A crypto pundit and Bitcoin maximalist, Mark Harvey, has defined why he believes the foremost cryptocurrency Bitcoin, is way off from its true potential. According to him, the crypto token could possibly be value near $17 million sooner or later.

Why One Bitcoin Could Worth $17 Million

In a post shared on his X (previously Twitter) platform, Harvey made a robust case for Bitcoin on why it might on why a worth even larger than $17 million is probably going. He referred to Bitcoin’s use case as a store of value and the way it might additional chop into the market share of different asset courses. He famous Bitcoin’s “tremendous upside” regardless of being a relative newcomer.

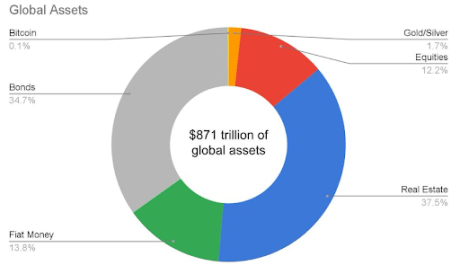

Bitcoin is alleged to have 0.1% of the $871 trillion that are invested in world property. Other world property that maintain a considerable market share embody gold and silver, bonds, equities, actual property, and fiat cash. Harvey believes that Bitcoin’s worth might rally considerably because the foremost cryptocurrency turns into the most preferred option for folks to protect their cash.

Source: X

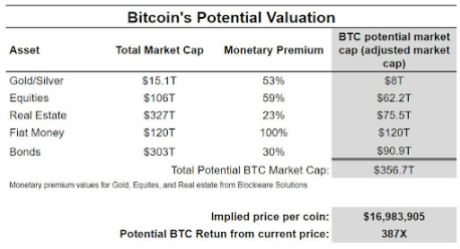

Harvey said that the financial premium of these world property highlights how a lot they’re used as a retailer of worth. The crypto pundit asserts that Bitcoin has the potential to seize the financial premiums of different asset courses, which might see its worth rise to $17 million with a market cap of $356.7 trillion.

Source: X

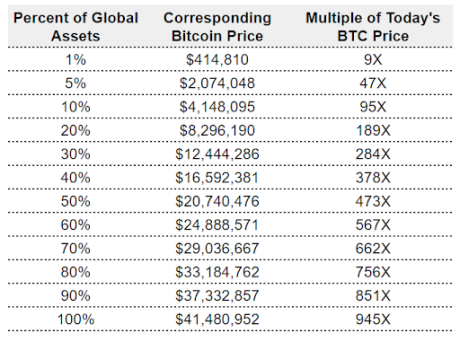

In his opinion, that is very possible as a result of Bitcoin is a “superior form of property.” If it does occur, the crypto token might additionally find yourself capturing 41% of the $871 trillion in world property. Harvey additionally supplied a extra possible situation as to Bitcoin’s future worth. He famous that the crypto token might nonetheless rise to as excessive as $415,000 per token if it captures 1% of worldwide property.

Source: X

Is BTC Superior To Other Asset Classes?

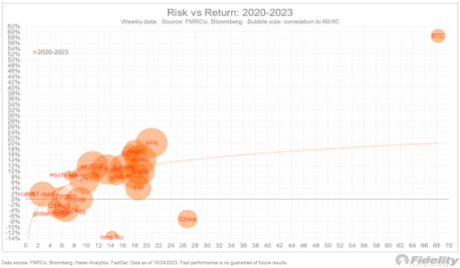

Harvey labeled Bitcoin as a “superior form of property,” and there’s proof to again up this assertion. As highlighted by the Director of Global Macro at Fidelity Investments, Jurrien Timmer, Bitcoin stands out compared to different asset courses.

Source: Fidelity Investments

According to information from Fidelity, the flagship cryptocurrency supplied the most effective risk-reward with a 58% return from 2020 to this yr. In phrases of drawdowns and rallies, Bitcoin additionally stood out with an 84% acquire from its 2-year low.

Meanwhile, a recent report by Glassnode famous that Bitcoin continues to steer as one of many best-performing global assets, with a acquire of over 140% yr to this point (YTD). Specifically, Bitcoin has greater than doubled in relation to Gold.

BTC worth stays above $43,000 | Source: BTCUSD on Tradingview.com

Featured picture from Coin Culture, chart from Tradingview.com

Source: Fidelity Investments

Source: Fidelity Investments