An analyst has defined, utilizing completely different on-chain indicators, how Uniswap (UNI) could possibly be gearing up for a worth breakout.

Uniswap Metrics May Point That A Rally Could Be Brewing Up

In a brand new post on X, analyst Ali has mentioned the result that UNI could face based mostly on some underlying metrics. The first indicator of relevance right here is the variety of addresses carrying their tokens with a internet quantity of unrealized loss.

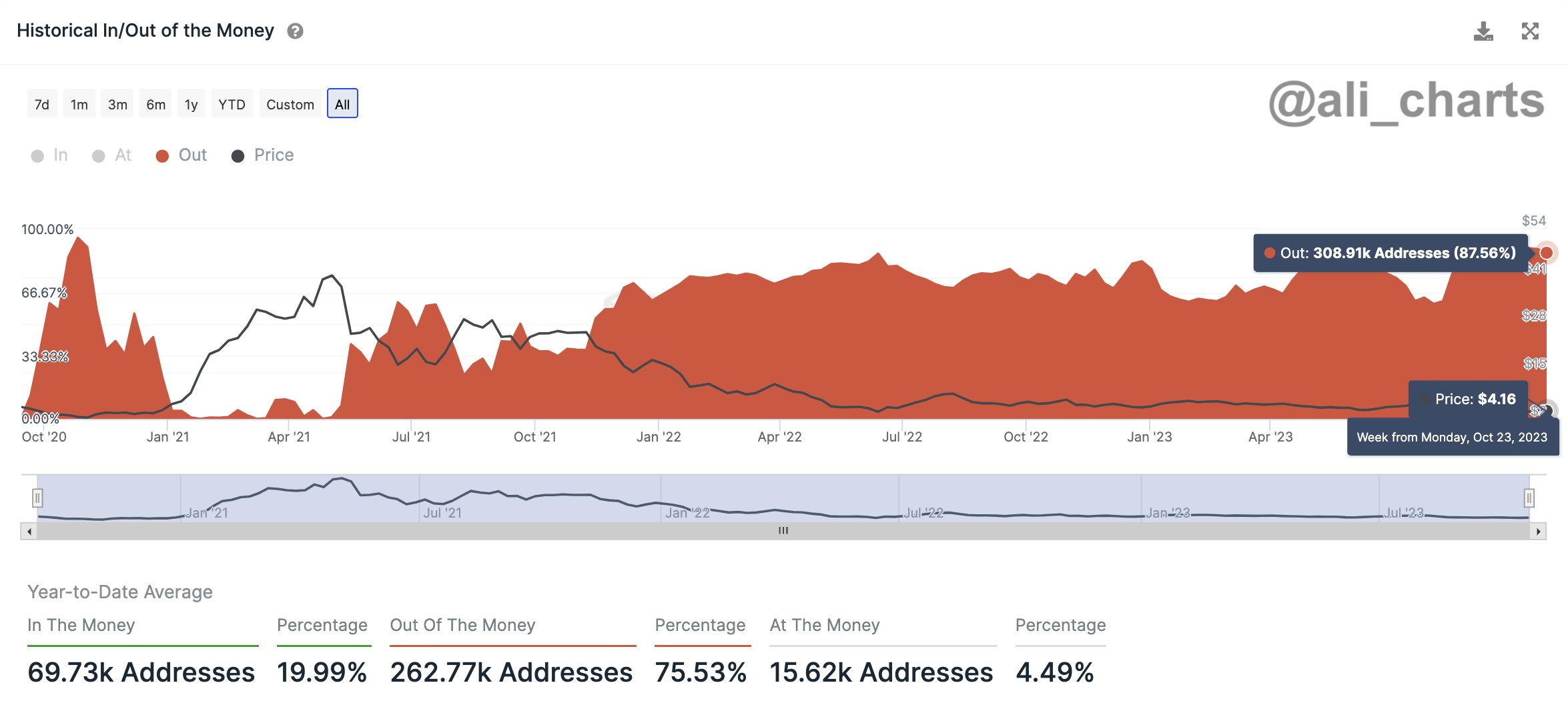

Here is a chart that exhibits the development on this Uniswap metric over the previous couple of years:

The worth of the metric appears to be at important ranges in the mean time | Source: @ali_charts on X

From the above graph, it’s seen that round 308,910 Uniswap addresses or buyers are underwater proper now. This is equal to about 87.56% of the cryptocurrency’s total consumer base.

