The world’s main cryptocurrency, Bitcoin (BTC), has seen a major surge in its value as we speak, reaching $28,004. While a number of elements have contributed to this leap, listed here are the first causes:

#1 SEC’s Non-appeal On Grayscale Spot Bitcoin ETF

Late on Friday night time, the market turned conscious of the US Securities and Exchange Commission’s choice to not attraction the decision which favored Grayscale’s conversion of the Grayscale Bitcoin Trust (GBTC) right into a spot ETF. This choice wasn’t maybe totally priced in on Friday, as Bitcoin’s value rose by a mere 1.2% on Friday ((adopted by a quick retracement), in stark distinction to the 8% spike on August 29 when the preliminary ruling was introduced.

The transfer signifies the SEC’s potential readiness to green-light a Bitcoin ETF within the imminent weeks. As one Grayscale spokesman pointed out, “The Federal Rules of Appellate Procedure’s 45-day period to seek rehearing has now passed. The Grayscale team remains operationally ready to convert GBTC to an ETF upon the SEC’s approval.”

James Seyffart from Bloomberg Intelligence highlights the possible talks between Grayscale and the SEC within the close to future, stating, “Dialogue between Grayscale and SEC should begin next week. Hoping for more info on next steps sometime next week or week after?”

As for when a Spot ETF is coming, Bloomberg Intelligence analysts predict a staggering 90% probability of the SEC’s approval by round January 10.

#2 BTC’s Correlation With Gold

Renowned analyst MacroScope just lately provided in-depth insights into the complicated relationship between gold and Bitcoin which can have contributed to as we speak’s value transfer. Gold has soared by greater than 6.5% from October 6 until Friday final week, pushed by a mixture of parts comparable to central financial institution insurance policies, the US’s fiscal challenges, and unfolding geopolitical occasions just like the Israel-Hamas struggle.

Remarkably, the Gold market has been witnessing a discernible sample: savvy traders, typically labeled because the ‘smart money’, have been strategically capitalizing on value dips to enhance their lengthy positions. This conduct has been notably pronounced across the $1820-1860 value marks, suggesting a foundational shift in gold’s pricing trajectory.

Related Reading: Analyst Predicts Next Bitcoin Cycle Top – Is It $89,000 Or $135,000?

This evolving dynamic within the gold market bears vital implications for Bitcoin. Historically, gold typically pioneers a pattern, with Bitcoin tailing behind to emulate it. This lead-lag relationship, as highlighted by MacroScope, may need been pivotal in forecasting Bitcoin’s transfer as we speak. As gold seems to be charting a bullish course, Bitcoin, whereas influenced by its distinct set of catalysts just like the spot ETF approval, might be poised to reflect gold’s trajectory.

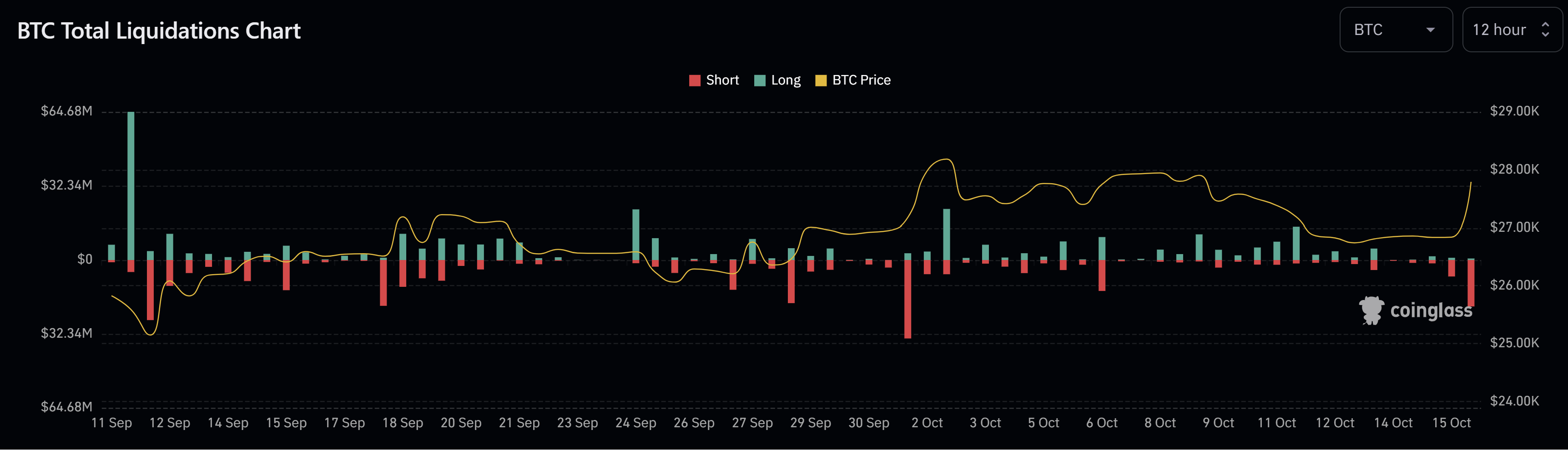

#3 Short Squeeze

Finally, on a extra technical notice, there was vital exercise within the BTC futures market that performed a component within the hovering value. Thus far as we speak, about $20 million briefly positions have been liquidated, the best quantity since October 1, when $37.5 million in shorts had been liquidated and BTC rose 4% from $27,000 to almost $28,100 in a really brief time frame.

In conclusion, Bitcoin’s spectacular surge to $28,000 could be attributed to a mixture of regulatory developments, its correlation with gold, the rising affect of huge holders or ‘whales’, and vital futures market exercise.

At press time, BTC traded at $27,880.

Featured picture from iStock, chart from TradingView.com