In an in depth market replace, Charles Edwards, founding father of Capriole Investment, has offered an in-depth analysis of Bitcoin’s present market place, highlighting a pivotal shift to an ‘expansion’ section within the Bitcoin Macro Index. This transition is especially noteworthy because it parallels situations noticed previous to historic worth surges in Bitcoin’s valuation.

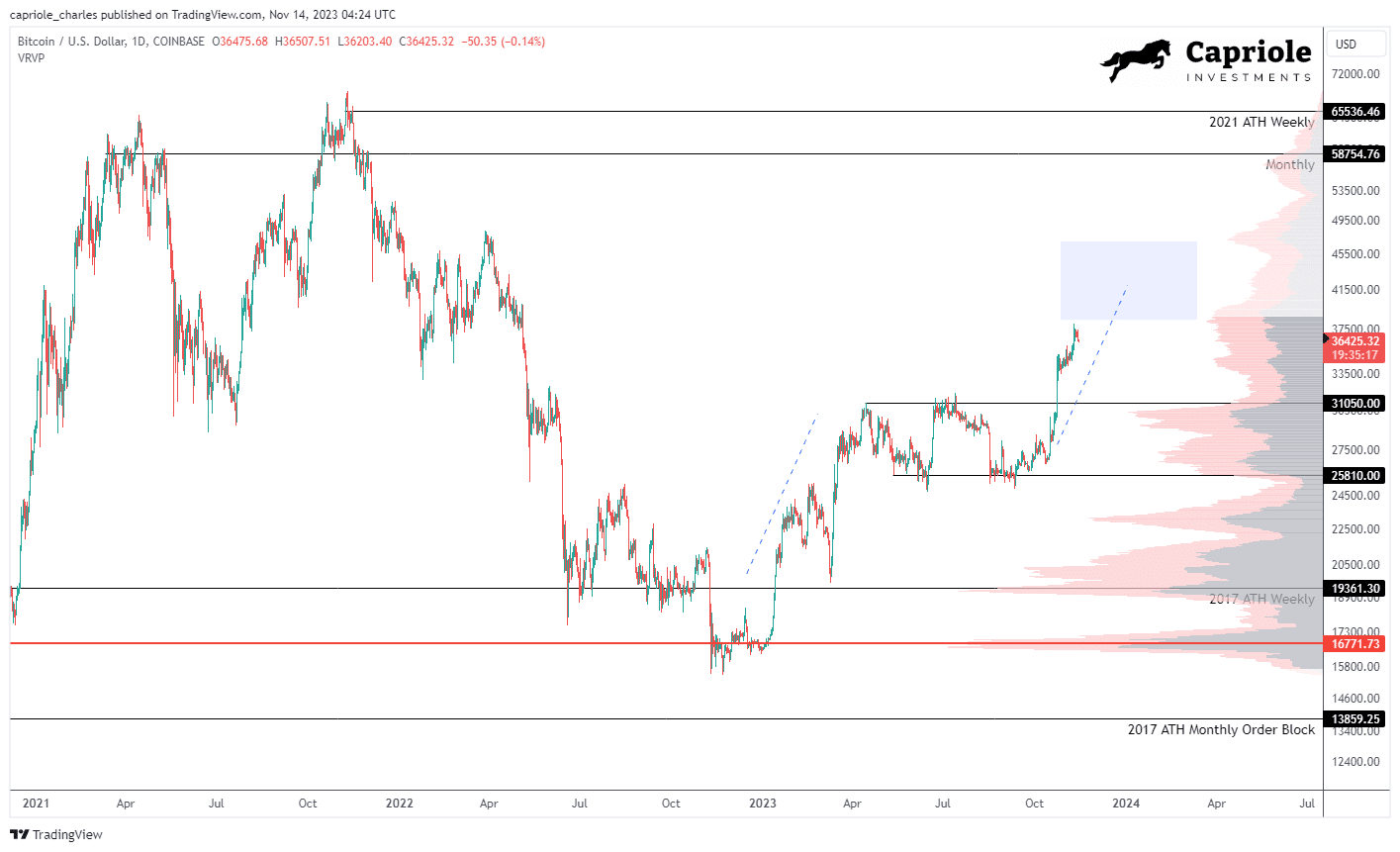

Bitcoin has lately skilled a pointy uptick, ascending from $34,000 to an interim excessive of $38,000. After a quick interval of resistance, the value corrected to roughly $36,500. Edwards highlights this motion as a vital technical victory, with Bitcoin overcoming and holding above the most important resistance benchmarks of $35,000 on each the weekly and month-to-month timeframes.