Generally, the extra buyers revenue, the upper the possibility of a selloff, as holders get tempted to understand their earnings. A excessive quantity of holders being in loss, alternatively, may suggest an exhaustion of sellers out there.

As there’s an excessive quantity of Uniswap addresses within the purple presently, the promoting strain could have already run out. Thus, the asset could also be unlikely to say no, at the very least for now.

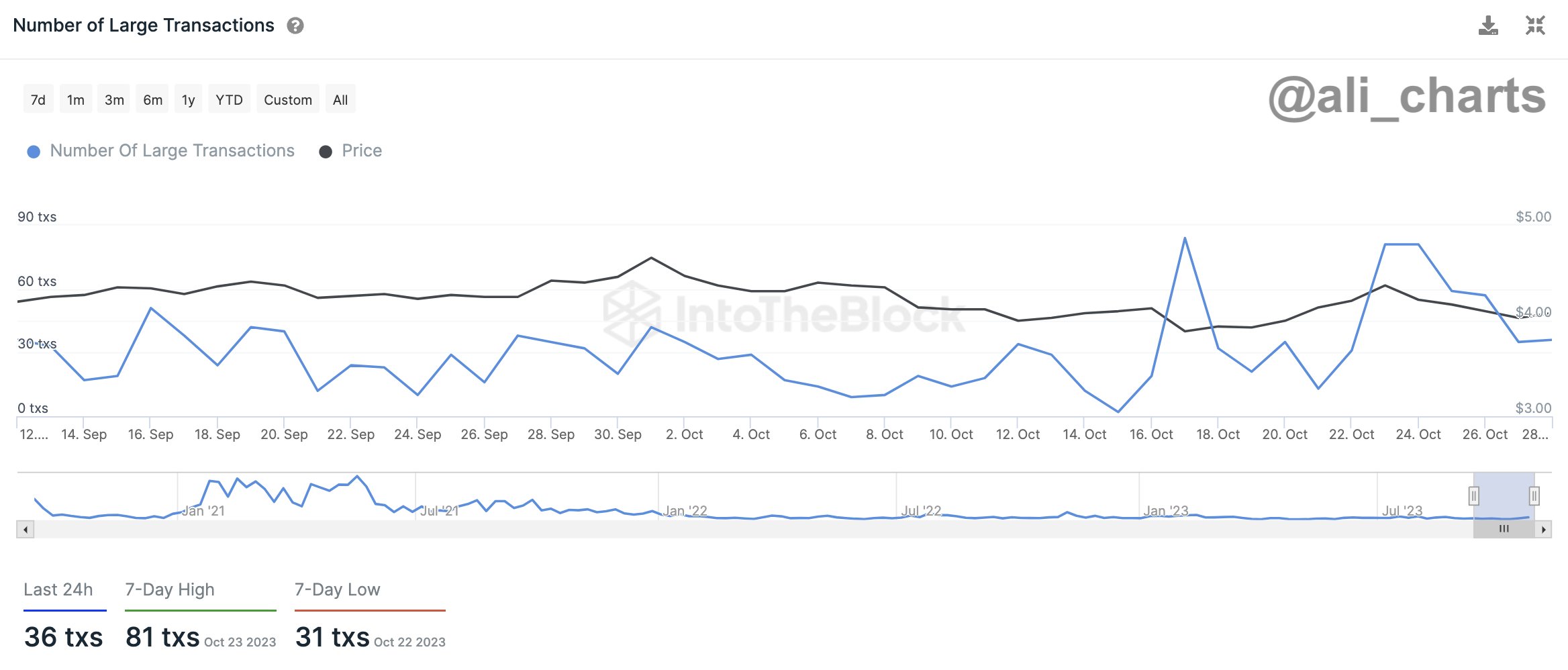

While the market is presently overwhelmingly underwater, Ali notes that the variety of massive UNI transactions is choosing up.

Looks like the worth of the metric has been excessive in latest days | Source: @ali_charts on X

The “large transactions” right here confer with the transfers valued at the very least $100,000. As solely the whales and institutional entities are able to shifting such massive quantities in single transactions, the variety of them can present hints about how energetic these humongous holders presently are.

