Data exhibits that Ethereum billionaire-sized wallets now management virtually one-third of your entire provide, the very best degree since 2016.

Ethereum Addresses With At Least 1 Million ETH Now Hold 32.3% Of Supply

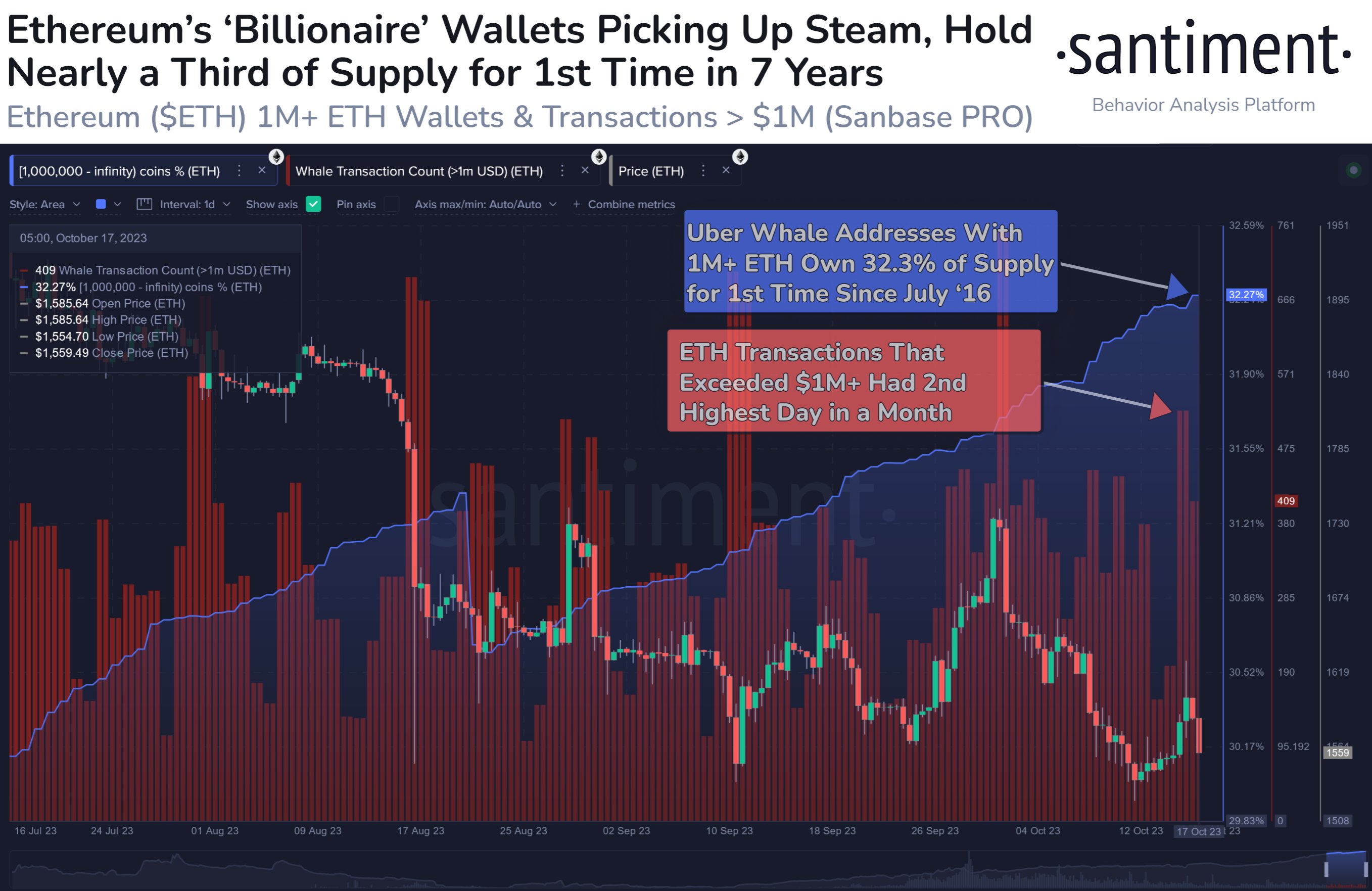

According to information from the on-chain analytics agency Santiment, the Ethereum whales with greater than 1 million ETH have grown their holdings lately. The related indicator right here is the “Supply Distribution,” which retains monitor of the proportion of the Ethereum provide that every investor group is holding at the moment.

