BitMEX founder Arthur Hayes has a brand new warning for the crypto group as spot Bitcoin ETF approval by the U.S. Securities and Exchange (SEC) is sort of right here. If TradFi asset managers, corresponding to BlackRock, turn into too profitable with spot Bitcoin ETF, they may utterly destroy Bitcoin, stated Arthur Hayes. Fundamentally dropping the crypto motion to separate cash and finance from the state.

TradFi Could Kill Bitcoin

Arthur Hayes in his new blog on December 23 purple flags potential efforts by conventional finance corporations to kill Bitcoin. He warns “If ETFs managed by TradFi asset managers are too successful, they will completely destroy Bitcoin.”

“If you dug a hole and deposited gold and reams of paper and came back in 100 years, the gold and paper would still exist. Bitcoin is completely different. Bitcoin is the first monetary asset in human history that exists only if it moves.”

Arthur Hayes asserts world’s largest TradFi asset supervisor Blackrock is within the asset accumulation sport. They will retailer Bitcoin and concern a tradeable safety, individuals will buy Bitcoin ETF derivatives moderately than shopping for and hodling Bitcoin in self-custodial wallets.

In the longer term, there will likely be no precise use for the Bitcoin blockchain and this can find yourself with miners turning off their machines. Miners solely obtain Bitcoin revenue if the community is used. With Bitcoin being saved in a vault, “Without the miners, the network dies, and Bitcoin vanishes.”

Also Read: BlackRock Prepares for $3 Million Seed Funding for Bitcoin ETF Next Week

2024 As the Year of Bitcoin

Arthur Hayes predicts 2024 because the 12 months of Bitcoin as spot Bitcoin ETF will get accepted by the U.S. SEC, elections, and surge in world cash printing.

The chart clearly exhibits Bitcoin (white) up 228% as in comparison with gold (yellow), the S&P 500 (inexperienced), and the Nasdaq 100 (purple) since 2020.

BTC price fell over 1% prior to now 24 hours, with the worth at the moment buying and selling at $43,613. The 24-hour high and low are $43,351 and $44,367, respectively. Furthermore, the buying and selling quantity has decreased by 11% within the final 24 hours, indicating a decline within the curiosity of merchants.

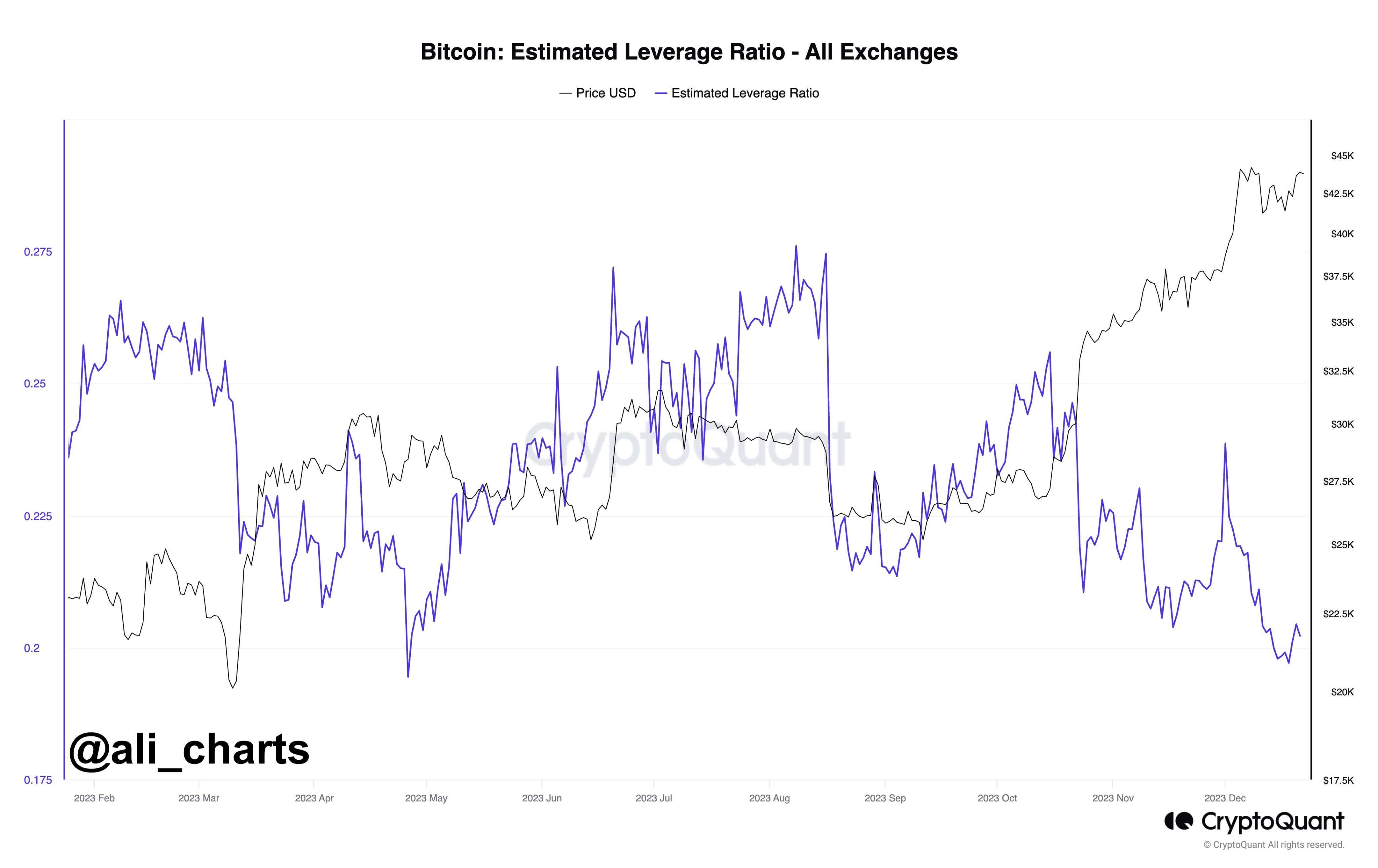

Analyst Ali Martinez revealed a extra cautious method within the crypto market regardless of the BTC worth uptick. A lower within the Estimated Leverage Ratio is an indication of decreasing leverage threat by merchants.

Also Read: Shiba Inu Whale Moves 4 Tln SHIB, Shytoshi Kusama Spotlights LEASH Listing

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.