This consolidation above key resistance ranges units a bullish context within the excessive timeframe technical evaluation, positioning Bitcoin in a robust technical stance in keeping with conventional market indicators. “The recent breakout into the 2021 range offers the best high timeframe technical setup we have seen in years. Provided $35K holds on a weekly and monthly basis in November, the next significant resistance is range high ($58-65K).”

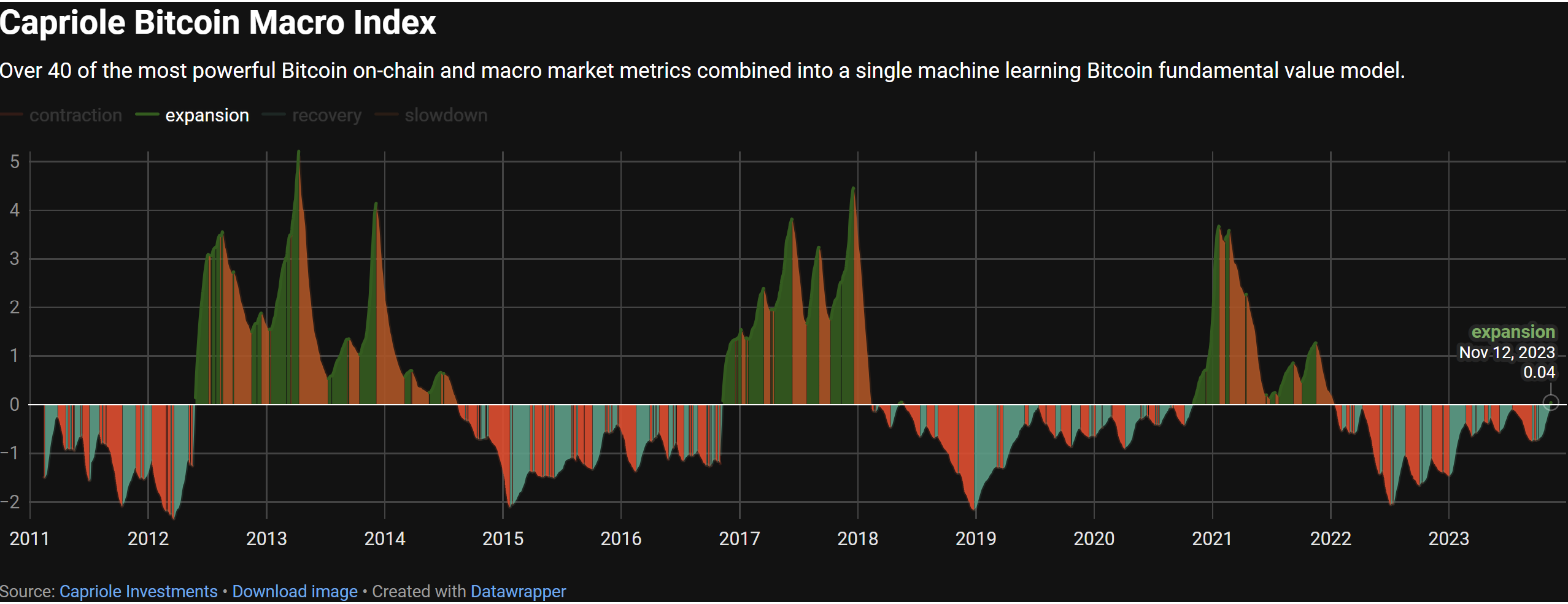

Bitcoin Macro Index Enters Expansion

The crux of Edwards’ replace is the shift within the Bitcoin Macro Index, a posh mannequin synthesizing over 40 metrics encompassing Bitcoin’s on-chain knowledge, macro market indicators, and fairness market influences. The index doesn’t take worth as an enter, thus offering a ‘pure fundamentals’ perspective.

The present growth is the primary since November 2020, and solely the third occasion because the index’s inception, with the 2 earlier events resulting in substantial worth rallies within the following durations. Edwards elucidates this with a direct quote: “The transition from recovery to expansion is simply the optimal time to allocate to Bitcoin from a risk-reward opportunity for this model.”

A have a look at the Bitcoin chart reveals that the Bitcoin worth rose by a whopping 400% over the past bull run from early November 2020 to November 2021, after the Macro Index entered the growth section. The first historic sign was offered by the Macro Index on November 9, 2016, which was adopted by an enormous bull run of virtually 2,600% till Bitcoin reached its then all-time excessive of $20,000 in February 2018.

