Volatility is again within the crypto market because the XRP worth and the worth of different main cryptocurrencies development to the upside and into new 12 months highs. The cryptocurrency is heading in the direction of its subsequent resistance degree with a excessive probability of

As of this writing, the XRP worth trades at $0.57, with a 9% improve within the final 24 hours. The cryptocurrency recorded a 16% spike within the earlier seven days and carefully adopted Bitcoin and Ethereum’s worth motion, which recorded a 22% and 16% revenue over the identical interval.

XRP Price On Its Way To Next Critical Level

According to an XRP trader on social media platform X, the token’s worth exceeded the important resistance degree of $0.528. The analyst claims that there’s a excessive probability that the XRP will rise near $0.60 within the quick time period.

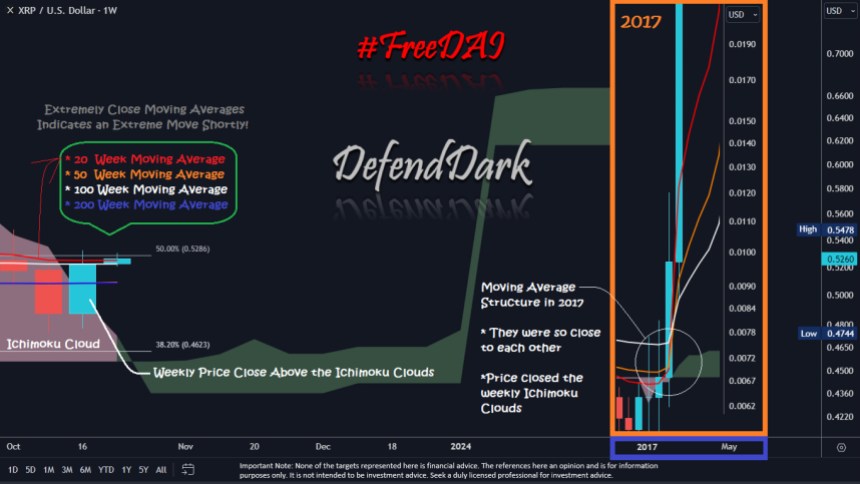

In that sense, the dealer believes that $0.66 will function as the subsequent important resistance degree based mostly on the chart beneath. The analyst in contrast the present XRP worth with the 2017 bull run.

The chart exhibits that throughout the 2017 run, XRP closed above the weekly Ichimoku Cloud, a degree used to gauge important resistance and assist ranges. Once the token broke above that degree, it might rapidly fall into new highs and worth discovery.

The analyst stated the next in regards to the XRP worth and its potential to proceed its run:

This isn’t a warning or monetary recommendation, however I want to share it with you and emphasize how shut we’re after this weekly shut. It appears the weekly Ichimoku shut might be above the clouds, and it solely occurred earlier than the 2017 run and 2021. When it occurs, it occurs. Be Ready.

Crypto Market Poised For Further Highs

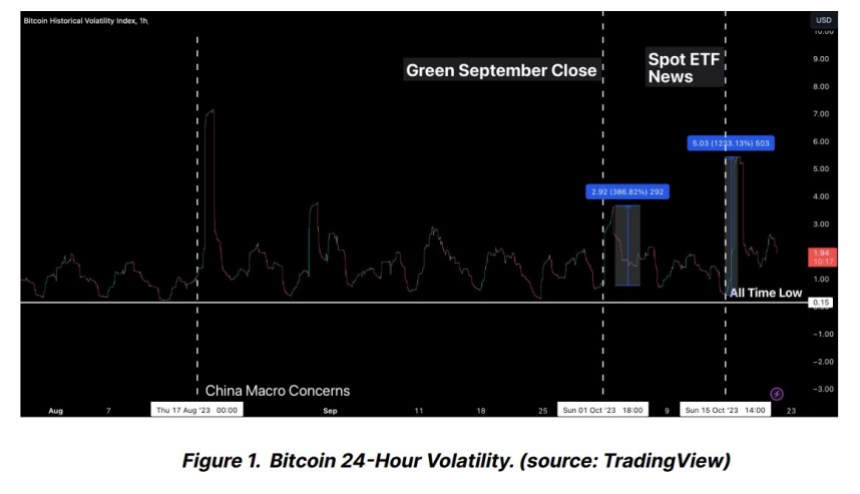

A report from Bitfinex Alpha corroborates the market susceptibility to “new narratives.” In specific, the potential approval of a spot Bitcoin Exchange Traded Fund (ETF) within the US.

As the XRP worth and the market proceed to tear greater, volatility within the sector is prone to stay excessive. As seen on the chart beneath, the crypto has been inching greater and better with every volatility occasion (the potential approval of a Bitcoin ETF was the latest.

In addition, the crypto analysis agency factors to a rise in on-chain exercise, which has traditionally supported greater costs for the sector:

On-chain exercise additionally continues to assist the conclusion that greater volatility is right here to remain and that it’s going to develop within the coming months. Our evaluation of Spent Output Age Bands (SOAB), which monitor the age of cash after they’re spent, and specifically the “age bands” of UTXOs which are most lively, we are able to discern which group of buyers is predominantly influencing market adjustments. For occasion, if the UTXOs aged between three and 5 years present vital exercise, it implies that buyers who’ve held their positions for that point span are the first movers available in the market at that juncture.

Cover picture from Unsplash, charts from Bitfinex Alpha, Dark Defender, and Tradingview