In a latest submit on X (previously Twitter), Ram Ahluwalia, the CEO of Lumida Wealth, weighed in on the potential market impacts on Bitcoin, significantly highlighting the importance of a failed Treasury public sale. Lumida Wealth, acknowledged as an SEC registered funding advisor, is understood for its specialization in different investments and digital belongings.

Ahluwalia’s tweet emphasised the necessity to monitor Bitcoin’s response to particular macroeconomic occasions. He acknowledged, “The test for Bitcoin as a macro asset will be ‘What happens if there is a failed Treasury auction?’ This year, Bitcoin rallied during (1) the March bank failures and (2) as Treasury rates have rattled markets. Here is the third test …”

Will Bitcoin See Another 50%+ Rally?

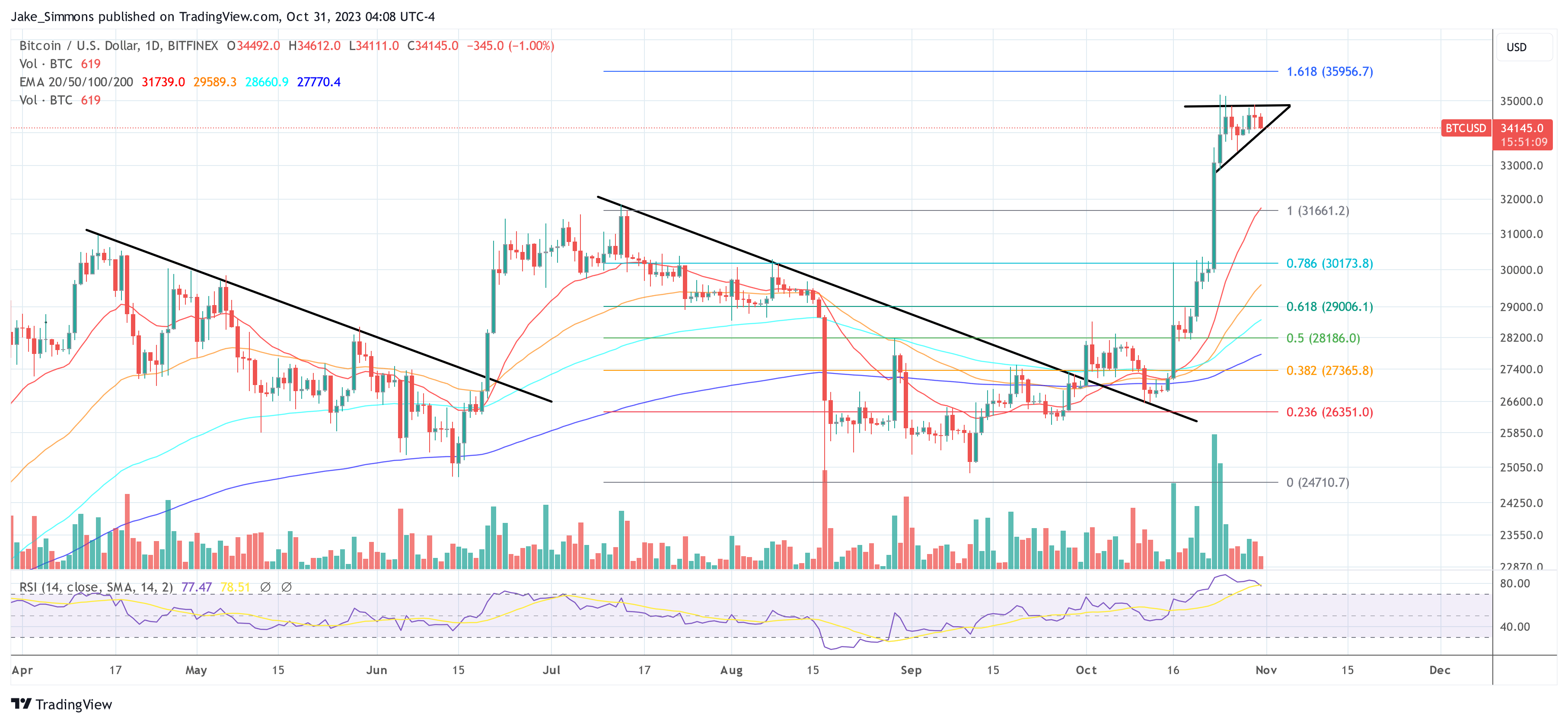

To recall, Bitcoin’s worth shot up by over 55% within the aftermath of the US banking disaster earlier this yr. On March 10, 2023, the Silicon Valley Bank’s unprecedented collapse, attributed to a financial institution run coupled with a capital disaster, turned a focus of the broader 2023 United States banking disaster. This noticed a domino impact with a number of small to mid-sized US banks falling inside a span of 5 days. While the worldwide banking sector shares plummeted, Bitcoin skilled a considerable surge in its worth.

More not too long ago, Bitcoin is rallying at the same time as treasury charges proceed to unsettle international markets. With the 10-year US Treasury yield crossing the 5% mark for the primary time in 16 years, there are indications of rising rates of interest on authorities bonds. Typically, such yield increments might push buyers to reconfigure their portfolios away from danger belongings, including to market volatility. However, akin to gold, Bitcoin has not too long ago been performing as a safe-haven asset in turbulent occasions.

