In a daring projection, Standard Chartered, the British multinational financial institution, envisions a considerable surge within the worth of Bitcoin, anticipating it to succeed in $100,000 by the conclusion of 2024.

Observing Bitcoin’s spectacular resurgence all through the present 12 months, the financial institution identifies the onset of what they discuss with because the ‘crypto spring.’

This interval of renewed vitality within the cryptocurrency market has sparked optimism, main Standard Chartered to set an formidable goal for Bitcoin’s future valuation.

Bitcoin Surpasses $38,200, StanChart Predicts $100K By 2024

The world’s largest cryptocurrency, Bitcoin, attracted curiosity from institutional traders as soon as once more this week, as its value surpassed $38,200 on November 29.

Geoff Kendrick, Head of Crypto Research at Standard Chartered Bank, reiterated the corporate’s bullish forecast that the worth of Bitcoin might attain $100,000 in 2024.

The projection is a continuation of the financial institution’s April outlook for this 12 months. The April analysis acknowledged that a lot of causes that may propel Bicoin’s ascent over $100,000 are already in motion, and that the crypto winter has now come to an finish.

The report emphasised that in March of this 12 months, there was disruption within the monetary system, which contributed to the “re-establishment” of Bitcoin’s use as a decentralized scarce digital forex.

Bitcoin market cap at present at $740 billion on the day by day chart: TradingView.com

Kendrick and the Standard workforce expressed their optimism that the US authorities’s approval of a number of spot Bitcoin ETFs would be the subsequent catalyst for the expansion of cryptocurrencies, and that these developments will happen earlier than initially anticipated.

“We think that a number of spot ETFs will now be approved in the first quarter of 2024 for both Bitcoin and Ethereum, setting the stage for institutional investment,” they mentioned.

Additionally, Standard Chartered highlighted one other trigger that may result in future value will increase: the upcoming Bitcoin “halving,” which might restrict the forex’s provide and is predicted to occur in late April 2024.

BTC seven-day value motion. Source: CoinMarketCap

With its headquarters positioned in London, Standard Chartered caters to a worldwide clientele of each particular person and company prospects. While it doesn’t provide retail banking providers within the United Kingdom, its multibillion-dollar operations throughout Asia, Africa, and the Middle East place it as one of many world’s most important monetary enterprises.

And it’s due to this vital function within the international monetary system that Standard Chartered’s constructive prediction for bitcoin earlier this month is all of the extra intriguing.

Record Hash Rate And Market Maturity Validate Standard’s Bullish Prediction

Bitcoin’s hash charge, the quantity of processing energy miners are utilizing to safe the community, and a measure of the community’s energy—which lately reached an all-time excessive—all help Standard Chartered’s bullish stance.

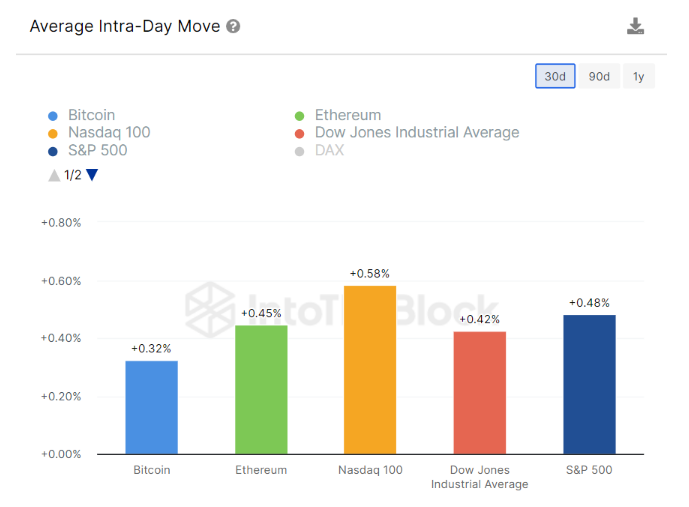

BTC Price Volatility Trends in comparison with Mega Cap Stocks (knowledge as of Nov. 2023). Source: IntoTheBlock

Meanwhile, latest on-chain knowledge from IntoTheBlock signifies that the Bitcoin market has displayed indications of increasing maturity and stability compared to large-cap shares and index funds.

Standard Chartered’s forecast of a Bitcoin value surge has gained validation as Bitcoin has witnessed a outstanding 130 p.c surge in 2023. According to the financial institution, all the things is unfolding as anticipated.

BTC’s dominance within the digital property market stays strong, having elevated from 45 p.c in April to a present 50 p.c share of the general market cap.

Bernstein analysts echoed Standard Chartered’s optimism, predicting that Bitcoin may attain $150,000 by mid-2025 for a similar supply-related causes.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing includes danger. When you make investments, your capital is topic to danger).

Featured picture from Shutterstock