On-chain knowledge exhibits Ethereum whales have bought round 12 million within the cryptocurrency inside the previous 12 months and have proven no indicators of slowing down.

Ethereum Whale Holdings Have Been In Constant Downtrend Since 2020

In a brand new post on X, analyst James V. Straten has mentioned how the Bitcoin and Ethereum whales have proven some stark distinction of their conduct.

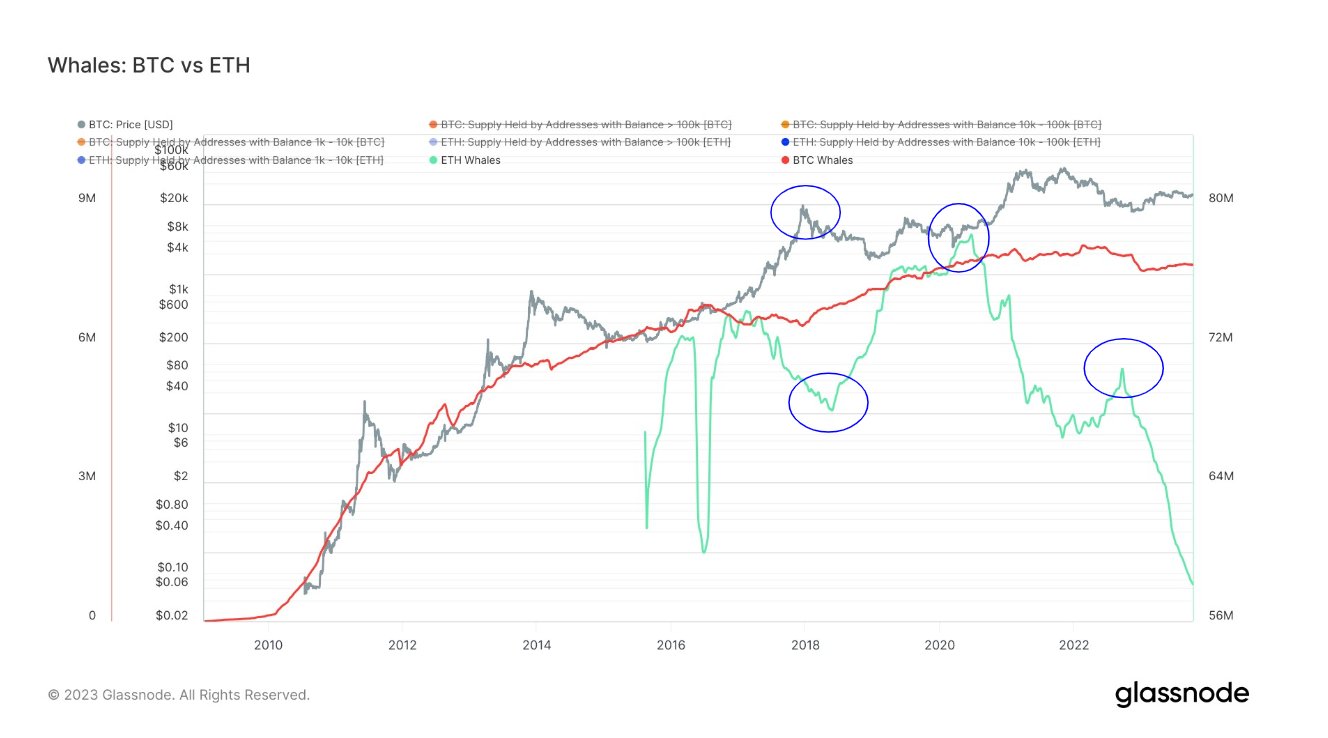

Here is the chart that the analyst has shared, which compares the traits within the holdings of those humongous holders for the 2 property over their total historical past:

How the holdings of the whales differ between the 2 cryptocurrencies | Source: @jimmyvs24 on X

For defining what a “whale” is, the analyst has chosen the 1,000 tokens cutoff for each property. The graph exhibits that the holdings of the Bitcoin whales have been in an total uptrend all through the asset’s historical past.

Some deviations have been from this upward trajectory, like through the 2021 bull run, the place these buyers participated in some profit-taking. However, such deviations have solely been short-term because the whales have finally resumed their accumulation.

However, a deviation that’s but to be reversed absolutely is the drawdown noticed across the FTX collapse in November 2022. Nonetheless, the whales have participated in some accumulation for the reason that begin of the 12 months; extra is required to retrace the aforementioned plunge.

The Bitcoin whales have seen their holdings transfer sideways previously couple of years. The Ethereum whales, then again, have participated in a steep selloff throughout the identical interval.

Since 2020, these holders have shed 20 million ETH from their mixed holdings, price about $31.6 billion on the present change price. In the previous 12 months alone, they’ve bought about 12 million ETH ($18.9 billion), an astonishing determine.

