The Bitcoin worth rose to $38.475 yesterday, marking a touch increased excessive for the 12 months. Nevertheless, the value didn’t handle to shut the day above the necessary $38,000 mark. Shortly earlier than the top of the day, the bears managed to push the value down once more.

As crypto analyst Daan Crypto Trades remarked, “Market does its best to shake out everyone trying to pre-position for a possible Bitcoin ETF approval. It’s just free liquidity for the MMs/Whales. Sweep highs, trap longs, squeeze out longs, bait shorts, front run lows and repeat the whole process.”

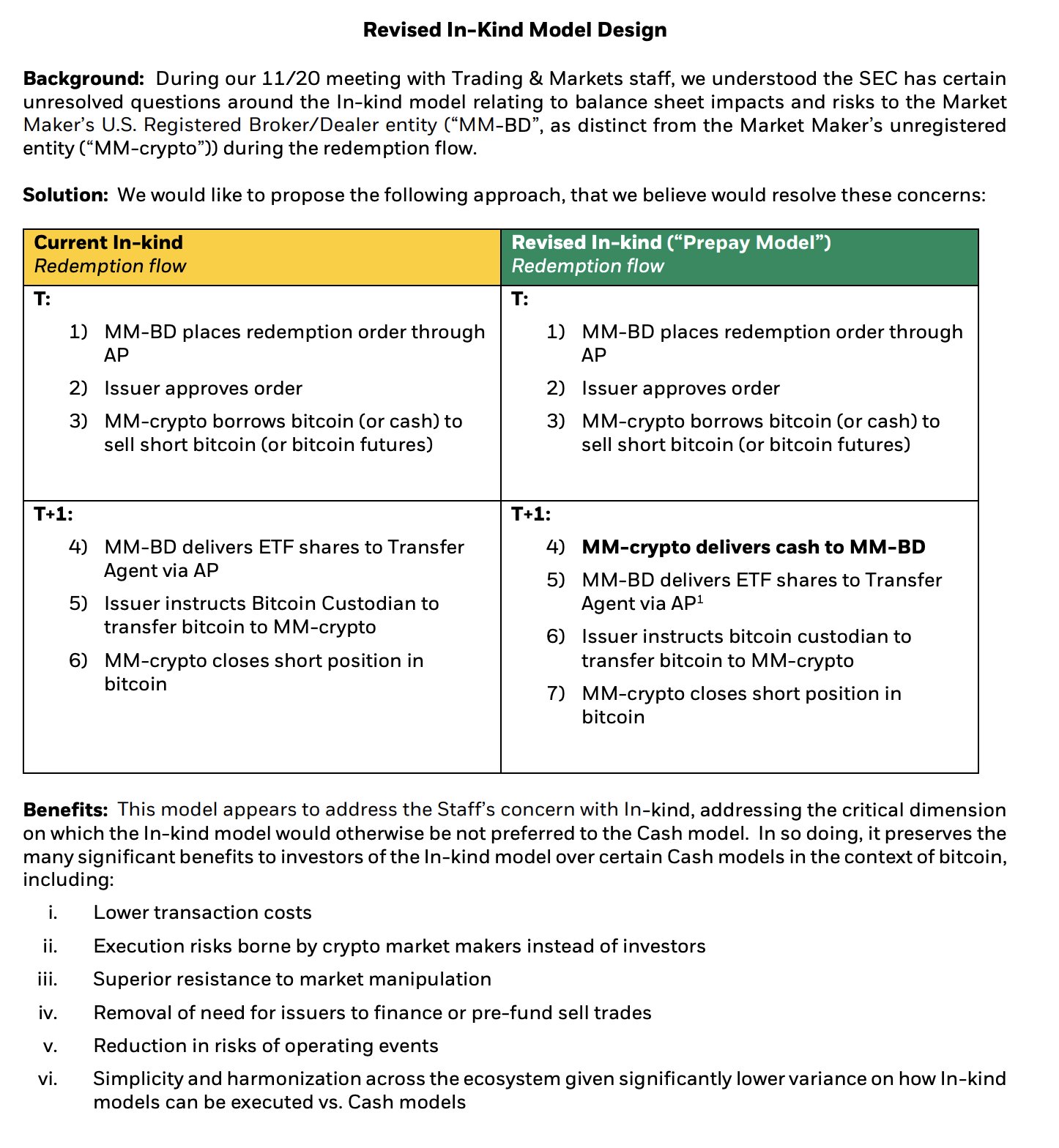

BlackRock Argues With SEC Over Details Of Spot Bitcoin ETF

In a notable improvement, BlackRock, the world’s largest asset supervisor, has been once more actively engaged in discussions with the US Securities and Exchange Commission (SEC) regarding the construction of its spot ETF yesterday.

Eric Balchunas, senior ETF analyst at Bloomberg, revealed, “BlackRock met with the SEC’s Trading & Markets division again yesterday and presented them with a ‘revised’ in-kind model design based on Staff’s comments at their 11/20 meeting.” This revised mannequin features a notable change within the course of, particularly at ‘Step 4’, which is the offshore entity market maker buying Bitcoin from Coinbase after which pre-paying in money to the US registered dealer vendor who shouldn’t be allowed to the touch BTC.

James Seyffart, one other Bloomberg analyst, highlighted the continuing negotiations, adding, “More confirmation that Issuers are still meeting with the SEC. BlackRock/Nasdaq still pushing for In-Kind creation & redemption. Seems like SEC hasn’t budged on cash creates demands if this was the primary focus of the meeting. At least not before yesterday, Interesting days ahead!”

The authentic “In-Kind Redemption” move had Market Maker’s Broker/Dealer entity (MM-BD) putting an order for redemption by means of the Authorized Participant (AP), who approves the order, permitting MM-crypto to borrow Bitcoin (or money) to promote quick. This redemption move had potential stability sheet impacts and dangers that the SEC was involved about.

BlackRock has now proposed a “Revised In-Kind (‘Prepay Model’)” Redemption move. This new mannequin includes MM-crypto delivering money to MM-BD as an alternative of Bitcoin, and MM-BD then delivers ETF shares to the Transfer Agent by way of API. The Bitcoin custodian is instructed by the issuer to switch Bitcoin to MM-crypto, who then closes the quick place in BTC.

The advantages of this revised mannequin are manifold. It goals to decrease transaction prices and shifts the execution dangers from buyers to crypto market makers. It additionally claims to supply superior resistance to market manipulation and take away the necessity for issuers to finance or pre-fund promote trades. The discount in dangers of working occasions and the simplification throughout the ecosystem may imply decrease variance on how In-kind fashions may be executed versus money fashions.

90% Odds Of Approval Remain

Should the SEC approve this revised mannequin, it may herald the introduction of the primary US-based spot Bitcoin ETF, a major milestone that might permit buyers to achieve direct publicity to Bitcoin somewhat than by means of spinoff devices like futures. Despite these developments, there stays a degree of uncertainty surrounding the SEC’s stance on the matter, notably concerning the implications of spot Bitcoin publicity for retail buyers by means of an ETF.

Recent leaks prompt the SEC may want money creation processes over in-kind Bitcoin transfers, a transfer that might considerably alter the panorama for ETF issuers and broker-dealers coping with Bitcoin. Nonetheless, Bloomberg’s ETF analysts have reiterated their 90% odds for a spot ETF approval by January 10 yesterday.

At press time, BTC traded at $37,728.

Featured picture from Shutterstock, chart from TradingView.com