The XRP value has been treading water in latest days. After XRP rose by greater than 52% in simply 18 days from mid-October to early November, the value is at present in a transparent consolidation part within the shorter time frames. However, a have a look at the 1-month chart of the XRP/USD buying and selling pair reveals that the XRP value has exhibited sturdy bullish months.

In this sense, Crypto analyst Egrag has drawn consideration to an especially uncommon phenomenon within the XRP month-to-month value chart. The sample in query is a collection of three consecutive month-to-month inexperienced candles, which have solely been documented twice within the history of the cryptocurrency.

As the market approaches the month-to-month shut as we speak, a affirmation by an in depth above $0.5987 might imply the third month-to-month inexperienced candle for XRP. “Get ready—within the next [few] hours, we’re poised to seal another trio of consecutive green candles,” Egrag famous.

Here’s What This Could Mean For XRP Price

Delving into the specifics, Egrag elucidates two distinct historic precedents put up such formations. In the primary situation, a 5-month consolidation part was noticed after XRP recorded three consecutive inexperienced candles from March to May 2017.

However, the consolidation part had an especially bullish impact. After it ended, the XRP value skilled a staggering 1,500% surge inside simply two months. Egrag means that if XRP’s value motion had been to emulate this historic sample, buyers can anticipate a possible surge to $10, ranging from the first of April 2024.

The second occasion Egrag refers back to the interval from December 2015 to February 2016. During this time, the value rose by roughly 102% in three consecutive inexperienced months. What adopted was a lengthier 12-month consolidation part. But the wait was price it once more.

In March 2018, the XRP value began a rare 8,000% rally. A replication of this situation would suggest a possible skyrocketing of XRP’s value to $50, starting on the first of November 2024.

Notably, Egrag gives a median value goal standing at $30. He said, “XRP army stay steady, the average of these two targets lands at $30, you know that I always whisper to you my secret target of $27. Hallelujah, the anticipation is palpable!”

Price Analysis: 1-Day Chart

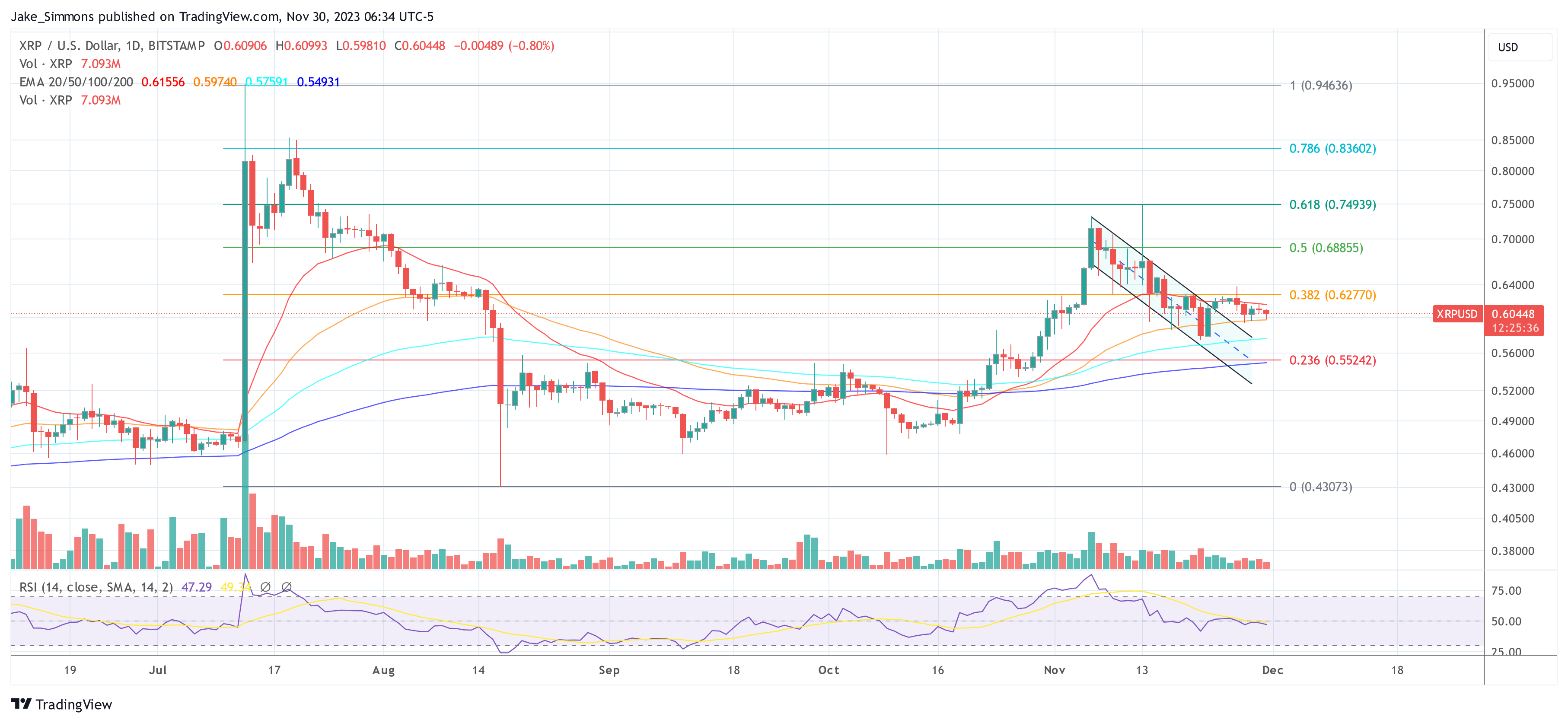

At press time, XRP was buying and selling at $0.60333. Every week in the past, the value managed to interrupt out of a downtrend channel. However, the bullish momentum shortly fizzled out after the value was rejected on the 0.382 Fibonacci retracement stage at $0.627.

Related Reading: Bitcoin Decouples with XRP, BNB But Correlates With Dogecoin and Cardano

For 4 days now, the XRP value has been squeezed into a good vary between the 20-day and 50-day EMA (Exponential Moving Average), with a breakout to the draw back or upside getting nearer and nearer. In the occasion of an upside breakout, the value stage at $0.627 can be decisive. Then, the value might sort out the 0.5 Fibonacci retracement stage at $0.688.

However, if a breakout to the draw back occurs, a 100-day EMA at $0.575 can be the primary assist. This should maintain to stop the value from falling in the direction of the 0.236 Fibonacci retracement stage at $0.552, which can be near the 200-day EMA. The convergence of each indicators signifies a value stage that the bulls should defend in any respect prices.

Featured picture from iStock, chart from TradingView.com