Bitcoin’s face-melting rally could possibly be coming to an finish as analysts have a look at potential market corrections. However, most agree that momentum and sentiment are optimistic, and the pattern is upward.

On December 5, Glassnode analyst “Checkmate” commented on the potential market pullback, stating, “I’d be surprised if Bitcoin didn’t consolidate [or] correct near term.”

Crypto Correction Imminent?

The analyst added that just a few months’ relaxation “would allow investor cost bases to re-acclimate above the True Market Mean Price.”

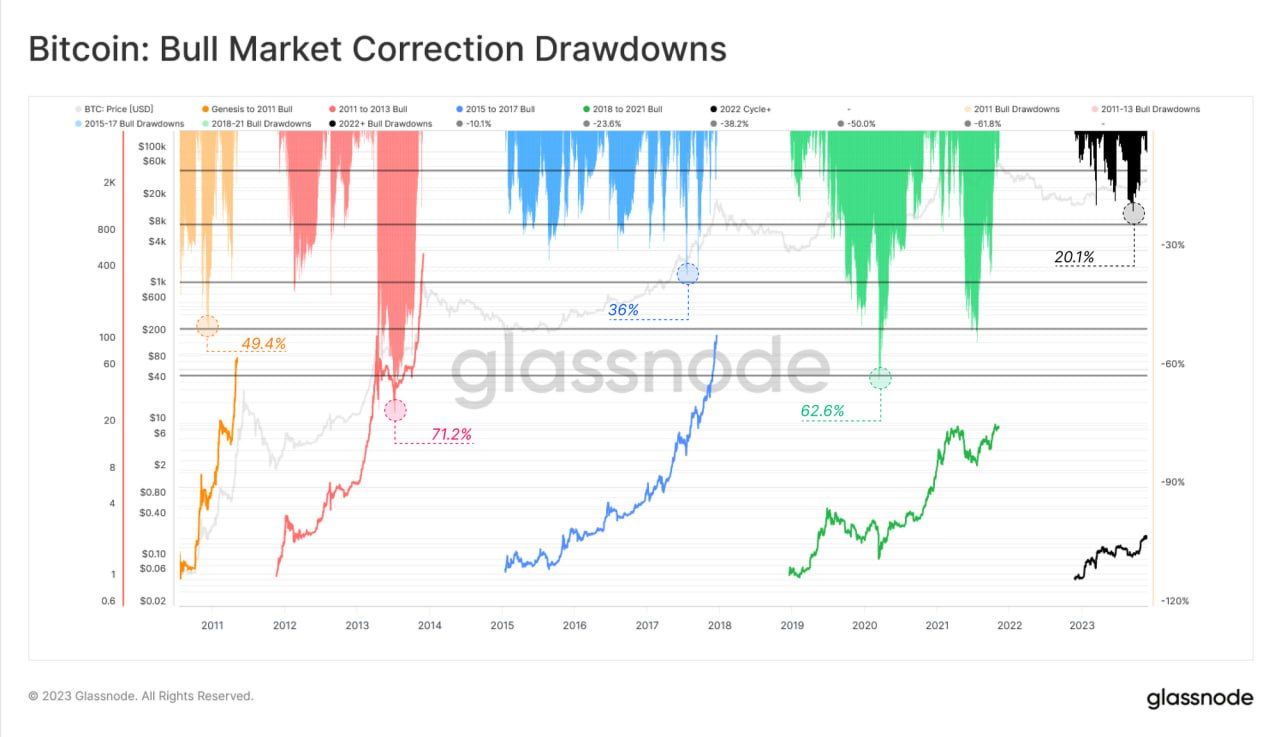

He additionally mentioned that the market hasn’t given again greater than 20% to this point this 12 months, “which suggests persistent and strong spot demand.”

The earlier bull market noticed drawdowns exceeding 60%, however this has but to occur in this bull cycle.

It must be famous that these are bull market corrections and never bear market bottoms, which are sometimes greater than 80% down from the earlier peak.

JRNY Crypto reminded his 767K X followers of a giant crash/correction earlier than the final bull market.

“Things are moving quick in the Crypto market right now, but just remember we had a similar run in 2019 that was followed by one of the worst crashes I’ve seen just before the last Bitcoin Halving.”

However, the large crash talked about was as a result of international market meltdown and the black swan occasion precipitated by Covid lockdowns in March 2020.

“I wouldn’t be surprised to see at least one more market correction before the real bull market starts,” he added.

This time round, there’s plenty of geopolitical rigidity and financial uncertainty to take care of, so the bulls will not be able to cost but.

Trader Justin Bennett concluded that the final two bear markets ended with a second capitulation. “Don’t rule out a $25k liquidity sweep,” he added.

Markets in Retreat

Bitcoin has remained steady at $41,600 with out gaining rather more at this time. As a outcome, complete capitalization has remained at round $1.61 trillion.

However, altcoins are already beginning to retreat, the vast majority of them seeing purple in the course of the Tuesday Asian buying and selling session.

Most of the high-cap altcoins had fallen between 1 and three % on the day. Nevertheless, some have been taking an even bigger hit, equivalent to Solana dumping 7.2% and Chainlink dropping 5.8%.

Moreover, altcoin markets have lagged behind Bitcoin throughout this rally and have solely reached resistance after 18 months of consolidation.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. However, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material.