Short-Term Technicals And Derivatives Market Analysis

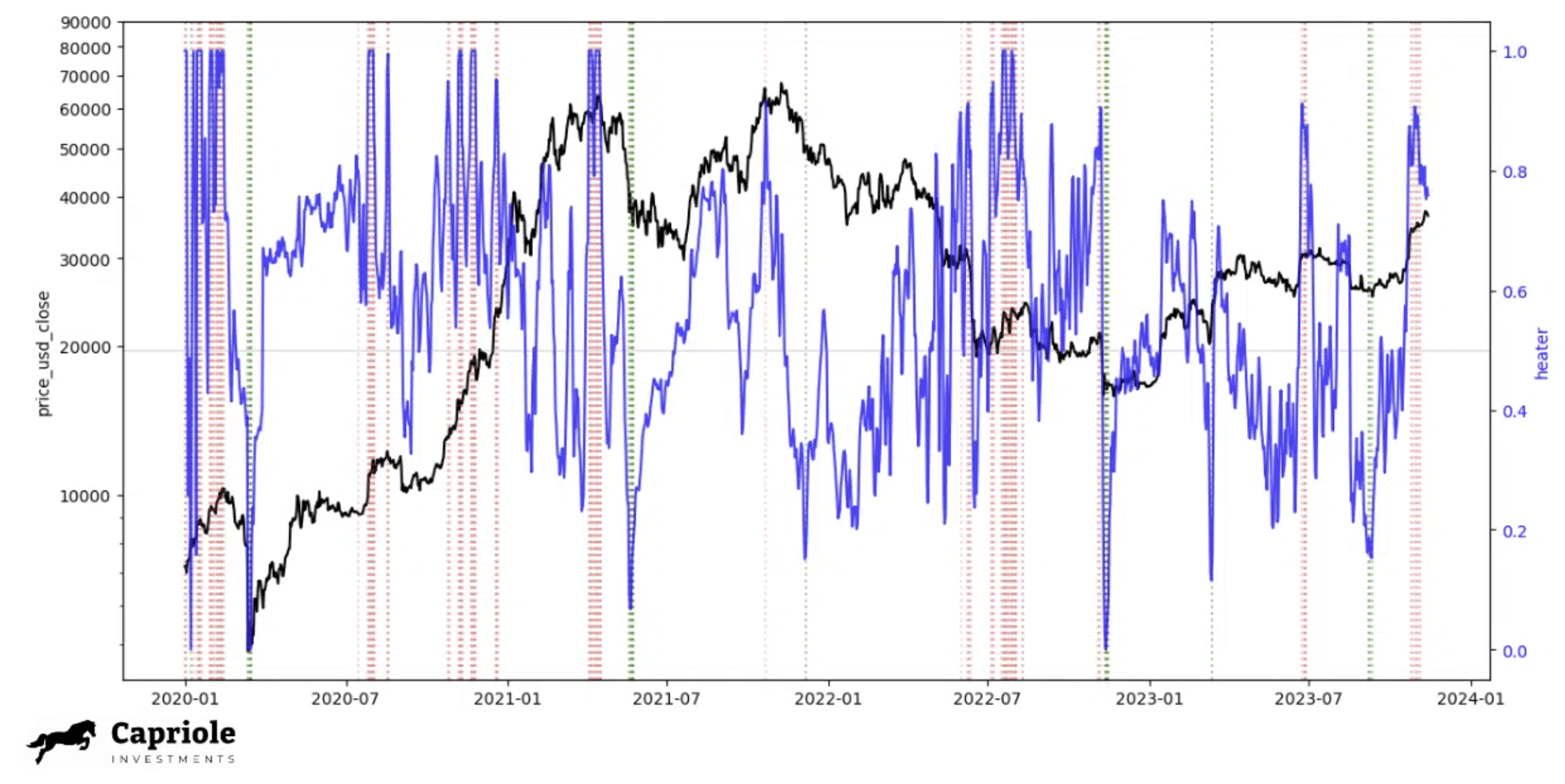

In the brief time period, the technical outlook presents a blended image, in keeping with Edwards. The spinoff markets are indicating an overheated state, with low timeframe evaluation suggesting a retracement might be imminent. Edwards introduces the ‘Bitcoin Heater’ metric, lately launched on Capriole Charts, which combination varied derivatives market knowledge and quantify the extent of market danger based mostly on the open curiosity and heating degree of perpetuals, futures, and choices markets.

The beneath chart reveals that more often than not when the Bitcoin Heater is above 0.8, the market corrects or consolidates. “But there are large exceptions to the rule: such as the primary bull market rally from November 2020 through to Q1 2021. […] We should expect this metric to be high more frequently in 2024 (much like Q4 2020 – 2021),” Edwards acknowledged.

The analyst concluded that the general development for Bitcoin stays optimistic, with main knowledge factors indicating a robust bullish state of affairs. However, he additionally cautioned about potential short-term dangers within the low timeframe technicals and derivatives market. These, in keeping with him, are frequent within the growth of a bull run and will provide useful alternatives if dips happen.

At press time, BTC traded at $35,626.

Featured picture from Shutterstock, chart from TradingView.com