As highlighted within the graph, the Ethereum whales confirmed a brief deviation section after they purchased on the bear market lows. Nevertheless, this accumulation was rapidly reversed because the indicator resumed a pointy plunge quickly after.

Something price noting right here is that the scale of the whales isn’t the identical between the 2 property. Due to the distinction within the costs of the cash, 1,000 tokens of every have vastly completely different weightages. Based on this cutoff, Bitcoin whales would maintain a minimum of $27.4 million price of the asset, whereas the ETH whales maintain simply $1.58 million.

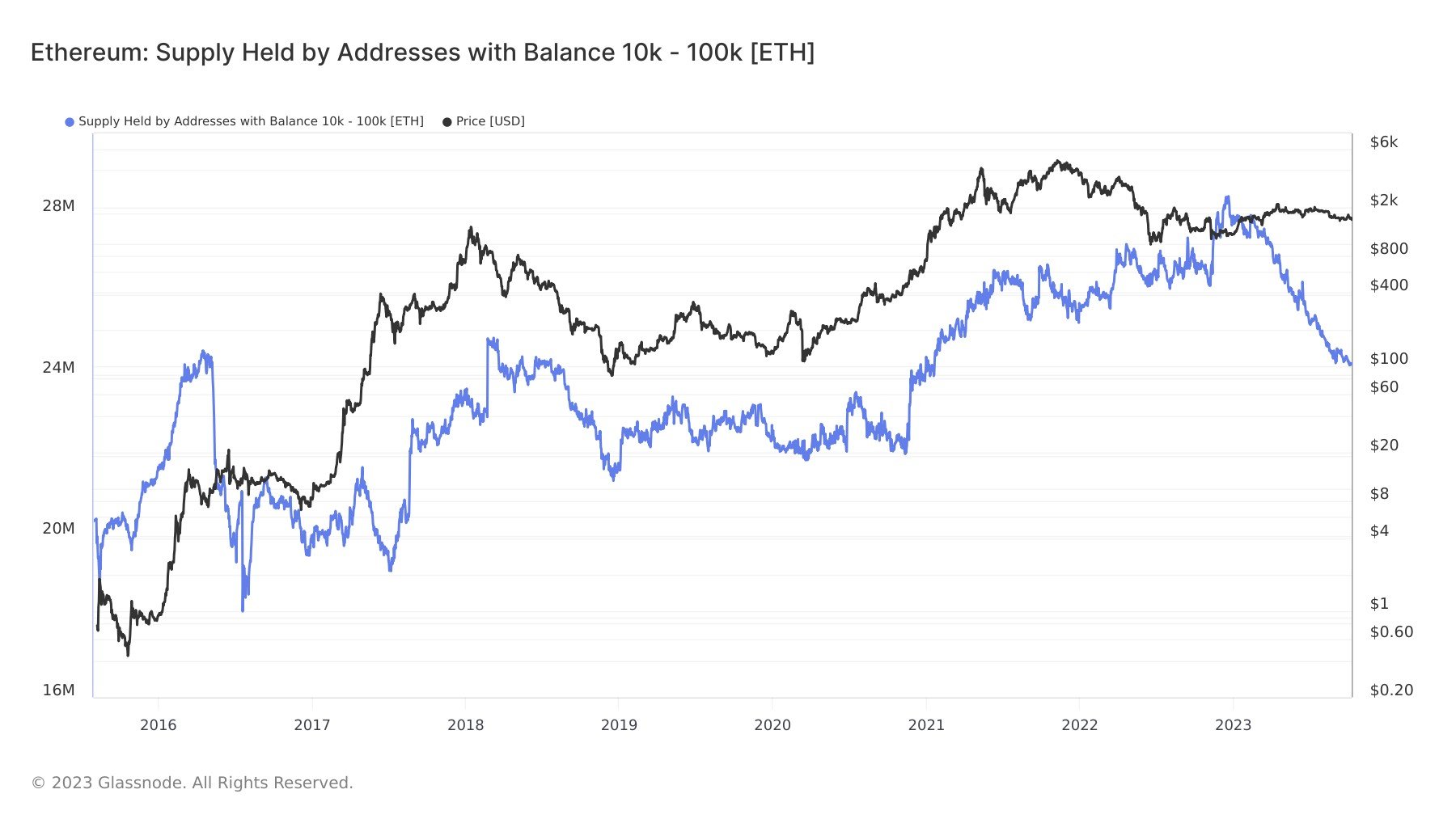

A extra truthful comparability could also be made by trying on the holdings of the ETH entities of comparable measurement to the BTC whales. As displayed within the chart beneath, the Ethereum whales with between 10,000 to 100,000 ETH ($15.8 million to $158 million) have proven accumulation through the years. Still, this cohort has additionally bought large quantities this 12 months.

