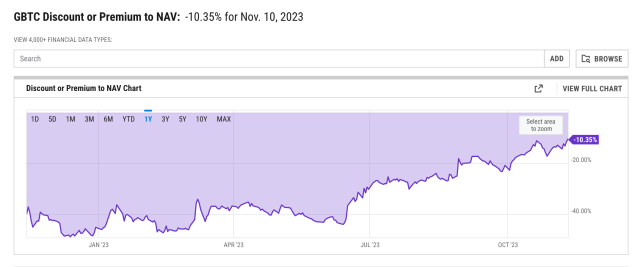

The largest Bitcoin belief on the planet, the Grayscale Bitcoin Trust (GBTC) has been closing ranks round its premium during the last 12 months. After hitting an all-time low of -48.89% in December 2022, the hole has been successfully closed to the purpose that it has reached a two-year excessive.

GBTC Premium Sitting At -10.35%

The GBTC premium to NAV is the distinction in how a lot a Bitcoin is priced within the Bitcoin belief in comparison with how a lot the cryptocurrency is buying and selling on the open market. When the determine is optimistic (excessive), it means there may be a number of demand for the belief and it buying and selling increased than spot volumes. But when the determine is unfavorable (low), it implies that BTC within the belief is buying and selling decrease than spot market costs.

This implies that when the GBTC premium was at its lowest in 2022, BTC within the belief was buying and selling at practically half the worth of what BTC was buying and selling for on the time. For many traders, this offered a chance to get in at a low value and evidently guess has paid off.

On November 10, 2023, the GBTC premium hit its highest stage in two years. Data from YCharts exhibits that the premium was sitting at -10.35% on Friday, an over 150% improve from its lows again in December 2022.

GBTC premium recovers | Source: YCharts

This has been a end result of the regular improve within the premium during the last 12 months as investor confidence within the crypto market started to return. The latest Bitcoin and crypto market recovery has additionally sustained this restoration as is clear within the regular rise within the premium since October.

BTC steadies amid expectations of Spot ETF | Source: BTCUSD on Tradingview.com

Grayscale Moves To Convert Bitcoin Trust To Spot ETF

Grayscale first moved to transform its Bitcoin Trust to a Spot ETF again in 2022. The argument was that the United States Securities and Exchange Commission (SEC) had already authorized a number of Bitcoin Futures ETFs and a spot ETF must be allowed.

However, the SEC has kicked in opposition to this which resulted in Grayscale suing the regulator after being rejected for the second time. The courtroom will ultimately aspect with Grayscale, asking the SEC to review the application for a Spot Bitcoin ETF.

The newest developments in Grayscale’s bid to rework its Bitcoin Trust to a Spot ETF got here final week when experiences emerged that the SEC is at present in negotiations with the corporate over its submitting. According to Craig Salm, Grayscale’s CLO, it’s only a matter of when, not if, the SEC approves the purposes.

Grayscale is at present one of 12 applicants who want to launch a Spot Bitcoin ETF. The regulator nonetheless has leeway to proceed to postpone its resolution. However, 2024 has been put ahead as a doable timeline for the SEC to approve the primary Spot BTC ETF.

Featured picture from CoinMarketCap, chart from Tradingview.com