The holders or addresses are divided into these teams based mostly on the variety of cash that they’re carrying of their balances. The 100-1,000 cash cohort, as an illustration, contains all traders who personal a minimum of 100 and at most 1,000 ETH.

In the context of the present dialogue, the Ethereum traders with 1 million or extra ETH are of curiosity. At the present trade fee, this threshold quantity is price slightly below $1.6 billion.

As such, this group contains the most important of the whales on the community. Given the sheer dimension of their holdings, these humongous entities would additionally naturally be probably the most influential available in the market.

Here is a chart that exhibits how the provision held by these Ethereum billionaires has modified through the previous few months:

The worth of the metric appears to have been going up in current weeks | Source: Santiment on X

As displayed within the above graph, the Ethereum wallets with a minimum of 1 million ETH now management a mixed 32.3% of the whole circulating provide of the cryptocurrency.

This is the most important a part of the provision that these mega whales have owned since July 2016. While on one hand, it’s a optimistic signal that the most important of the traders are at the moment accumulating the asset; alternatively, this does elevate considerations in regards to the centralization of the asset.

Ideally, a cryptocurrency can be decentralized amongst its customers, with the most important arms not controlling an excessive amount of of a major a part of the whole provide. This is very related within the case of Ethereum, which is a coin that makes use of a consensus mechanism based mostly on “Proof-of-Stake” (PoS).

In a PoS system, validators lock their cash into the staking contract and get an opportunity to deal with transactions. The bigger their stake, the upper the chance of them being chosen. In principle, a single entity with 51% of the staked provide might achieve management of your entire community.

Obviously, these billionaire whales don’t management provide near this quantity but, however the present centralization degree of the community might nonetheless nonetheless be one thing price taking note of.

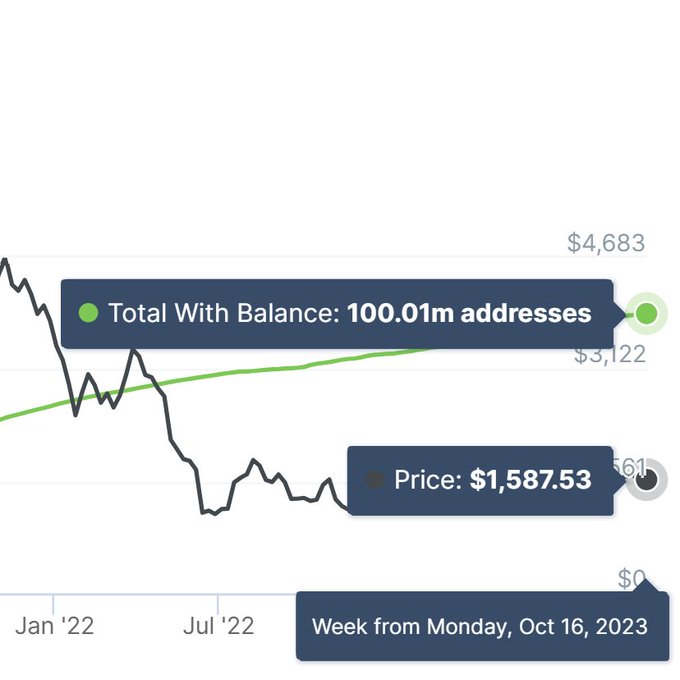

In some extra uplifting information, the whole variety of Ethereum wallets carrying some steadiness has crossed the 100 million mark, a brand new milestone for the adoption of the asset, as information from the market intelligence platform IntoTheBlock exhibits.

The adoption of the asset continues to take maintain | Source: IntoTheBlock on X

ETH Price

Ethereum is at the moment buying and selling across the $1,580 mark after having made some restoration from its low of $1,550 yesterday.

ETH has struggled to realize upwards momentum lately | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web, IntoTheBlock.com