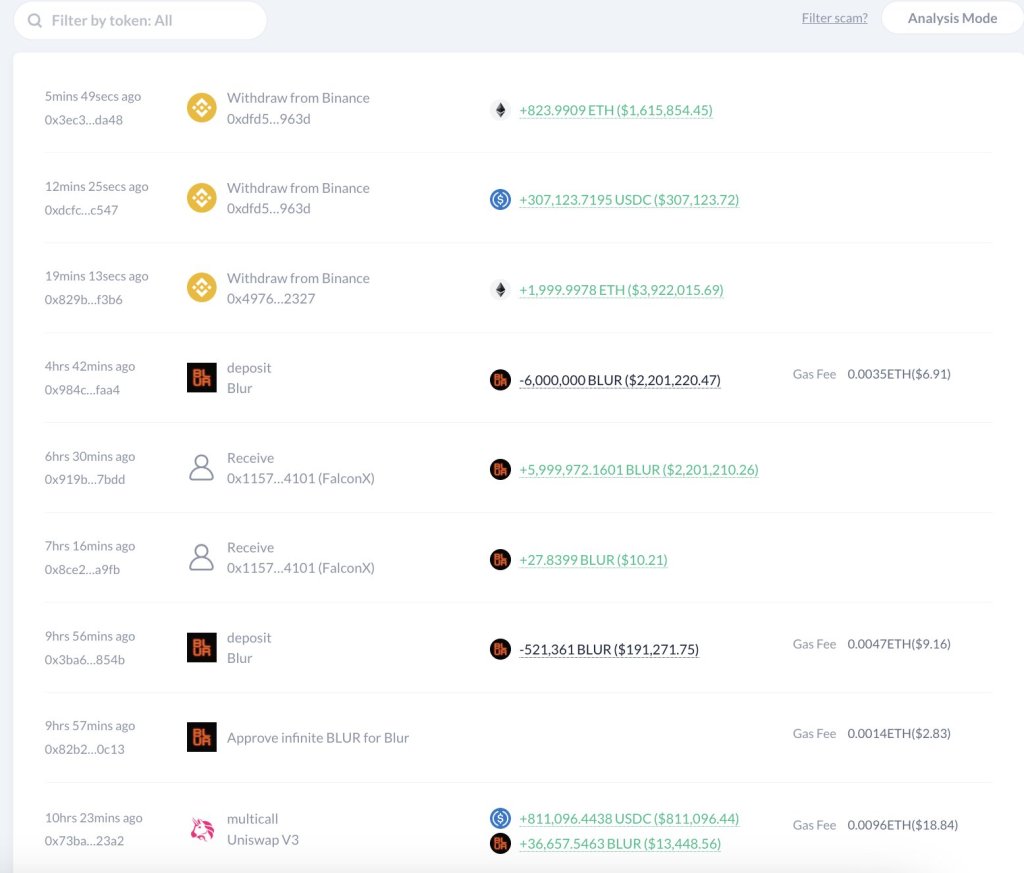

According to on-chain knowledge platform Lookonchain, an unnamed crypto whale identified for well-timed Ethereum (ETH) trades up to now, has purchased an extra $5.53 million value of ETH on Binance amidst turbulent market circumstances.