The indisputable fact that these buyers have immediately began making a comparatively excessive variety of transfers lately could point out that they’re within the asset at its present worth degree. “They may be investing or positioning themselves before Uniswap breaks out,” explains the analyst.

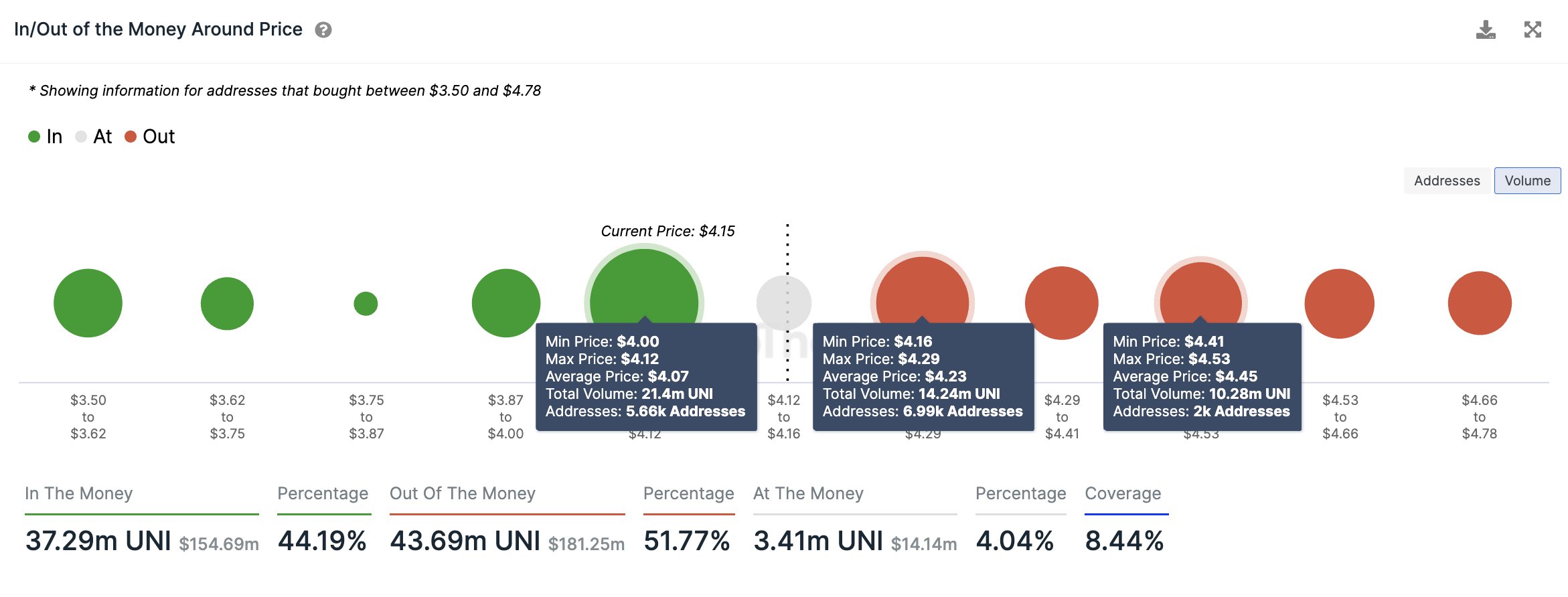

Ali has additionally identified how the present UNI costs have a powerful on-chain help wall under them.

The varied help and resistance ranges of the coin on the premise of on-chain knowledge | Source: @ali_charts on X

In on-chain evaluation, help and resistance ranges are outlined based mostly on what number of addresses/buyers purchased at them. As is seen within the chart, the vary just under the present UNI costs is full of holders, implying that ought to the asset retests them, it may really feel shopping for strain.

“Even though Uniswap built a key support floor at $4, there are 2 supply walls it needs to overcome to signal a bullish breakout,” says Ali. “One is at $4.23, where 7,000 addresses bought 14.24 million UNI, and the other is at $4.45, where 2,000 addresses hold 10.28 million UNI.”

UNI Price

Uniswap has been consolidating across the $4 degree for some time now, unable to search out upward breaks.

UNI has been shifting sideways in the previous couple of weeks | Source: UNIUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com