Looks like the worth of the metric has sharply declined lately | Source: @jimmyvs24 on X

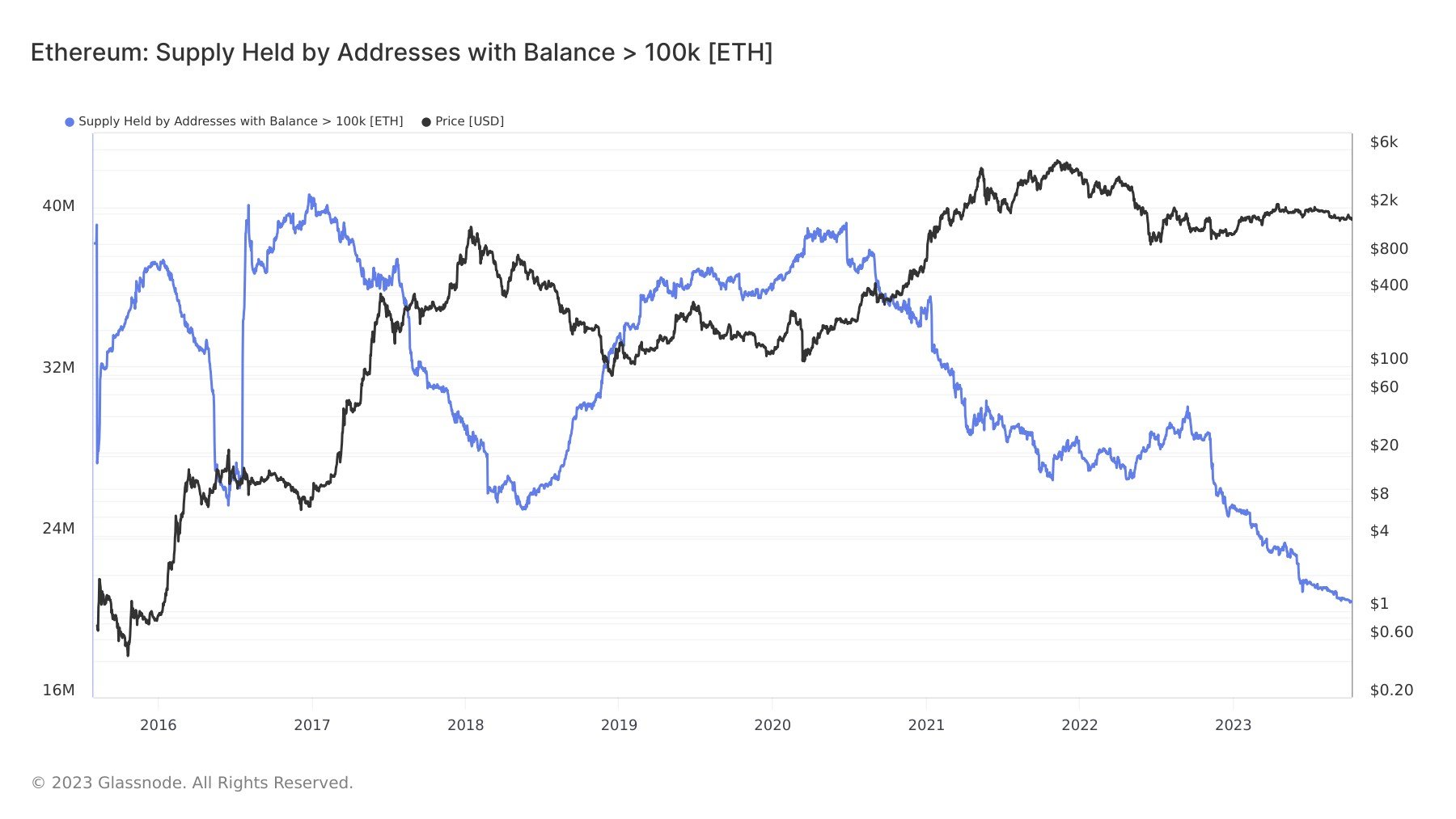

However, the mega whales on the community ($158 million+) have proven conduct extra in step with the combination 1,000+ ETH group, as they’ve distributed closely since 2020.

These whales have been promoting for a couple of years now | Source: @jimmyvs24 on X

Ethereum’s scenario seems bleak, a minimum of by way of the holdings of the whales. The undeniable fact that these humongous holders have proven no indicators of a turnaround thus far would be the most regarding, as they lack curiosity in accumulating the asset. This differs significantly from the sentiment across the Bitcoin whales, who’ve been collaborating in internet shopping for this 12 months.

ETH Price

Ethereum has registered some decline lately, because the coin’s value is now retesting the identical lows as again in August.

ETH has been shifting sideways over the previous couple of months | Source: ETHUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Glassnode.com