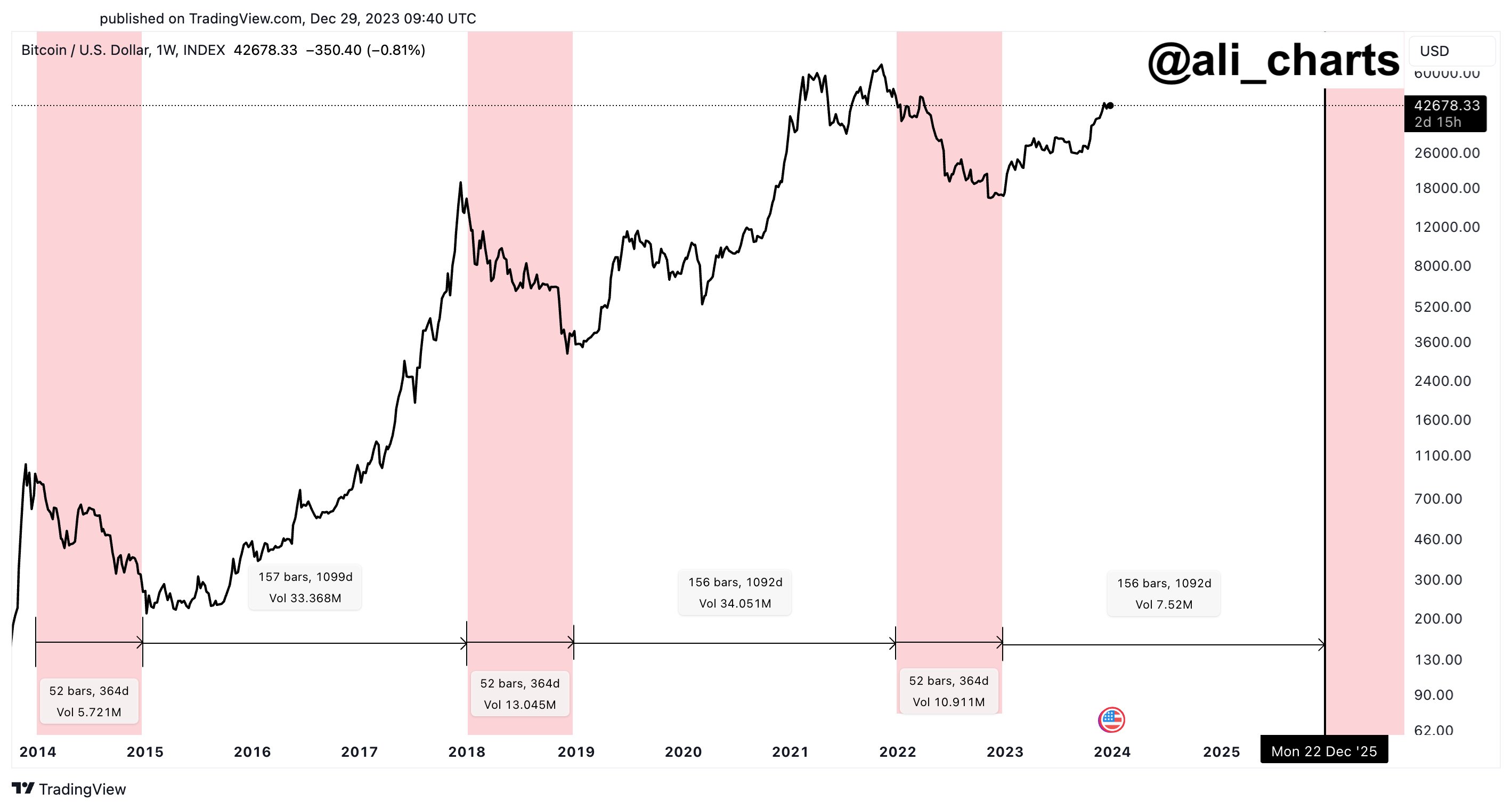

Popular analyst Ali Martinez shared a Bitcoin cycle chart indicating BTC value patterns from 2014 to 2025. He mentioned Bitcoin is designed round four-year cycles, which is pushed by Bitcoin halving occasions occurring night 4 years.

Bitcoin halving occasions often led to an enormous rally in Bitcoin value. The four-year cycle has 3 years of bullish traits adopted by 1 yr of bearish correction. Bitcoin value patterns have been related traditionally.

Martinez predicts Bitcoin is at the moment in a bullish section since January 2023 and can probably proceed its bullish run till December 2025. BTC value rallied 170% in 2023 regardless of a number of lawsuits, regulatory challenges, and heightened scrutiny.

The subsequent Bitcoin halving is estimated to occur on April 20, 2024, as per the countdown data by NiceHash. Bitcoin block reward will lower from 6.25 BTC to three.125 BTC. Bitcoin value has already began rallying increased within the final 2 months in response to the upcoming halving occasion.

Also Read: LUNC News – Terra Classic Community Votes On 8 Million USTC Burn Proposal

BTC price buying and selling sideways within the 24 hours, with the value at the moment buying and selling at $42,916. The 24-hour high and low are $42,216 and $43,202, respectively. Furthermore, the buying and selling quantity has decreased by 7% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Spot Bitcoin ETF approval by the US SEC and optimistic sentiment attributable to fee cuts by the US Federal Reserve are additionally components influencing Bitcoin value rally.

Also Read:

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.