On-chain knowledge exhibits the common transaction charges on the Ethereum community have hit a 4-month excessive as person exercise has spiked.

Ethereum Average Fees Recently Hit The $5.72 Mark

According to knowledge from the on-chain analytics agency Santiment, the transaction charges on the ETH community have shot up because the cryptocurrency has just lately damaged above the $2,000 degree.

The related metric right here is the “average fees,” which retains observe of the imply quantity of charges that the customers on the Ethereum blockchain are attaching with their transfers proper now.

Generally, the worth of this metric rises every time the person exercise on the community goes up. The cause behind that is that the ETH community solely has a restricted capability to deal with transactions.

If a person needs to get their switch by as quickly as attainable throughout a interval of rush, they don’t have any selection however to connect a charge that’s increased than the common in order that the validators have some incentive to course of their transfer first.

When the site visitors is particularly excessive, the common charges can rapidly spiral uncontrolled as customers compete towards one another. On the opposite hand, when there’s little exercise on the community, senders don’t have any cause to go for a excessive charge, so the imply on the blockchain naturally stays low.

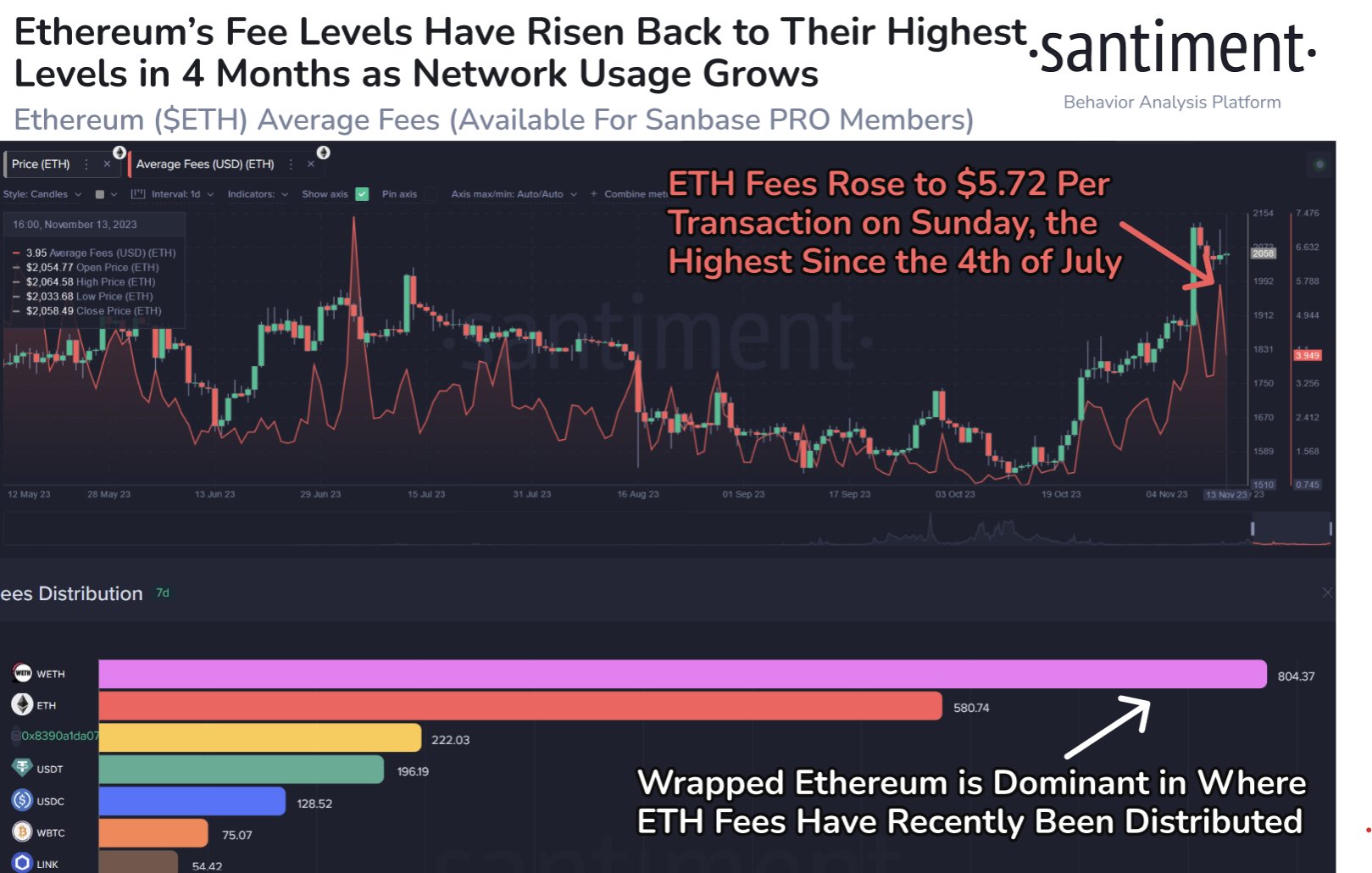

Now, here’s a chart that exhibits the development within the Ethereum common charges over the previous few months:

The worth of the metric has been excessive in current days | Source: Santiment on X

As displayed within the above graph, the Ethereum common charges have gone up just lately because the cryptocurrency’s worth has noticed a rally. Historically, the charges going up throughout such a interval of volatility hasn’t been that surprising, because the buyers discover sharp worth motion thrilling, so they have an inclination to make extra strikes.

Instead, it’s extra worrying if a rally doesn’t accompany a spike in community utilization, because it implies that the holders aren’t being attentive to the cryptocurrency. Without a excessive dealer curiosity, surges can simply run out of gasoline, thus dying off earlier than lengthy.

This weekend, the Ethereum common charges hit a price of about $5.72, the best degree that the indicator has touched for the reason that 4th of July, greater than 4 months in the past. However, these ranges are nonetheless not a lot in comparison with the $14 values in May.

Below the chart, Santiment has additionally hooked up the information for the distribution of the charges throughout the assorted tokens on the blockchain. Wrapped ETH (WETH) seems to have proven probably the most dominant exercise prior to now week.

As for what these excessive charges might imply for the asset, the present excessive utilization naturally implies that the buyers are actively collaborating out there. However, the result of this doesn’t essentially must be bullish.

This excessive exercise, if it retains up, might end in extra worth volatility as many buyers make strikes directly, however its route can go both means.

ETH Price

As the chart exhibits, Ethereum has continued to maneuver flat above the $2,000 mark prior to now few days.

ETH hasn't proven a lot volatility in the previous few days | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web