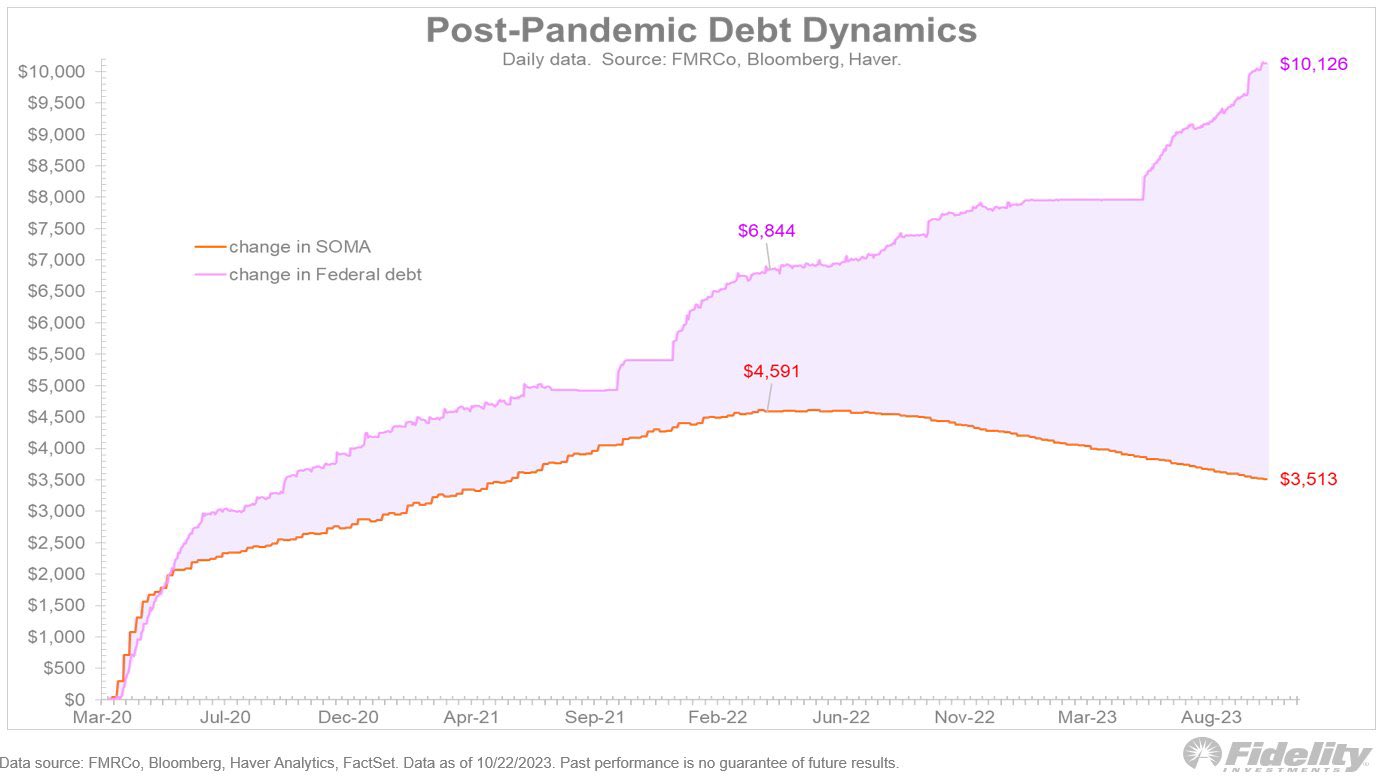

Diving deeper into the subject, Ahluwalia elucidated, “The Bitcoin rally, in part, is due to concerns that the Federal Reserve may need to intervene with Yield Curve Control or QE. […] Fidelity makes the case that the Fed may need to engage in Japanese style Yield Curve Control. If so, that would be strongly bullish for real estate, stocks, Bitcoin, bonds, REITs, TIPS and real assets more generally. It would also be bearish for the USD. The US has hard choices ahead.” He additional emphasised the significance of structuring portfolios to face up to potential financial shocks and underscored the significance of commodities in weathering inflationary pressures.

Ahluwalia shared his perspective on the present state of the Federal Reserve and the Treasury markets, pointing to latest Treasury auctions that displayed softer bid-to-cover ratios. “There is a legitimate argument that the Fed may need to intervene in Treasury markets. The recent Treasury auctions have weaker bid-to-cover ratios. Japan and American households are the marginal buyer…and they’ve been rewarded with losses,” Ahluwalia remarked.

Three Peat For BTC As Safe-Haven

He added that the Fed’s steadiness sheet “is already upside down […] it has the equivalent of negative equity (called a Deferred Asset) – an accounting treatment that is not permitted for private companies… The Federal Reserve…has $1.5 trillion mark-to-market losses because it bought Treasuries & MBS. For the first time in 107 years, this bank has negative net interest margin. Its losses are poised to exceed its capital base.”

Ahluwalia defined {that a} treasury public sale is deemed unsuccessful when the US Department of the Treasury initiates its common auctioning of presidency securities, akin to Treasury payments, notes, or bonds, however fails to draw ample bids to cowl the whole lot of the securities on supply. Essentially, this alerts a scarcity of investor curiosity in buying the federal government’s debt instruments on the predetermined rates of interest or yields.

On Bitcoin’s intrinsic worth, Ahluwalia famous, “My view on Bitcoin is that it is a ‘hedge against negative real rates’. That’s CFA talk for what Bitcoiners refer to colloquially as ‘money printer go brrr’.” He additionally pressured the potential repercussions on danger belongings if long-end charges had been to see a major spike.

“If long-end rates do blow out, that would hurt risk assets like long-duration Treasuries. The higher discount rate would cause a re-rating in stocks – much like we saw in 2022 and the last two months. However, If Bitcoin can rally during a ‘yield curve dislocation scenario that would give Bitcoin a ‘three peat’. Bitcoin would then find a welcome home on a greater number of institutional balance sheets,” Ahluwalia concluded his bullish thesis for Bitcoin.

At press time, BTC traded at $34,145.

Featured picture from Shutterstock, chart from TradingView.com