Ethereum Whale Ramping Up Purchase

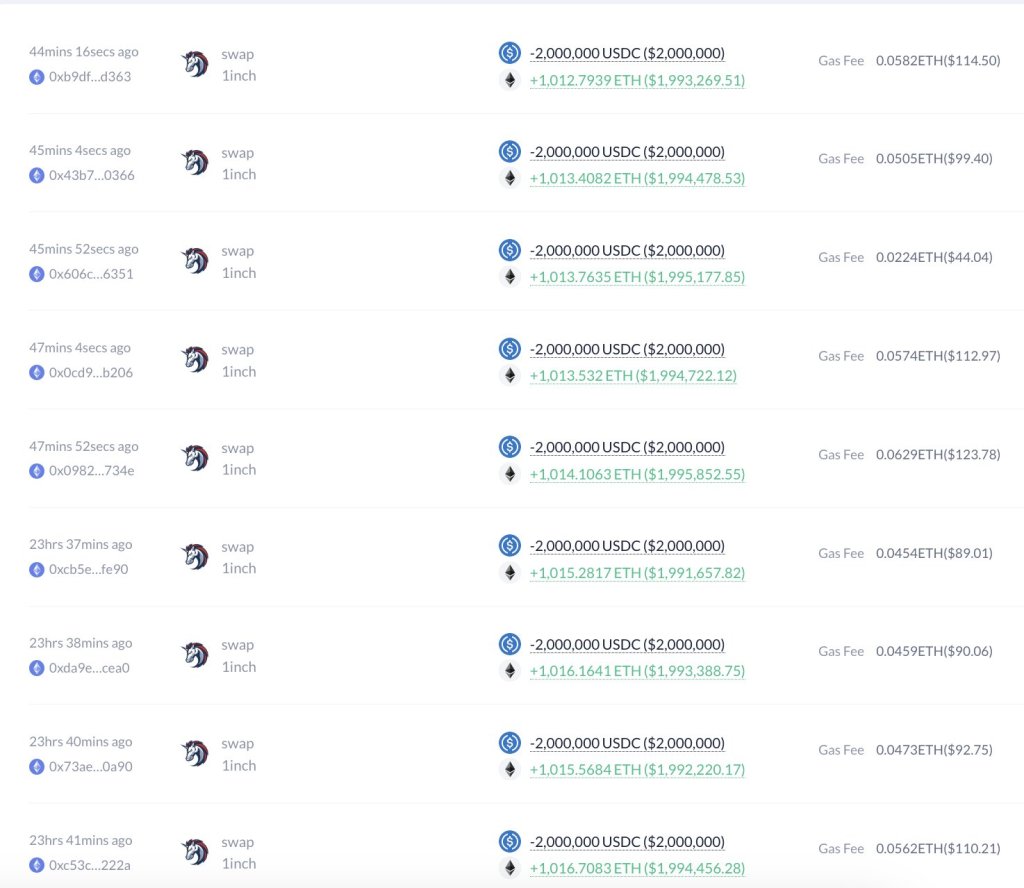

According to an X publish on November 22, the acquisition follows an acquisition final week when $18 million of USDC, a stablecoin, was used to accumulate ETH at round $1,971. With the whale showing to ramp up ETH purchases, Lookonchain speculates that the identical dealer is positioning for an upcoming ETH breakout previous the cussed $2,100 resistance degree that might sign a renewed bull market.

It needs to be noticed that regardless of current expansions in ETH, the $2,100 degree stays an important response level for merchants. The solely time costs flew above this degree was in late July and early November 2023. Prices proceed to edge larger when writing however stay beneath the liquidation line.

Binance And Changpeng Zhao Settle With U.S. Authorities

The Ethereum whale is doubling regardless of information that the U.S. Department of Justice levied over $4 billion in fines towards Binance associated to regulatory violations – resulting in founder Changpeng Zhao resigning as CEO on November 21. According to experiences, the founder can pay $50 million as a settlement with U.S. authorities.

While the penalties briefly brought about crypto costs to falter, markets have since stabilized, with ETH costs recovering round 5% not too long ago towards $2,100. Based on this, extra upside may emerge if the whale dealer’s prognosis proves right in time.

Meanwhile, BNB, the native foreign money of the BNB Chain and used to incentivize buying and selling on Binance, remains beneath strain however comparatively agency. The coin has did not reverse losses of November 21, however losses have been contained on November 22.

From what has panned out up to now two days, some specialists now counsel the Binance settlement brings validation that allows established cash like Bitcoin to develop into entrenched and resilient sufficient to climate authorized storms. To illustrate, although the DOJ penalty triggered liquidation amongst altcoins, Bitcoin appears largely immune, buying and selling above $36,500 however beneath the $38,000 resistance degree.

Beyond this, Paul Tuchmann, a former United States prosecutor and companion at regulation agency Wiggin and Dana, believes that Binance is now too massive to fail for the reason that DOJ issued a deferred prosecution settlement, successfully cushioning harmless shareholders, shoppers and others related to the change from bearing the total brunt of this ruling. With this settlement, the change can pay the fantastic over 15 months.

Feature picture from Canva, chart from TradingView