Peter Schiff, the Chief Market Strategist at Euro Pacific Asset Management, is some of the revered folks in finance. He has been proper on so many issues up to now, together with the tempo of rates of interest, US authorities debt, and the continued dangers available in the market. I share most of his issues.

One space I disagree with Schiff is on his Bitcoin outlook. For a very long time, Schiff has advocated towards Bitcoin, which he believes that has no worth. Instead, Schiff, who additionally runs a gold firm known as Schiff Gold, has advocated for gold.

Finally @novogratz bought one thing proper about #Bitcoin. He admitted that it is not purchased, however offered. No one wants Bitcoin. So folks solely purchase it after another person talks them into doing so. Then as soon as they purchase, they instantly attempt to persuade others to purchase too. It’s like a cult.

— Peter Schiff (@PeterSchiff) October 18, 2023

Gold has completed properly over years. It has moved from $35 in Nineteen Seventies to nearly $2,000 right this moment and he expects it to proceed hovering through the years. He cites the hovering authorities debt and the rising accumulation by central banks like these in Russia, Turkey, and Chiba.

While gold is asset, the fact is that it has not been funding up to now decade. Gold has jumped by nearly 220% since November 2006 whereas the S&P 500 index has jumped by nearly 400%. Including dividends, the index has completed significantly better.

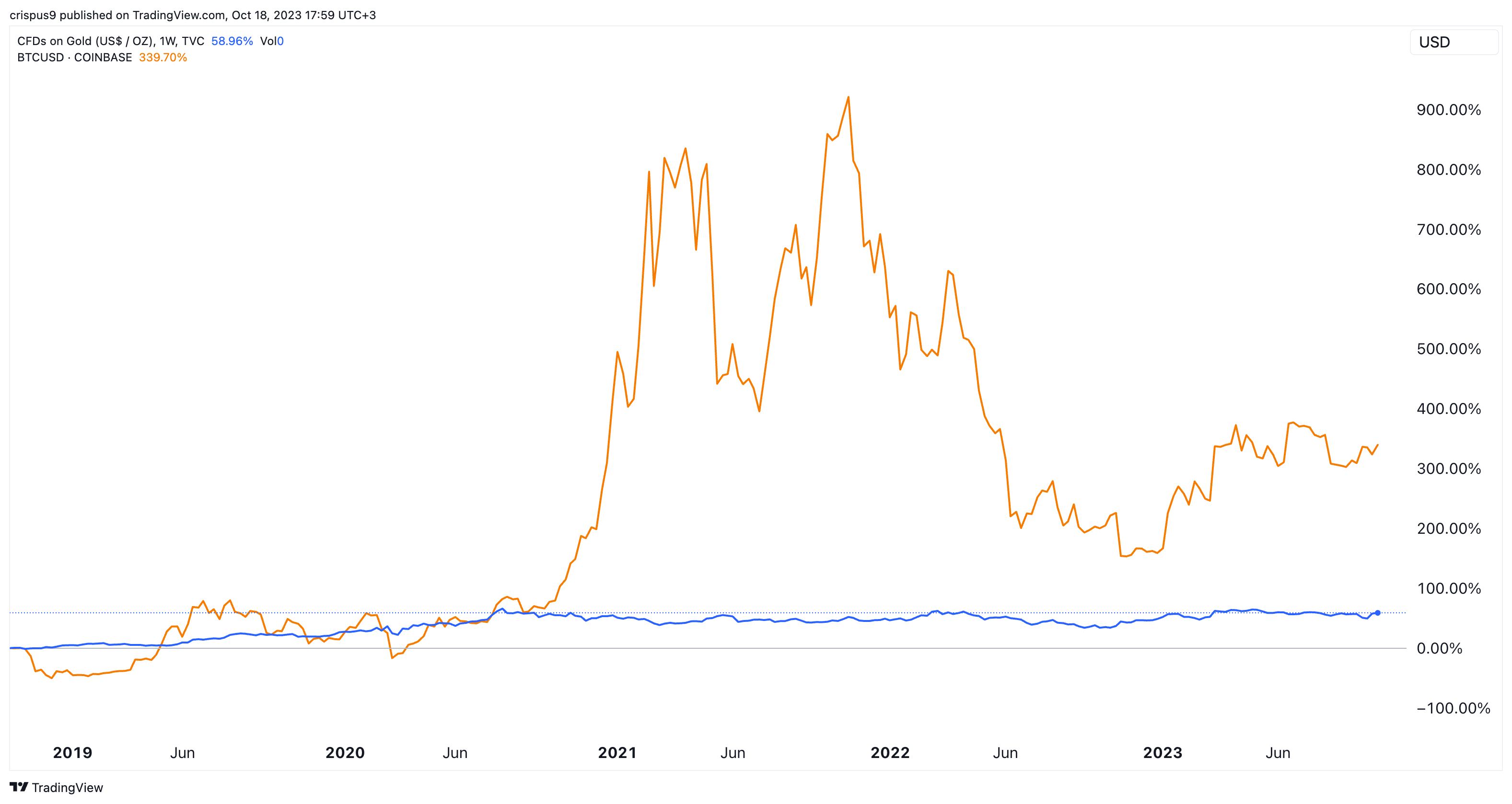

Bitcoin has additionally completed higher than gold by far. While BTC has dropped sharply from its all-time excessive, it has nonetheless overwhelmed gold up to now few years. Bitcoin has risen by nearly 400% up to now 5 years whereas gold is up by simply 63%.

Peter Schiff argues that Bitcoin has no actual worth and that it is solely purchased by speculators. This is wrong. While there are a lot of speculators within the crypto area, the fact is that many giant buyers have held it for years. MicroStrategy has held Bitcoin for 3 years now whereas the common holding interval was over 3 years.

It is additionally value noting that gold has no actual use within the industrial area. Instead, many patrons accomplish that as a result of it is a retailer of worth. This explains why gold is principally purchased by buyers and central banks.

Events of the previous few years are proof that Bitcoin is an actual asset. For one, the coin survived the Mt. Gox collapse, the Covid-19 pandemic, and the present section of stagflation. It is additionally surviving when rates of interest have jumped to the very best degree in 22 years.

All because of this Bitcoin has actual worth, which explains why firms like Blackrock and Invesco are looking for to launch an ETF. In a press release this week, Blackrock’s CEO famous that the corporate was seeing robust demand from worldwide buyers.

How to purchase Bitcoin

eToro

eToro gives a variety of cryptos, equivalent to Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro customers can join with, study from, and duplicate or get copied by different customers.

Public

Public is an investing platform that means that you can make investments shares, ETFs, crypto, and various belongings like positive artwork and collectibles—multi functional place.