On December 4th, Bitcoin (BTC) witnessed an sudden surge in its age-consumed metric, indicating a big improve in beforehand inactive cash coming into circulation.

This outstanding growth, marked by a 400% surge in a 24-hour interval, might probably sign upcoming worth volatility within the Bitcoin market.

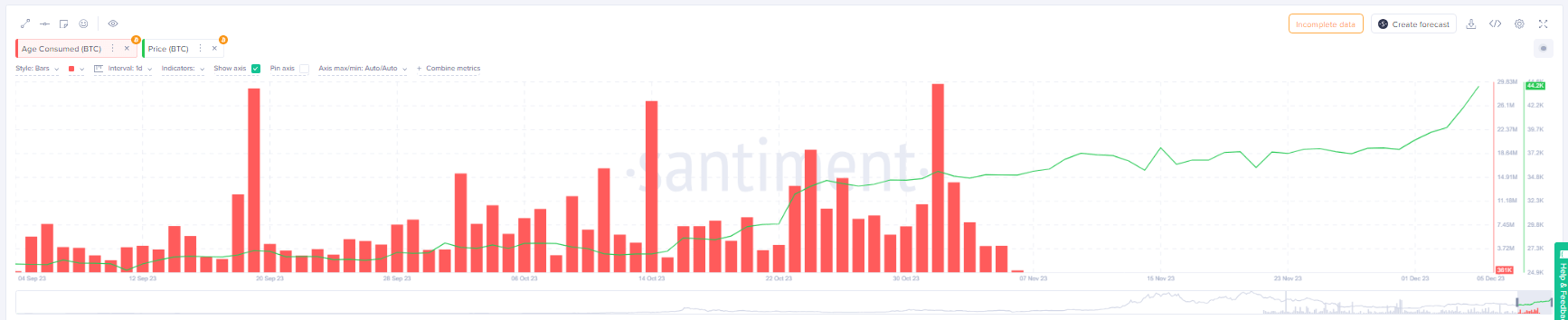

The age-consumed metric in cryptocurrency serves as a key indicator that tracks the motion of tokens, significantly specializing in the time since these tokens have been final transferred. This metric is calculated by multiplying the amount of tokens that change addresses on a selected date by the length they’ve remained stationary in these addresses.

Deciphering Markets: Long-Term Holder Insights Via Age-Consumed Metric

Essentially, it provides insights into the habits of long-term holders by revealing shifts in token circulation. A notable improve within the age-consumed metric indicators {that a} important variety of dormant tokens, held for an prolonged interval, are actually on the transfer, indicating a considerable and sudden change within the exercise of long-term holders.

Bitcoin Age-Consumed Metric. Source: Santiment

Conversely, a lower within the metric suggests a interval of stability, with long-held cash remaining in pockets addresses with out being actively traded.

Traders and analysts intently monitor the age-consumed metric to glean details about potential market tops and bottoms. The metric’s fluctuations present beneficial information on the dynamics of token circulation and the habits of long-term holders, contributing to a deeper understanding of market situations.

BTC at present buying and selling within the $43K territory. Chart: TradingView.com

Overall, the age-consumed metric is a device that aids in deciphering the exercise ranges and potential shifts in sentiment inside the cryptocurrency market.

As the king crypto achieves a big milestone, surpassing $44,000 in worth early Wednesday, the surge within the age-consumed metric turns into much more intriguing.

BTC breaches the important thing $44,000 barrier right now. Source: Coingecko

Bitcoin Surges: Weekly Gain Signals Investor Confidence, Expanded User Base

This surge aligns with the cryptocurrency’s notable 16% acquire in worth over the previous week, pushed by elevated demand and rising investor confidence. Data from Coingecko underscores this constructive momentum, highlighting the increasing attraction of Bitcoin out there.

Importantly, the cumulative variety of BTC addresses has seen a 20% improve because the starting of the 12 months, aligning with the general progress within the cryptocurrency market’s capitalization.

Total quantity of Bitcoin holders. Source: Santiment

Insights from Santiment reveal {that a} sturdy rely of 50 million BTC addresses at present maintains a stability, underscoring the cryptocurrency’s increasing attain.

The determine emphasizes the widespread participation within the Bitcoin ecosystem. The remark underscores the rising affect and adoption of Bitcoin as a digital asset, suggesting that an rising variety of people or entities are actively concerned in holding and transacting with Bitcoin.

The current surge in Bitcoin’s age-consumed metric provides a component of anticipation to its trajectory, hinting at potential market shifts and fluctuations in worth on the horizon.

As the cryptocurrency panorama evolves, the affect of long-term holders and the dynamic interaction of market forces proceed to form Bitcoin’s journey past the $43,000 milestone.

Featured picture from Freepik

Bitcoin Age-Consumed Metric. Source:

Bitcoin Age-Consumed Metric. Source:  Total quantity of Bitcoin holders. Source:

Total quantity of Bitcoin holders. Source: